Securities settlement bank Euroclear recorded bumper profits during the first nine months of the year as it earned interest on cash balances frozen by Russian sanctions.

US and EU sanctions on Russia and Russian countermeasures saw a loss of Russia-related business income for Euroclear, however, this was “more than compensated” by increased income from interest payments on its cash balances.

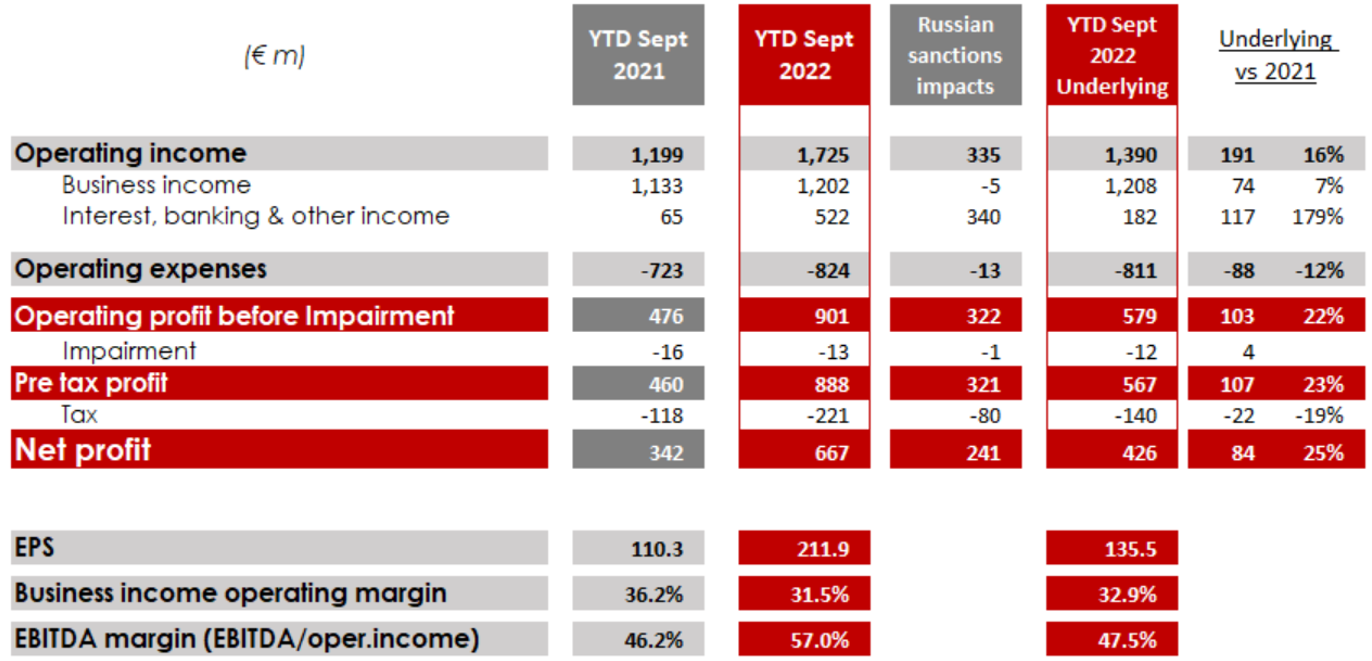

The servicing bank saw its net profit surge 95% for the first three quarters versus the same period in 2021, from €342m to €667m, of which €241m owed to impacts related to Russia sanctions.

Cash on its balance sheet increased by €88.7bn year-on-year to €119.9bn as sanctions meant blocked coupon payments and redemptions continued to accumulate.

Euroclear’s board said it expects interest income to continue to grow “materially” as these asset freezes persist alongside a rising interest rate environment. It added it would retain any profits related to the Russian sanctions until the situation becomes clearer.

The bank said in a statement: “As per Euroclear’s standard process, the cash balances arising from the sanctions are invested which, depending on the prevailing interest rates, results in interest income.

“With the growth of sanctioned liabilities and the increase of interest rates, the materiality of revenues on cash balances arising from sanctions on Russia on the group’s financial results is unprecedented.”

Between January and the end September alone, it amassed €340m in additional revenues on cash balances arising from Russia sanctions.

Source: Euroclear

Lieve Mostrey, CEO of Euroclear, commented: “The group benefits from a diversified business model which allows us to focus on supporting clients through these uncertain times, providing robust infrastructure and fulfilling our duties with respect to the sanctions on Russia.”

The impact of Russia sanctions has been far less positive for other parts of the ETF industry. Russia ETFs from Invesco, BlackRock, HSBC Asset Management, DWS and Amundi are either suspended or have been terminated altogether.

Meanwhile, market makers Jane Street, Flow Traders and GHCO are still fighting to recoup millions of dollars of assets from ailing Russian broker Sova Capital.

Related articles