Amsterdam has become a European financial powerhouse over the past few years. Following the UK’s decision to leave the European Union, the city has embraced its role as an incubator for financial innovation while convincing a wide range of institutions to move their operations from London to the Dutch capital.

As a symbol of its rise, Euronext Amsterdam overtook the London Stock Exchange as Europe’s top share trading venue at the end of 2021, as the Netherlands hoovered up trading lost since Brexit. Despite imposing itself on the global financial stage, it is fair to say that ETFs have not completely captured the imagination of the typical Dutch investor.

While ETF growth across the European Union has been strong, the Netherlands only ranks as the sixth biggest market for investor ETF assets under management (AUM), as part of the Benelux region, behind ETF powerhouses Germany and the UK, but also Italy, Switzerland and France, according to research by Blackwater Search and Advisory.

Part of the reason for this, according to Gerwin Wijnia, CIO at InsingerGilissen, part of Quintet Private Bank, is the passive space in the Netherlands is the domain of index funds that benefit from 15% dividend tax cuts. “In the portfolios we manage for institutional clients, we mainly use index funds because of the financial benefit for Dutch investors,” Wijnia said.

“The tax withholding means that for some index funds you compensate the management fees, in some cases, making it attractive from a Dutch client perspective.”

Despite this, there are signs the tide is turning as Dutch investors switch on to the benefits of using cheap beta ETFs as strategic allocation tools in their portfolios.

Martijn Rozemuller, CEO of Europe at VanEck, who has been at the forefront of the ETF market in the Netherlands, estimates that passives have grown from 0% to 20% of the market over the past 15 years, in line with the wider European market.

Cost-conscious Dutch investors

One of the main reasons ETFs are starting to make headway in the Netherlands is due to the cost-conscious nature of Dutch investors.

“The typical Dutch client is very cost-aware regarding the total costs of the underlying funds in their portfolio,” Wijnia said. “It is something that gets high attention from clients and is the reason why ETFs have been growing in client portfolios over the last few years in particular.”

He added passives in InsingerGilissen’s portfolio have grown relative to the wider market, up from 0% a year ago to 20% today, and are currently split evenly between index funds and ETFs.

Since launching Think ETFs in 2008, low-cost strategies have also been an important feature in Rozemuller’s offering as the firm looked to compete with BlackRock, Vanguard and State Street Global Advisors as the new kid on the block.

In a bid to get ahead of the game, the business was one of the first in the Netherlands to create a tax-efficient ETF. At the time, a Dutch investor investing in an Irish-domiciled ETF would not be able to reclaim dividend tax.

“We figured if we could prove that we have a brilliant business case everyone will get it and we will grow much faster,” Rozemuller said.

“We were among the first products, with our small and mid-cap index, with a tax advantage and we figured that is going to be huge. When we founded Think ETFs, we were very rational and assumed everyone else running ETFs was too. We were focused on keeping costs as low as possible and being well-diversified and tax efficient.”

This allowed Think ETFs, later acquired by US firm VanEck in 2018, to gain a foothold in the market. Despite this, there were still many legacy challenges to overcome in the Dutch market.

One such challenge, and a major factor in keeping costs high, was asset managers paying kickbacks to banks and brokers to distribute their products.

“A we were cheap compared to the rest of the market, we thought banks would love ETFs but they hated the structure because we did not pay them,” Rozemuller said. “We had some really good investment products and were told ‘no, we are not selling these because you are not paying us’.”

Rozemuller and his co-founder Gijs Koning, the current COO at VanEck Europe, went to the local regulator to highlight the practice. A commission ban was introduced in the Netherlands in 2013. “When the kickbacks disappeared, things sped up,” he explained.

The portfolio completion tool

Despite the tax advantages of investing in index funds in the Netherlands, Gerwin believes an ETF’s ability to be used as a tactical allocation tool makes it an important part of portfolios. “Typically, we use ETFs as a tactical or regional allocation that allows us to make speedy decisions within our portfolio,” he said.

“This is particularly helpful in the equities space. Within our fixed income allocation, the portion to ETFs is growing but we prefer to have more of a selective approach to ETFs instead of buying broad-based ETFs.”

For example, in the current inflationary environment, Gerwin said the private bank tactically rotated its European equity ETF allocation to the US while also using the wrapper to ensure its sector allocation is “aligned with InsingerGilissen’s values”.

He added the bank does not use thematic ETFs in its discretionary fund offering but does have plans to bring them into the portfolio next year.

ESG leaders

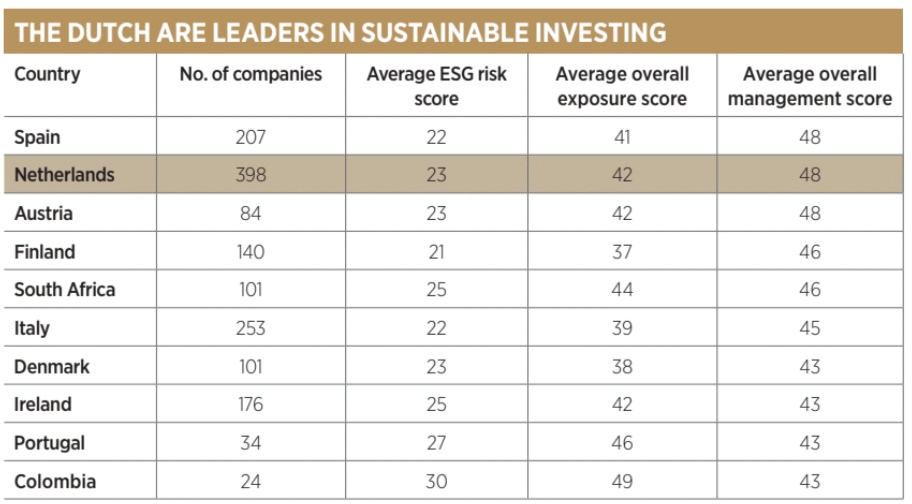

Much like the rest of Europe, Dutch investors are very conscious of sustainability, and according to Wijnia, demonstrate a higher level of understanding of ESG investing than their European counterparts.

Highlighting this, Dutch investors were among the least exposed to Russian securities at the time of the invasion of Ukraine.

Speaking at the Morningstar ESG investment conference in Amsterdam, Kunal Kapoor, CEO of the index and data provider, said: “Our research and data show Dutch investors are very mature in their thinking around ESG.

“Dutch investors are among those with the least exposure to Russia. They did not invest in the sovereign bonds or sovereign wealth funds and Russian state-owned enterprises before the invasion of Ukraine because they simply did not meet the ESG criteria.”

Source: Morningstar

Highlighting this, Wijnia said Dutch investors are typically ahead of other countries in terms of ESG ambitions and objectives within portfolios.

“Over the past five years, our clients have been asking to move from our responsible port-folios to our more sustainable portfolios,” he continued. “Sometime in the future we will go for a full sustainability offering because that meets our clients’ needs. That is the typical difference for clients in the Netherlands and other countries.”

He added he uses green bond ETFs within his portfolio to capture client demand for ESG but said the ETF market offering is still weakin this area. “It is a matter of time before this offering grows.”

What is driving demand?

While admitting ETF usage in the portfolio is relatively low at the moment, Wijnia said he expects this to grow quickly over the coming years. “It comes down to the age-old debate between active funds and passive strategies,” he said.

“It is clear the passive strategies are winning in this current environment. The increase in passive strategies will grow in our typical portfolios over time.

“We would like to see more thematic strategies and get the buy-in and work with providers to create these.”

Echoing his thoughts, Rozemuller said thematic ETFs are the demand driver for wealth managers and private banks in the Netherlands.

“Wealth managers and financial advisers are interested in the narrative, but they will try and make it a part of their balanced portfolio.

“Private banks are pretty neutral on whether something is thematic or more generic, but if it is thematics it has to be pure play, as they are much more focused on the details.”

He added he is seeing increased demand fromretail investors, highlighted by the firm’s growing retail distribution channels in the country.

“The differences between European countries are clearer in the different distribution channels,” Rozemuller said. “We have a particularly strong focus on retail and there are not many ETF issuers that have that focus.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles