The European ETF market recorded €32.6bn inflows in Q3, a 26% decrease on the previous quarter, as investors shunned value, according to data from Morningstar.

BlackRock dominated flows over the quarter, accounting for 42% of all inflows, as investors poured €13.8bn into its iShares products in Q3, a significant drop on the €21.1bn pulled in over Q2, as flows slowed across the board.

This was driven by $2.4bn and $2.8bn inflows into the iShares Core S&P 500 UCITS ETF (CSPX) and the iShares Core MSCI World UCITS ETF (IWDA), respectively.

In fact, CSPX set a record for September inflows as investors poured $1.5bn into the ETF, according to data from Bloomberg Intelligence.

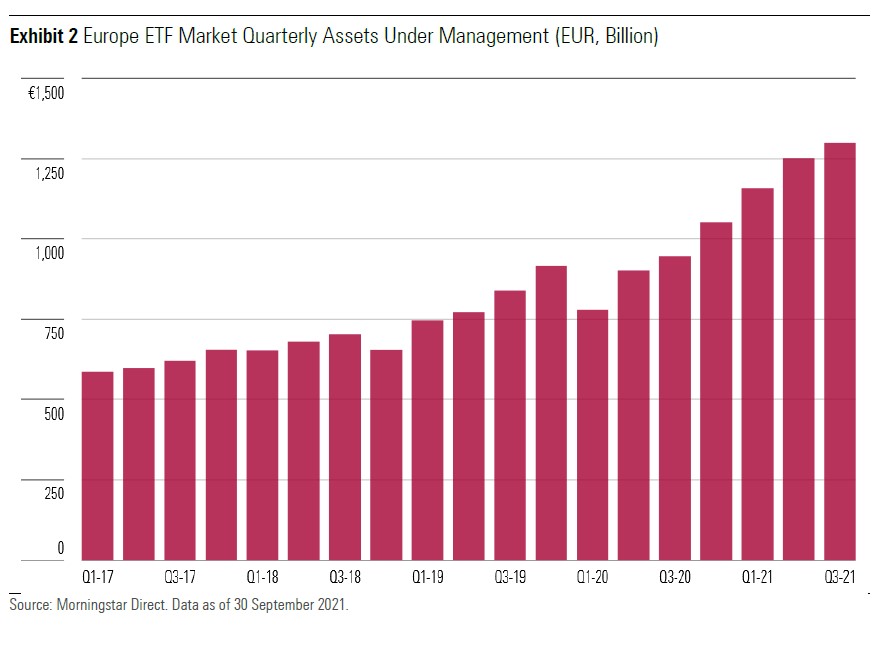

Despite the slowdown, flows into ETFs have already surpassed the whole of 2020 at €125.7bn and look set to set a new annual record-high in 2021.

DWS was a distant second to BlackRock, recording inflows of €3.8bn over the quarter, down on the €5.5bn it received in Q2, driven €1.1bn flows into the Xtrackers MSCI World UCITS ETF (XDWL).

The Xtrackers MSCI USA ESG UCITS ETF (XZMU) saw its assets grow by €520m while the Xtrackers II Corporate Bond UCITS ETF (XBLC) recorded roughly €600m over the quarter, according to data from ETFLogic.

Flows into equity and fixed income were broadly split, with the former seeing €16.7bn inflows – a sharp decline on the €30.8bn seen in Q2 – compared to €14.7bn for fixed income.

Jose Garcia-Zarate, associate director for passive strategies at Morningstar, said: “Interest in bond ETFs has been on the ascent through 2021 as investors have grown increasingly wary of building inflationary pressures and the likelihood that this may force central banks to hike interest rates much earlier than anticipated.”

Elsewhere, Vanguard came in third with €2.5bn of inflows with two ETFs, the Vanguard S&P 500 UCTIS ETF (VUSA) and the Vanguard FTSE All-World UCITS ETF (VWRL) recording €1bn and €790m, respectively.

Invesco (€2.2bn) and UBS (€2bn) rounded off the top five with the Invesco S&P 500 UCITS ETF (SPXS) raking in a notable €1bn. Amundi, HSBC Asset Management and Lyxor all grew their assets by over a billion euros in the quarter, increasing by €1.8bn, €1.4bn and €1bn, respectively.

Value dominates outflows

Investors seemingly shunned value-orientated ETFs over Q3, led by €2.2bn net outflows in US large-cap value ETFs, with the iShares Edge MSCI USA Value Factor UCITS ETF (IUVF) recording outflows of €2.3bn.

This was followed closely by over €2bn outflows from the Xtrackers S&P 500 Equal Weight UCITS ETF (XDEX) and €1.3bn outflows from the iShares Edge MSCI USA Momentum Factor UCITS ETF (IUMF).

Garcia-Zarate said: “If ETF flows are a good gauge of sentiment, then it could be inferred that the value investing theme may have run its course. After solid interest in the two previous quarters—in fact, even in the latter part of 2020 – value ETFs shed money in the third quarter.”

In terms of provider outflows, WisdomTree recorded a second consecutive quarter of outflows, losing €200m over Q3. However, it was Credit Suisse who shed the most assets, losing €479m, followed by Societe Generale which saw outflows of €345m.

Flows into ESG ETFs grew from €12.5bn in Q2 to €13.8bn in the third quarter, accounting for over 42% of total flows into ETFs over the period. It means ESG ETFs now account for 12.2% of the total European ETF market, up from 11.4% in Q2, at €158.3bn.

Elsewhere strategic-beta ETFs saw €3.6bn outflows putting an end to their strong run over 2021.

Thematic ETFs recorded €1.8bn inflows, taking total assets to €34bn, driven by the KraneShares CSI China Internet UCITS ETF (KWEB) with €342m inflows and the iShares Ageing Population UCITS ETF (AGES) and the iShares Global Clean Energy UCITS ETF (INRG) with inflows of €153m and €132m, respectively.