ETFs will revolutionise the bond market in the same way that they revolutionised the equities market, a new white paper from BlackRock has argued.

Owing to better trading technologies, new regulations restraining banks, and widespread acceptance of ETFs, bond ETFs are well-positioned to reap a whirlwind, the paper argues.

"We believe the coming years will see a transformation in fixed income similar in many respects to that experienced in equities in the 2000s," it says.

Before the 2008 financial crisis, the paper says, bond trading was almost exclusively over the counter, where broker-dealers and banks spoke directly with investors.

Yet new regulations have reigned in bond trading. Under the Volcker rule, banks cannot participate in debt speculation like they used to. And thanks to new capital requirements, banks can no longer have the risky debts on their balance sheets that they once could.

This means, the paper argues, that debt markets are more fragmented than they were before the crisis. And this fragmentation creates room for bond ETFs which, by their very design, bring different parts of the market together.

"Bond ETFs have been a key beneficiary of market fragmentation," the report says.

"[The] aggregation of multiple bonds through the ETF structure can help reduce fragmentation and increase liquidity by focusing trading in a single line item."

Bond ETFs are also well-placed to end liquidity shortfalls because they offer market makers two ways of making a profit. First, in arbitraging underlying bonds with the ETF. Second, in bid/ask spreads.

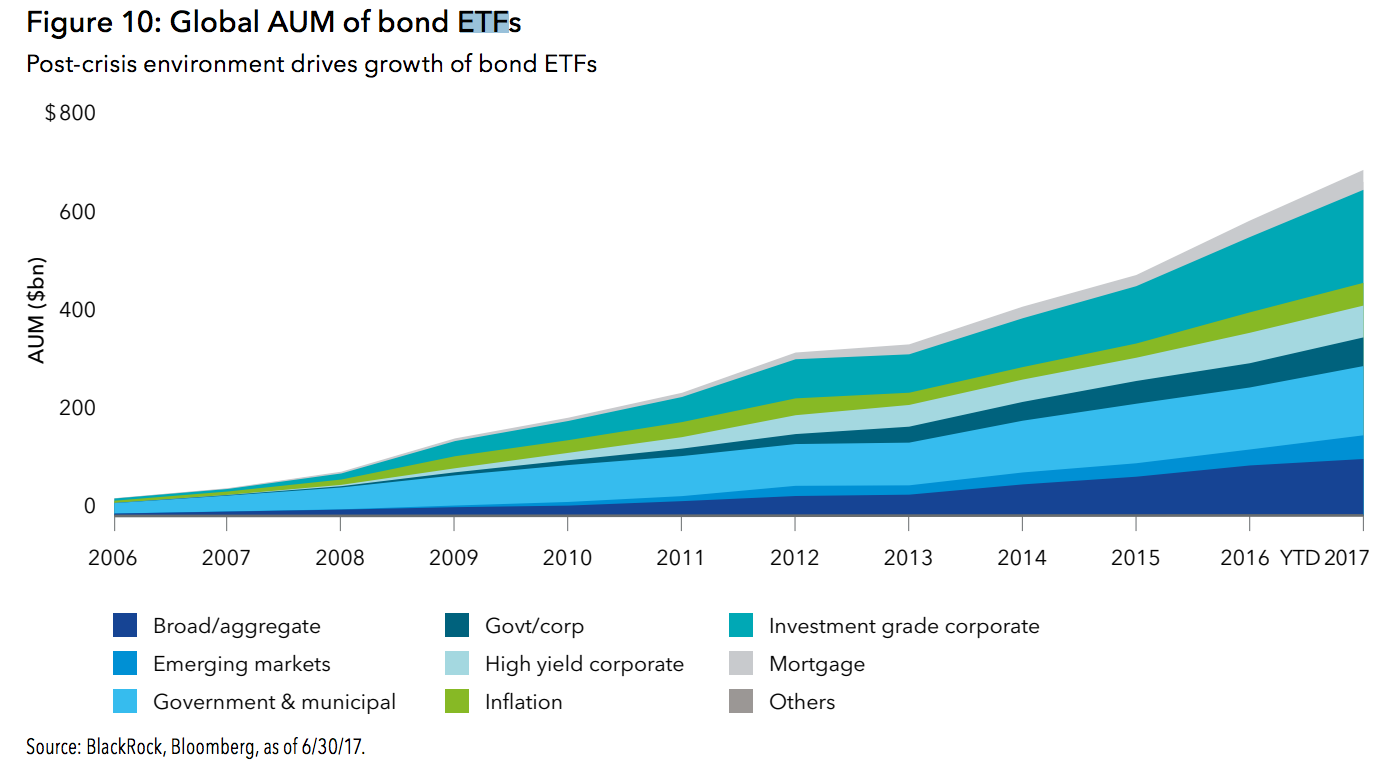

The results of this are already visible, the paper says.

"One potential contributing factor to the apparent stabilization in high yield turnover is the growing use of bond ETFs…As ETF volumes and activity have increased, so has the underlying activity in bonds that they hold."

While bond ETFs have grown and now have over $740 billion in assets, they make up less than 1 percent of the overall global bond market.