A number of years ago I saw a chart that struck a chord with me. It showed how every decade has a theme which, if invested in, produces tremendous returns over a multi-year cycle, but then peaks and enters into a period of wilderness.

For example, the 1970s theme was gold; the 80s was Japan, the 90s was the ‘dot-com’ boom; the 2000s was China and so on. We all know about the FAANGs phenomenon more recently, and currently this appears to have developed into AI – or so my bot tells me.

What has changed most dramatically is the number of apparent themes that are emerging and crucially, the access that we now have to benefit from these themes through the availability of thematic ETFs which can laser focus into specific sectors that would previously have simply fallen under the more woolly tech umbrella.

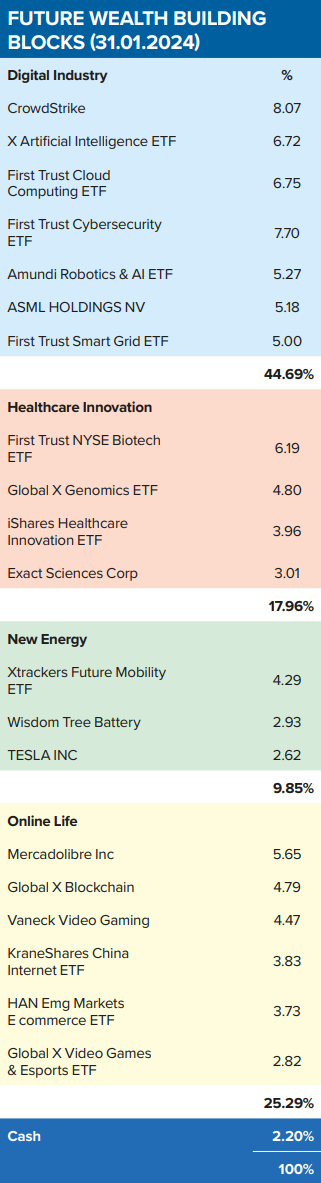

A four-piece puzzle

The fund I help to run has identified four ‘building blocks’ upon which to develop our thematic approach. The range of easily accessible exposures available to investors is constantly expanding, though care needs to be taken in trying to identify what is a theme that is truly a multi-year opportunity from those which may turn out to be a passing fad.

It is also important to try to find themes that are actually profitable rather than simply being ideological. Our four blocks are comprised of:

Digital industry – Within this we include AI, cloud computing, cybersecurity, robotics and smart grid.

Healthcare innovation – This currently has biotechnology, genomics and healthcare innovation, the latter including companies that are involved in medical equipment and remote surgery rather than simply being drug related. There are other ideas available in this sector but at the moment healthcare is struggling to gain momentum, but once it does, we will probably expand this area.

New energy and transportation – A similar comment can be made about this ‘block’ as it is proving difficult to match profitability with necessity. There are a plethora of ETFs focussing upon clean energy, individual variants such as solar, hydrogen and nuclear, as well as climate change and decarbonisation offerings, yet these have struggled to deliver a meaningful return since the exuberance that met a Joe Biden win in the last US election. At the moment, we are concentrating more upon the theme of future mobility but know that these other sources are there should we need them.

Online life – In this sector we include inter[1]net providers and ecommerce, video gaming and Esports as well as blockchain. Importantly, the ETF world provides access to the emerging market space for the growth in eCommerce and enables investment into China and most recently India, should you want to go down this route.

Source: IDAD Funds

It is clear some of these ETFs are not without significant risk and volatility, but this is why we choose the ETF route rather than individual stocks.

Why ETFs?

You would be forgiven for thinking that any investment outside the ‘magnificent seven’ have been a waste of time, given all the attention that they have received.

However, one of my favourite themes in which I have been investing for around a decade is threatening to become the next overnight sensation that has been years in the making, much as AI emerged around this time last year. This theme is cybersecurity.

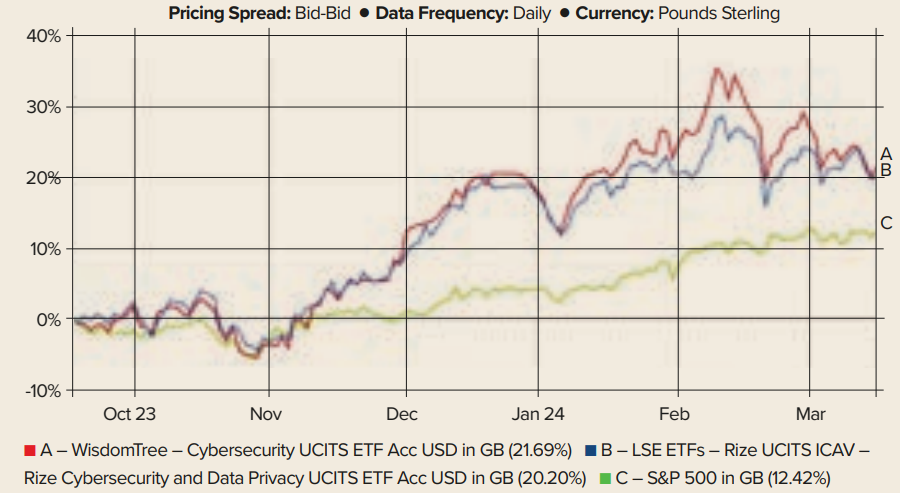

The dominance of the ‘seven’ at the head of the S&P 500 is often the reason that is given for why it is so hard to beat, but the returns of the cyber sector – expressed through the likes of Ark Invest Europe and WisdomTree’s ETFs – tell a different story.

Chart 1: Cybersecurity ETF performance

Source: FE fundinfo

With the US and other elections coming up this year and strange ‘outages’ at Sainsbury, Tesco and Greggs in just the last week as examples, I can only see the demand for cybersecurity increasing substantially.

Interestingly, cybersecurity now features within a couple of defence ETFs that would previously of only held such companies as BAE Systems and Lockheed Martin. Which leads to why we use ETFs to capture themes.

In relatively new sectors such as those mentioned previously, it carries less risk to invest in everything within that sector rather than trying to anticipate which companies will emerge as sector leaders.

Most ETFs are passive and by investing in a passive product you are taking an active decision to invest in everything. ETFs are constructed in very different ways from one-another depending upon the provider – and their process – chosen, but this is a whole different subject that cannot be covered here.

Take the example of the differing performance of two of the leading names in the cybersecurity sector in recent months. Crowdstrike has doubled while Palo Alto Networks has only made 15% over a similar period.

By investing in an ETF, we capture the outperformance of one over the other and with rebalancing that occurs within the structure, we maintain the chance of running winners through their subsequent higher weighting within the given index – subject to the process being followed.

If we had tried to stock pick, we run the risk of choosing wrong, even given our exposure to the sector. For those of a certain vintage it is akin to Eric Morecambe – of the Morecambe and Wise Show – being aggrieved with Andre Previn for criticising his piano playing, asserting that he was “playing all the right notes, but not particularly in the right order”.

This argument can be made for investing in ETFs covering any theme, particularly relatively new and developing ones.

Should allocation models adjust?

A final consideration that deserves more in-depth scrutiny is the question of whether most current asset allocation models are keeping up with a rapidly changing investment landscape.

Most continue to adhere to the old geographically based frameworks, but I would seriously question whether at least 5-10% of any global equity budget should not be directed towards themes rather than countries.

These themes are truly global and it is striking that many of the ETFs covering them invest across all regions – although the US is still largely dominant.

Investing in themes is not the be all or end all of modern investment, but I would argue that investing in modern times should certainly entail some level of segmented exposure to the themes that increasingly drive so many aspects of modern life.

Andrew Merricks is co-manager of the Margetts IDAD Future Wealth fund.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.