First Trust has added to its range of actively managed S&P 500 buffer ETFs – the latest with an annual outcome period and an April reset date.

Like its January predecessor, the First Trust Vest U.S. Equity Buffer UCITS ETF - April (FAPR) debuts with a total expense ratio (TER) of 0.85% and is listed on the London Stock Exchange.

Buffer ETFs work by providing long exposure to an equity index – the S&P 500 in the case of FAPR – while using put protection to ‘buffer’ investors from drawdowns up to a certain magnitude – 10% in this case – below which point investors are fully exposed to losses.

The fund then sells a call option at whatever level neutralises the cost of the protection. This effectively caps the potential upside.

In April 2026, FAPR’s buffer will be reset to 10% relative to the prevailing level of the S&P 500. In April 2027 it will reset again and so on in perpetuity.

As ETF Stream recently explored, buffer ETFs are popular retirement products because they provide exposure to equities while constraining the possible range of outcomes, both on the upside and downside.

Rupert Haddon, managing director at First Trust Global Portfolios, said: “We are pleased to expand our range by launching another innovative buffer strategy for European investors.

“In today’s volatile market environment, we believe FAPR offers a compelling solution for investors seeking exposureto leading S&P 500 companies while managing downside risk.”

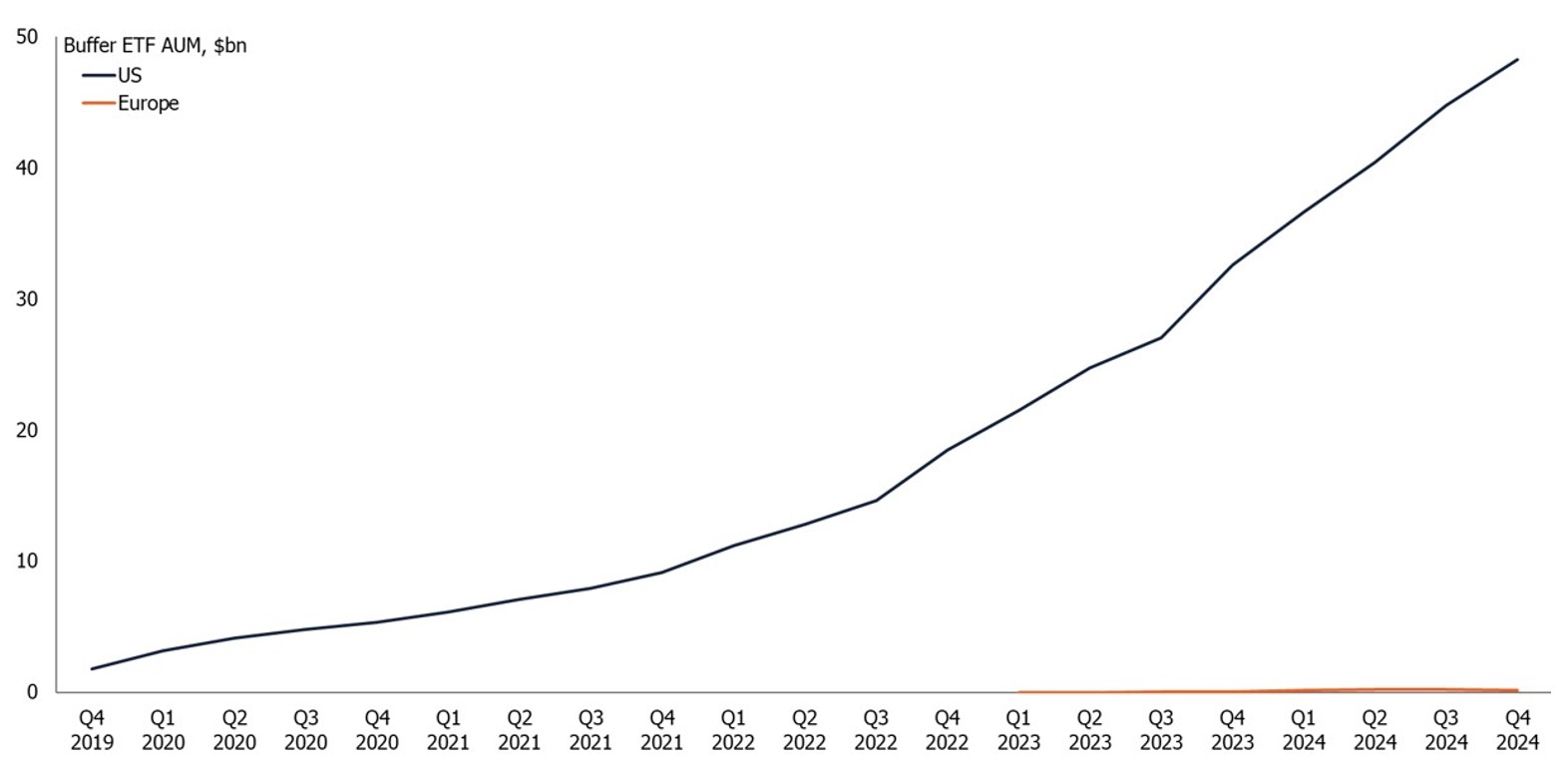

As the below chart illustrates, buffer ETFs have become a huge market in the US but are yet to gain significant traction in Europe.

Chart 1: Buffer ETF assets under management by region, 2019-present

Source: Morningstar Direct. ETF Stream calculations.

First Trust and Global X are the only two providers in Europe but both are yet to attract significant demand for their buffer ETFs ranges.

However, 30% of the 115 professional European investors interviewed for Brown Brother’s Harriman’s 2025 Global ETF Investor Survey said they were planning to invest in buffer ETFs this year and the recent turmoil in equity markets could have added fresh impetus.

Cliff Asness’ AQR recently warned that they were structured to disappoint, however.