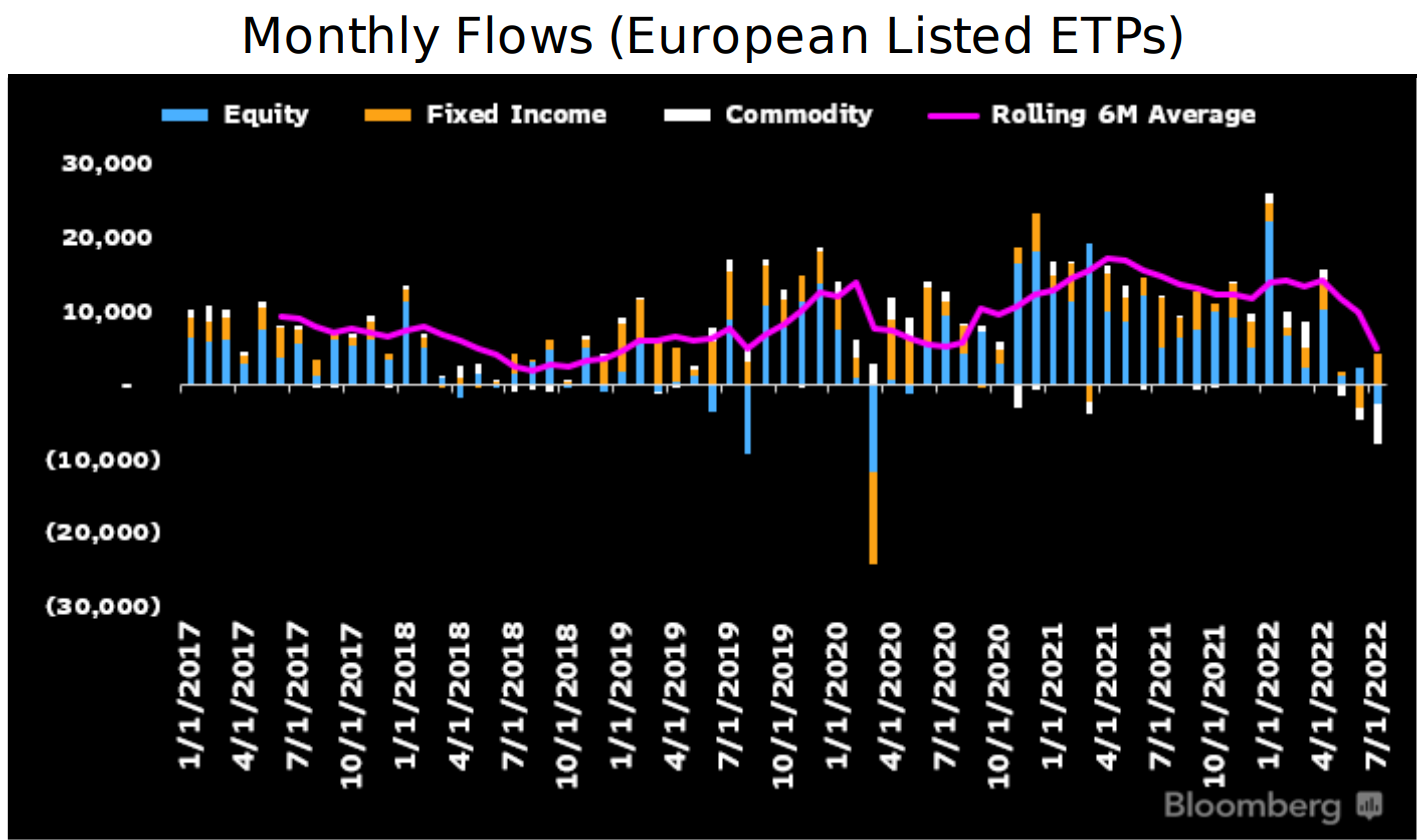

ETFs in Europe have gone from shattering the annual flow record with four months to spare in 2021 to posting “one of the worst outflows ever” over the past three months.

According to data from Bloomberg Intelligence, European wrapped products shed €4.7bn in three months as July marked a “rare second month of outflows”, with €3.7bn of investor cash leaving ETFs in four weeks alone.

Bloomberg Intelligence ETF analysts Athanasios Psarofagis and Henry Jim said European ETF flows are now “way off the pace” of last year, with the industry taking in €104bn during the first seven months of the year in 2021, compared to €55bn this year.

It is also worth noting where the current downturn in assets is located. Commodity exchange-traded products (ETPs) saw an exodus of €5.3bn in three months while equities suffered €2.4bn outflows. Meanwhile, fixed income ETFs stole a march with an impressive €4.1bn in new money.

Source: Bloomberg Intelligence

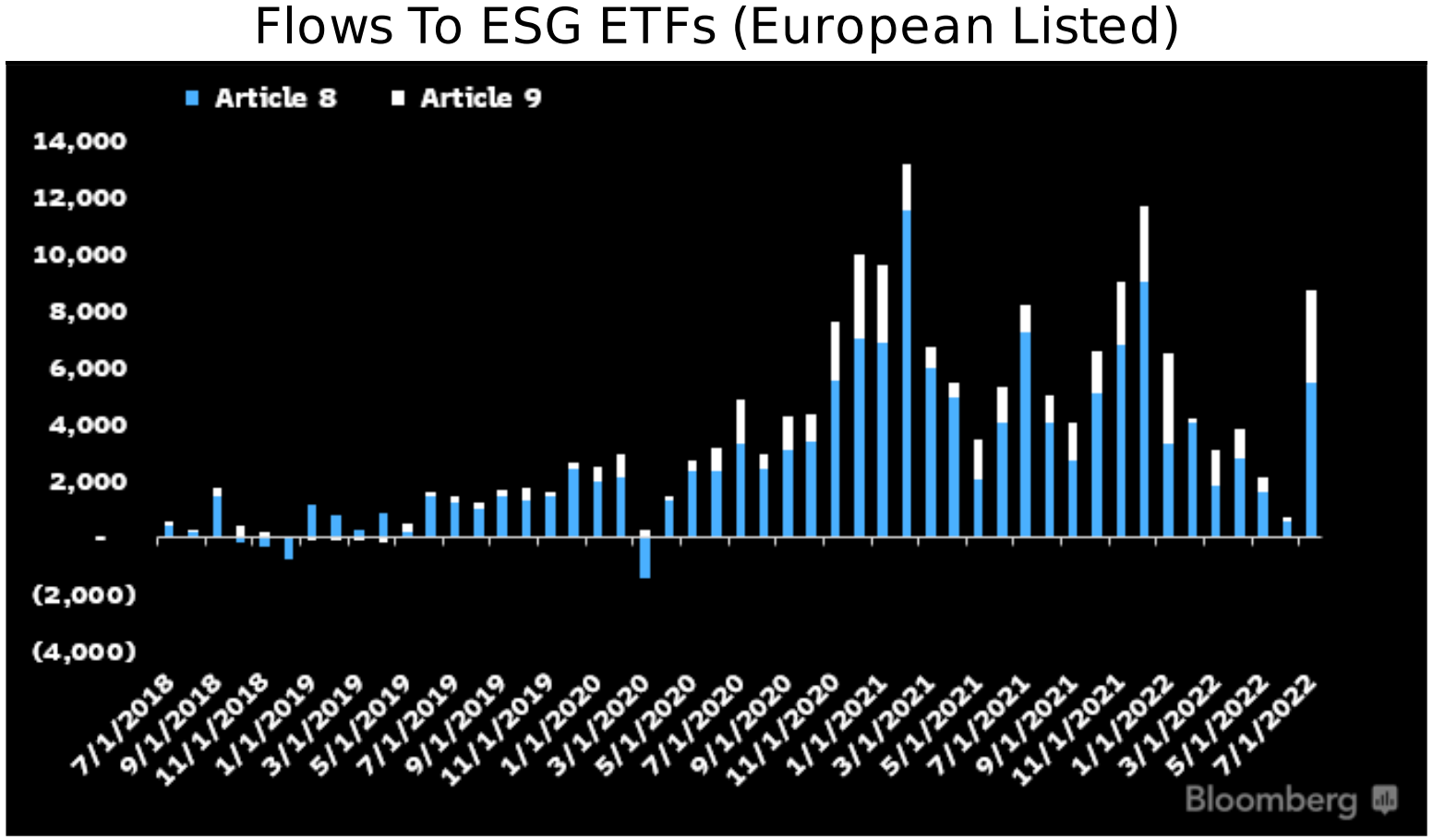

Psarofagis and Jim added: “Though on the surface that may seem to paint a dismal picture of investor interest, there are encouraging signs of more tactical use of ETPs through asset-class rotations, shifts into ESG funds and a spike in trading levels.”

In fact, ETF trading hit €227bn in July, an “abnormally high” number for the summer months. This suggests investors are turning more tactical and using ETFs to address market shifts such as anti-commodity in the face of recession and the recent risk-on momentum following assumptions the Federal Reserve will be less hawkish in future policy meetings.

July was also a standout month for ESG ETFs, which booked €9bn inflows while strategies categorised under Sustainable Finance Disclosure Regulation (SFDR) Article 9 saw €3.3bn inflows, their best month on record.

Source: Bloomberg Intelligence

Overall flows into each asset class have also been short of earth-shattering over the past 12 months. While equity ETFs saw €81bn inflows, this was comfortably shy of the 12-month record of €137bn.

Bond ETFs saw €28bn net new assets over the same period while commodities remained “essentially unchanged”, Psarofagis and Jim said.

Interestingly, this unemphatic year-to-date has been shared by other fund structures in the continent. Europe-listed UCITS equity funds as a whole have amassed €24bn inflows so far this year, however, ETFs have outshone mutual funds in the fixed income space, managing to gather new money while fixed income UCITS funds as a whole saw €80bn outflows.

The question now will be whether full-year ETF flows lose their streak of 12-digit asset gains. Inflows topped out at $112bn in 2019, $120bn in 2020 and broke through $100bn in H1 2021.

At current exchange rates, the €55bn inflow to the end of July is equivalent to $56bn, leaving plenty of ground for European wrappers to cover by the end of 2022.

Related articles