Euronext is set to stop using intraday net asset value (iNAV) as the reference price to trigger halts on ETFs during periods of market volatility, ETF Stream can reveal.

The pan-European bourse is currently the only exchange globally to use the iNAV as a reference price for ETF circuit breakers, except Euronext Oslo and Milan which adopt similar standards to the rest of the market.

Other Euronext exchanges will follow Oslo and Milan’s methodology of basing the reference price on a combination of the last traded price and the static reference price.

The last traded price is the price of the last contract traded during the session while the static reference price is based on the adjusted closing price from the previous day until the first trade is concluded which then becomes the new static price for the remainder of the day.

Euronext said the reason for the change is because the iNAV causes “unnecessary halts”, especially during periods of heightened volatility, which increases the operational burden on the bourse.

iNAVs can become stale when there are time zone differences between where an ETF and its underlying securities are listed.

iNAV agents struggle to give an accurate measure of value when the underlying market is closed as the ETF is no longer fed by live pricing.

This can occur if a European-listed ETF offers exposure to global equities, for example. According to data from Jane Street, over 70% of UCITS ETF assets under management (AUM) are invested in ETFs that track non-domestic underlyings.

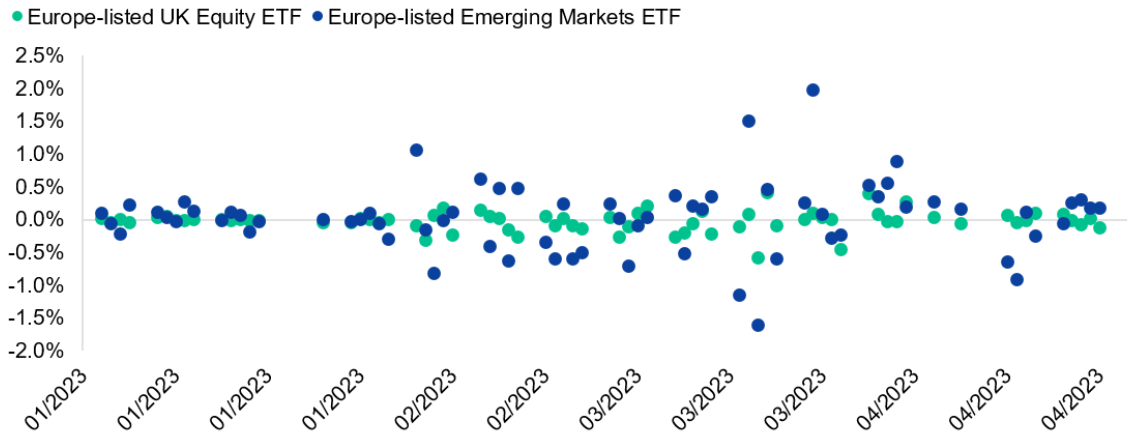

Chart 1: Difference in iNAV last price to daily NAV

Source: Jane Street, Bloomberg, as of 21 April

“When iNAV was incorrect, it has caused unnecessary market suspensions,” Euronext said in a statement. “By identifying best practices and harmonising rules through a pan-European approach, we will attract greater participation onto lit venues, with positive knock-on effects in terms of liquidity and spreads, specifically for retail investors.”

In a research note seen by ETF Stream, Peter Whitaker, head of EMEA market structure and regulation at Jane Street, said Euronext’s changes align it closer with international standards.

“It is fair to suggest iNAV’s unreliability makes it a flawed metric for the basis of a trading reference price,” Whitaker added. “In particular, when used as a value to establish volatility control mechanisms, a metric that may not accurately reflect real trading values has the potential to cause markets to be less orderly than usual.

“Jane Street welcomes Euronext’s changes to align further with global exchanges and establish a more effective reference price.”