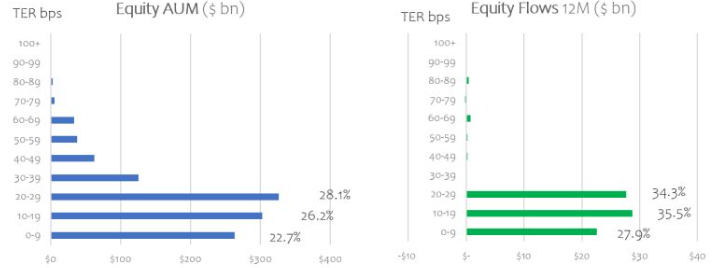

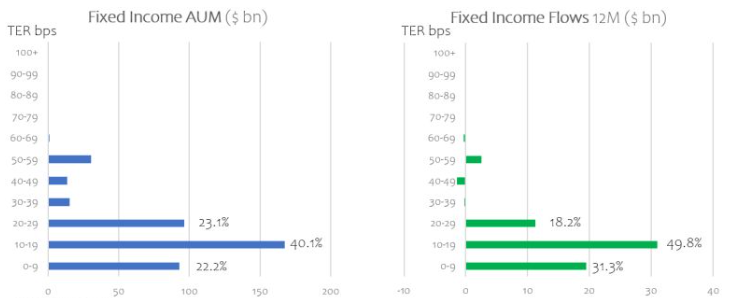

Almost all inflows into fixed income and equity ETFs have been into products with total expense ratios (TERs) below 30 basis points (bps), highlighting the acute price sensitivity of ETF investors.

Equity ETFs with TERs below 0.30% have seen 97.8% of the inflows into the asset class over the past 12 months while fixed income ETFs priced below the threshold recorded 99% of inflows, according to data from ETFbook.

Within equities, most of the flow was into the middle price band – 9-19bps – which took in 35.5% of the inflows while ETFs priced between 0-9bps recorded 27.9% of inflows.

Source: ETFbook

More broadly, equity ETFs with fees below 30bps account for 76.9% of the asset class which rises to 85.5% for fixed income.

The average ongoing charges for equity ETFs fell from 0.39% in 2013 to 0.23% in 2022, according to the Investment Company Institute. Over the same period, fixed income ETFs fell from 0.25% to 0.20%.

Source: ETFbook

Fees continue to be the major consideration for investors when selecting ETFs, alongside liquidity, spreads, tracking error and replication methodology.

Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, said: “Falling prices is a sign of a maturing market and one thing investors have ultimate control over is cost.

“When you look over the long-term it is hard for active mutual funds to outperform the benchmark consistently. As ETFs grow, it will continue to put pressure on active managers to reduce their fees.”

ETF fees have once again been in the spotlight in recent weeks after State Street Global Advisors slashed the fees on SDPR S&P 500 UCITS ETF (SPY5) from 0.09% to 0.03%.

In the month since the fee cut, SPY5 has amassed over €1.1bn inflows, having seen just €35m net new assets in 2023 until the day of the fee cut on 23 October.

In the UK, the Financial Conduct Authority (FCA) fired a warning shot at wealth managers and stockbrokers earlier this month, noting many still offer “poor value” with high fees.