ETP launches are accelerating in 2021. In the first four months of 2021, asset managers launched 135 new products in Europe, according to CFRA’s recently expanded ETF database, a higher number than the 113 for the US.

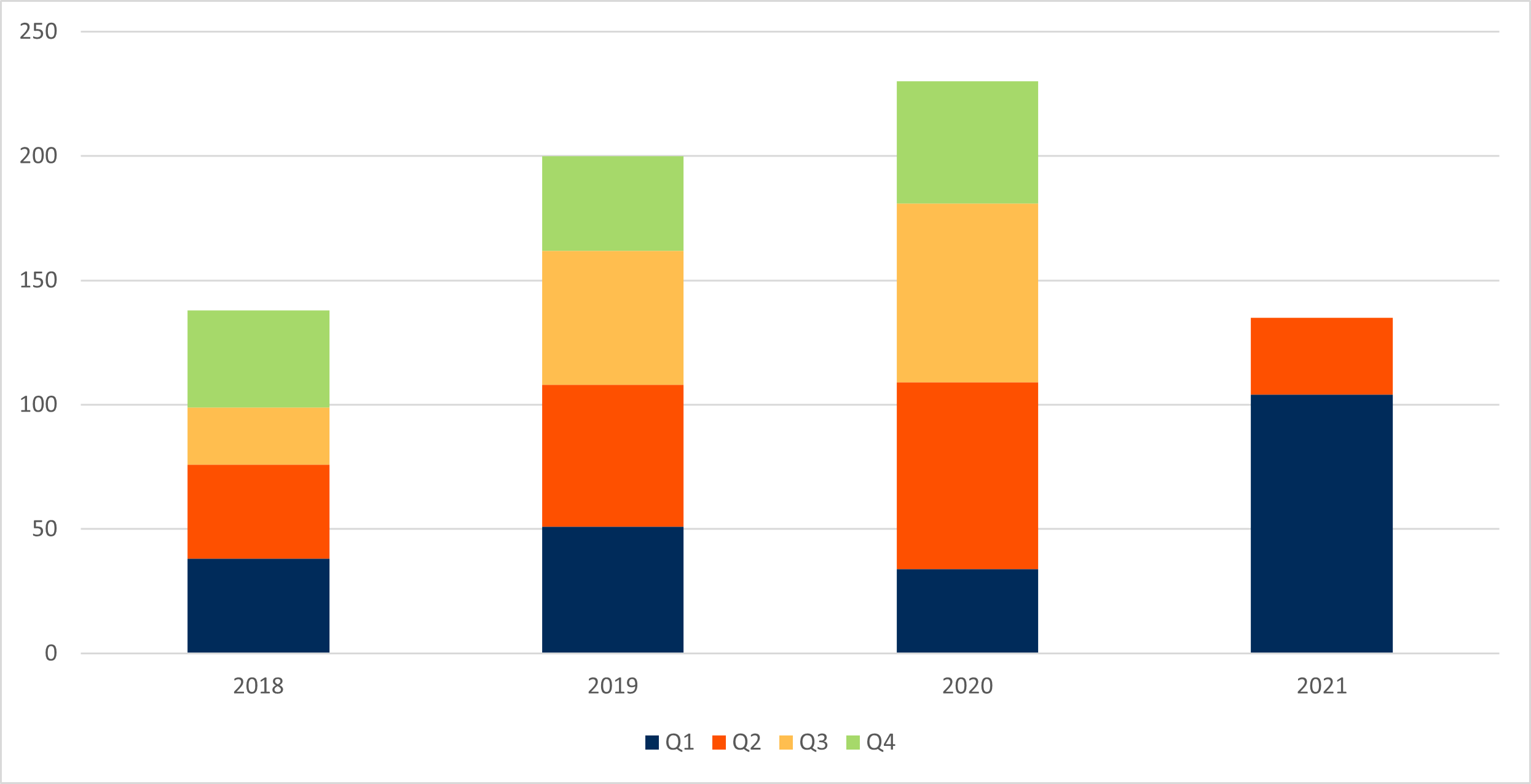

If the pace continues, as we think is likely, there will be more products at year-end that began trading in 2021 than those that launched in 2019 (200) and 2020 (230) combined, net of closures. In the first quarter of 2021, 104 products began trading and an additional 31 were initiated in April.

The number of launches already exceeds the first half of the last three calendars, with two months remaining. While COVID-19 might have played a role in 2020 (109), first-half product development has been at a much faster rate than in 2018 (76 new products) or 2019 (108) and the industry has ramped up efforts in the third quarter, relative to the second quarter in recent years.

Chart 1: European ETF launches accelerating

Source: CFRA’s ETF database. As of 30 April

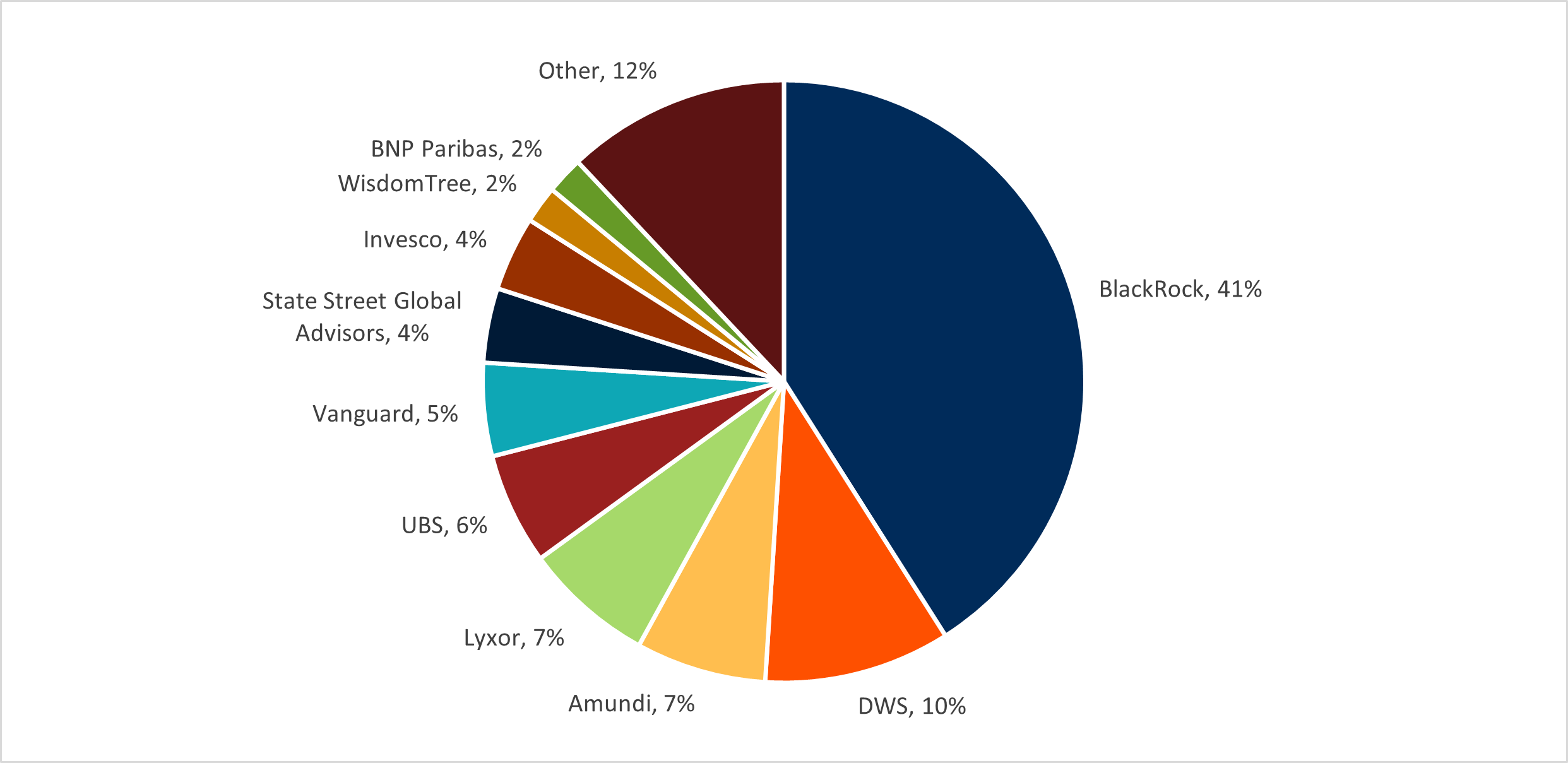

While the European ETP industry remains concentrated, there is a healthy middle class and newer entrants fighting for share. At the end of April, BlackRock managed an industry-leading 41% share of the European market far ahead of DWS, which had a 10% slice of the pie.

The rest of the top-10 asset managers had between approximately 2% and 7% share, before the Amundi-Lyxor combination is completed. However, 12% of the assets are managed by dozens of other providers, some of whom have aggressively launched products in 2021 believing that the European market has begun to evolve.

Chart 2: European ETP industry’s market share

Source: CFRA’s ETF database. As of 30 April

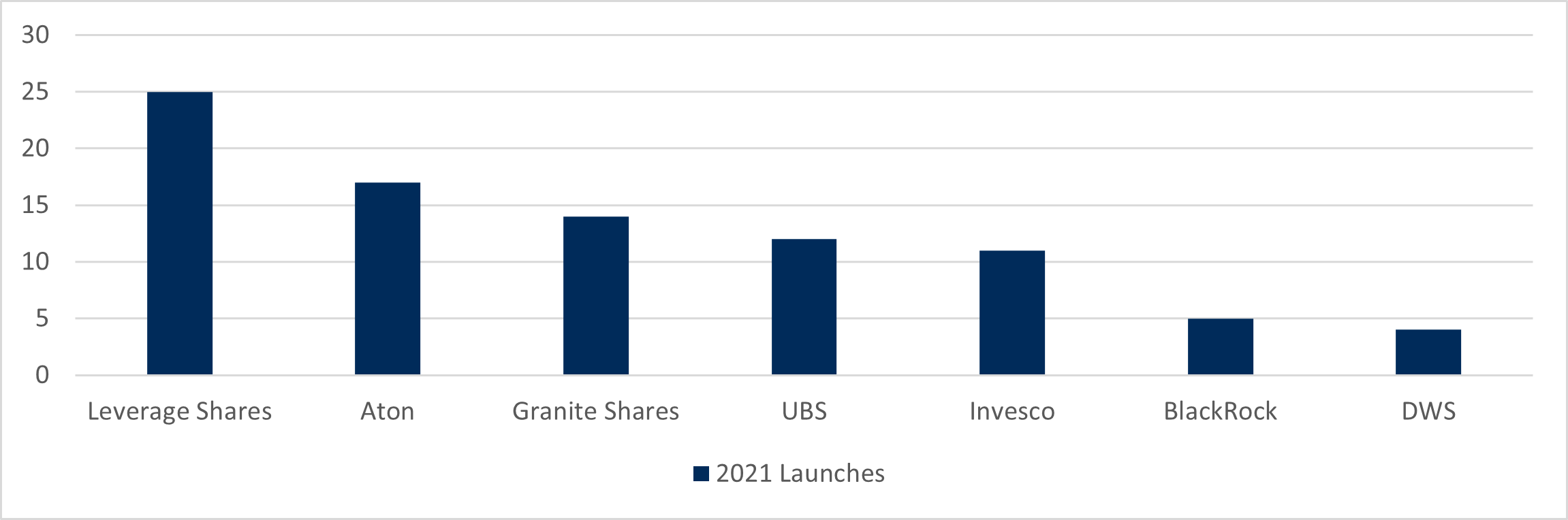

GraniteShares are among the upstarts in Europe. GraniteShares was initially a disruptive force in the US when in 2017, it launched GraniteShares Gold Trust (BAR) at a much lower price than largest commodity ETF, SPDR Gold Shares (GLD), leading to State Street Global Advisors (SSGA) launching a lower cost alternative. In the US, GraniteShares has five ETFs, including GraniteShares XOUT U.S. Large Cap ETF (XOUT), but the firm had 53 ETPs in Europe as of April including 14 that began trading this year. This compares favourably to the nine combined new products from BlackRock and DWS. GraniteShares’ new offerings were the third most, behind Leverage Shares (25) and Aton (17).

GraniteShares’ new offerings include synthetic products tracking a basket of five US mega-cap growth stocks. For example, GraniteShares FAANG ETP (FANG) tracks the performance of an equally weighted basket of Facebook, Amazon, Apple, Netflix, and Alphabet. Another one is GraniteShares GAFAM ETF (GFAM), which swaps Netflix for Microsoft. GraniteShares offers various leveraged and inverse version of these strategies.

Will Rhind, founder and CEO of GraniteShares, told CFRA that he believed the European market is evolving at a rapid rate. He said the traditional asset management industry in Europe caters much more to the institutional customer and is ill-equipped to supply the investment products of the future to appeal to the growing retail investor audience.

Figure 3: Number of ETP launches in 2021

Source: CFRA’s ETF database. As of 30 April

Conclusion

As the European ETP industry seeks to appeal to a growing investor base, the number of new products available is likely to increase.

In the US, the larger asset managers, such as SSGA, have combatted upstarts by offerings lower-cost retail-friendly versions of popular strategies. If they borrow from this playbook, we could see a further acceleration of product development in Europe.

Todd Rosenbluth is head of ETF and mutual fund research at CFRA