Europe’s ETF market looks set to move to the next level as regulators address structural barriers that have seen the wrapper lag the growth enjoyed in the US and increasingly Asia.

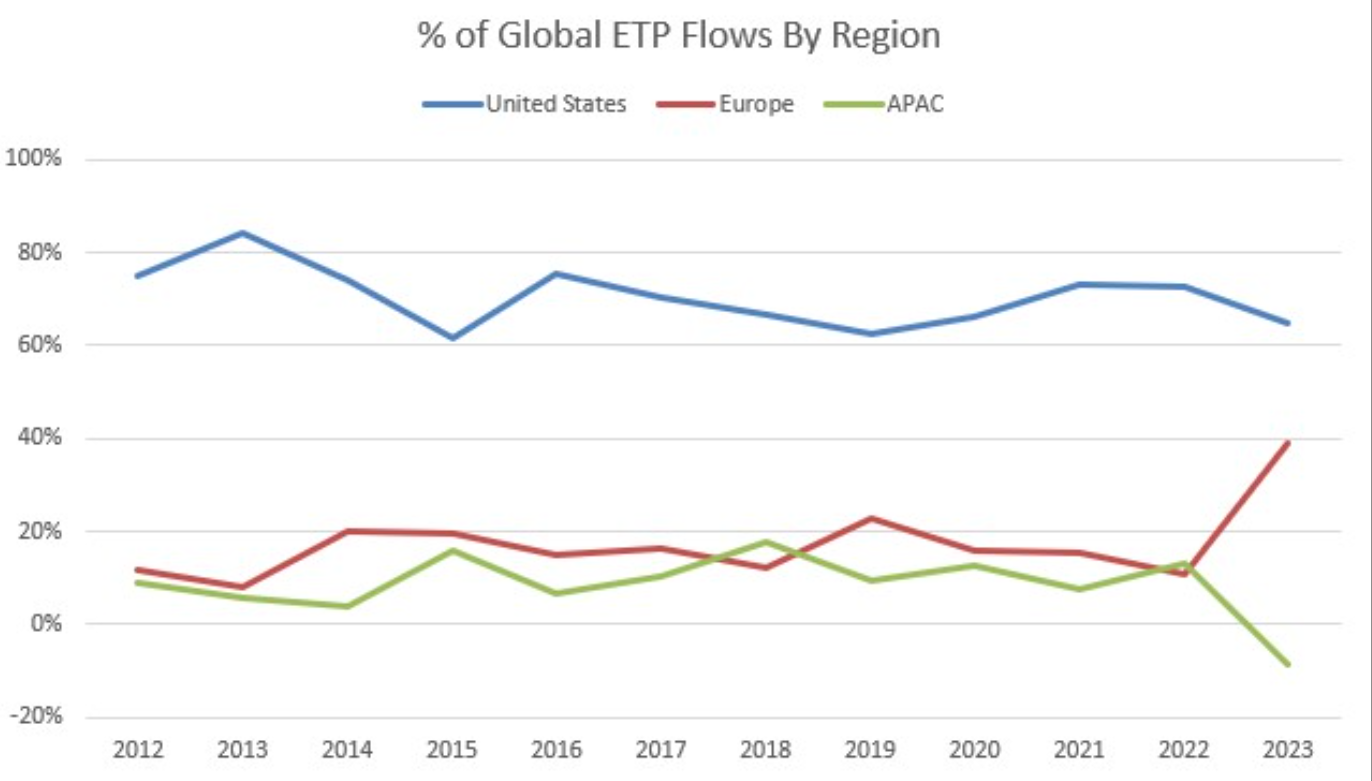

European-listed ETFs have started the year brightly, with its share of global exchange-traded product (ETP) flows already more than double normal levels, at 39%, according to Bloomberg Intelligence.

Source: Bloomberg Intelligence

“A big part of this is better relative performance in EU markets this year and natural home country bias is elevating flows,” Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, explained.

However, Psarofagis also noted continued organic adoption of ETFs in Europe, with a number of key structural ingredients potentially set to crystallise over the coming year.

A consolidated tape within reach

Most recent – and arguably most significant – among these is plans from 14 exchanges to build a consolidated tape for equities and ETFs in Europe.

The group including Nasdaq, Euronext, Deutsche Boerse and SIX Swiss cover every EU member state except Slovakia and will aim to boost the EU’s Capital Markets Union (CMU) by removing costs and inefficiencies associated with fragmented data.

The lack of a complete liquidity picture in Europe to-date has seen many non-European investors opt for ’40-Act’ ETFs despite having to pay US withholding tax.

The European Fund and Asset Management Association (EFAMA) said a consolidated tape would increase the competitiveness of the European market by ensuring best execution on trades for investors and driving more flow into mid and small cap stocks.

EFAMA’s director general Tanguy van de Werve stressed a consolidated tape must be provided at reasonable cost and incorporate both pre and post-trade data.

End of kickbacks in sight

A few weeks earlier, EU commissioner Mairead McGuiness announced the regulator is reviewing the possibility of an outright ban on retrocession fees, or inducements, which are incentives paid by asset managers to advisers for selling their products to clients over equivalents from rival providers.

McGuiness said such practices represent clear “conflicts of interest” and “can have a negative effect on the quality of investment advice”, with consumers recommended products that “are not always the most suitable for their needs”.

She added products where inducements are paid are on average 35% more expensive than those where no kick-back is attached. Retrocession fee arrangements also mean low-cost products such as ETFs “are hardly ever recommended”.

Some, including Amundi CEO Valerie Baudson, have opposed an outright ban on inducements, however, Amundi offers higher-cost mutual funds as well as ETFs, with the former division standing to come under pressure if such a ban were implemented.

A recent survey by the CFA Institute also found just 34% of 100 professional advisers globally support an outright ban, but interestingly 49% of UK advisers are in support, after such a ban was put in place as part of the UK Retail Distribution Review (RDR).

Also, while Baudson claimed the availability of financial advice has worsened since bans were implemented in the UK and the Netherlands, McGuiness said the level of Dutch retail investment has risen and “the level of trust in financial advice has also increased”.

Other ETF issuers including Vanguard have come out publicly in support of an outright ban on retrocessions.

Caroline Baron, head of ETF distribution EMEA at Franklin Templeton, said: “[The inducement ban] is how we saw a boom in the ETF business in the US, where there is an equal split between retail and institutional users, versus less than 10% retail ETF uptake in Europe.”

Retail push

While advisers in many European states may not be pushing their clients towards low-cost products, a growing number of ETF issuers are taking matters into their own hands by offering ETFs and ETF savings plans through investment apps.

BlackRock, for instance, has made a series of investments in German neobroker Scalable Capital – whose savings plans include BlackRock ETFs – before partnering with Dutch wealth platform Bux to launch yet more ETF savings plans across eight European countries.

In January, Vanguard also expanded its German retail platform from the advised index fund investments with the launch of Vanguard Invest Direkt which enables clients to perform self-directed ETF investment.

This followed the success of self-directed ETF investments on its UK platform, with ETF Stream revealing its UK assets housed in ETFs jumped from 9% in 2017 to 20% in 2022 following the launch of its UK Personal Investor (UKPI) platform.

The start of 2023 also saw M&G Wealth partner with Moneyfarm to launch &me, its investment platform offering six portfolios investing in passive ETFs.

Recent headlines have capped off a clear direction of travel for banks, asset managers, neobrokers and robo-advisers. Fineco Bank launched ETFs and added them to its investment platform while Trade Republic expanded its ETF offering by 1,000 last year.

Previously, Franklin Templeton previously partnered with Directa in Italy and JP Morgan Asset Management previously acquired ETF-based digital wealth manager Nutmeg.

BlackRock now expects digital platforms in Europe to have €500bn ETF assets under management (AUM) by the end of 2026.

More barriers to break

In the ideal scenario where European investors can see full liquidity picture of ETFs, the end of biasing kickbacks and further retail adoption, it will still lack the tax advantage for ETFs available in the US.

However, such tax efficiency may not be in the best interests of the market as the true test of a product’s virtues is to have all investment instruments on as equal a tax footing as possible.

This principle should apply in Europe and mean disparities such as the tax advantage for mutual funds over ETFs in Spain or the harsh tax treatment of ETFs in Ireland are reformed.

In Ireland, for example, investors pay 33% capital gains tax on profits made when selling stocks in non-tax-efficient accounts versus 41% on gains when selling ETFs – or alternatively an automatic 41% ‘deemed disposal’ gains tax after eight years if they do not exit their position.

While this tax level is set to be reviewed by Ireland’s Minister for Finance Michael McGrath, it is just one of many examples of how Europe has been a laggard in removing barriers for investors to access diversified, low-cost investments.

There now appears to be increasing momentum to remove outdated structural defects which could mean the best days are yet to come for the European ETF market.