As explosive growth in future trend investing hit a brick wall last year, the uncertainty ahead will prompt ETF investors to continue separating hype from sensible themes with secular growth stories.

Interestingly, after initially being less enthusiastic, Europe now appears to be the land of opportunity for megatrend investing.

Amid 2022 volatility, thematic ETFs saw four consecutive quarters of net outflows in the US. However, in Europe “we did not see everyone rush to the door”, according to Kenneth Lamont, senior analyst for manager research, passive strategies at Morningstar, with outflows from technology themes offset by physical world themes such as the energy transition.

Lamont noted the start of the year has seen “ridiculously hot-performing funds, such as those in the blockchain theme and affiliated sectors”, but added “there are still a number of opportunities in robust thematics and from a valuation perspective, a good number took quite a hit last year”.

Echoing his thoughts, Omar Moufti, thematic and sector product specialist, told ETF Stream his firm’s 2023 outlook saw potential in more defensive themes.

“Our thematic outlook for H1 is focused on resilience because there is uncertainty in growth and inflation, the monetary policy reaction and geopolitical uncertainties, which are all outside our realm of control,” Moufti said.

Amid these potential sources of volatility, industry commentators told ETF Stream their themes to hold for the long-haul.

Cybersecurity

Starting off by looking at one segment of the recently-unloved tech sector, Moufti identified cybersecurity as a theme that supports macro resilience.

With a potential recession scenario, he said his firm are interested in sectors where fundamentals can remain strong, which has led his team to increasingly view cyber or digital security as a “tech staple” in recent years.

“Digital security has moved from the IT department to the C-suite, with national and supernational importance amid geopolitical tensions,” he continued. “In our outlook, we show a census looking at where companies are least likely to cut their budgets. The security side has the highest response ratio across the IT sector.”

Morningstar’s Lamont agreed, stating: “In Europe, cybersecurity had inflows last year, despite the fact most tech themes suffered outflows. This shows how a theme can be stronger than its sector peer group.”

As new fields of tech innovation emerge such as quantum computing, Aanand Venkatramanan, head of ETFs for EMEA at Legal & General Investment Management (LGIM), noted this will underline the importance of cybersecurity with new verticals for the theme.

“Quantum could make existing applications and even AI processes faster but with that comes equivalent threats,” Venkatramanan told ETF Stream. “Imagine the certificates that come up during the digital banking process – which contain encryption keys that are sent to the server – if someone in the middle begins reading the data in the middle, it would currently take millions of years to decrypt it.

“With what researchers have found so far, quantum could break that 256 byte or 2048 bit encryption in hours or days.”

Water

Looking at one subset of the effort to address climate resilience, Moufti identified water resources as a key concern.

“With increasingly unpredictable weather patterns, we are seeing droughts followed by floods in the same region – such as in Pakistan, California and Australia – and that has contributed to the rise in prices of fundamental resources,” Moufti said.

“On the policy side, water is supported by the US Inflation Reduction Act and Infrastructure and Jobs Act, which have a focus on water accessibility and cleanliness including tax breaks, which is an incentive for investment in this area.”

Lamont argued water is a good example of what can be considered a “robust theme”, as it addresses an area of need with investable solutions.

“The case for water is quite compelling and interlinked with climate change. The dispersion of clean water around the world is getting more exacerbated, with longer, drier spells, which is clearly going to have an enormous effect.”

He added the existing technology and infrastructure are not sufficient in both developing and developed countries, with the direction of travel moving towards greater extremes with a current lack of solutions.

“This creates an opportunity for the market and companies around the world to step in and profitably solve this problem,” he added, noting the growth opportunities on the technology side are “quite compelling”.

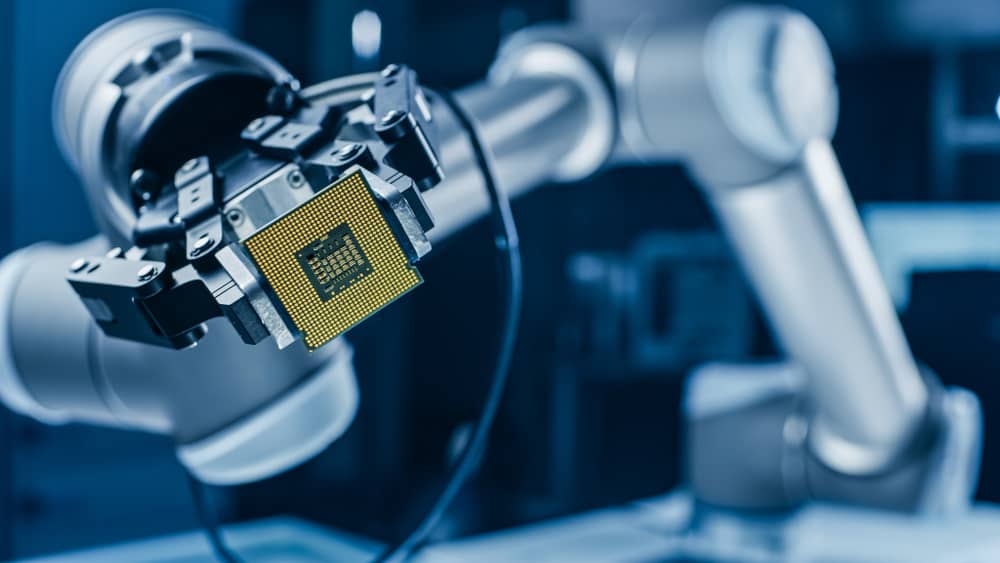

Automation

As a final piece of the defensive thematic puzzle, Moufti identified supply chain resilience as an addressable trend, with automation and robotics standing to be key beneficiaries in his view.

He said a growing number of jobs are being reshored to the US, with this trend continuing over the course of years amid trade wars, prolonged COVID-19 lockdowns in East Asia, rising transportation costs and most recently the escalation of geopolitical tensions.

On the pull side, he added US initiatives such as the Inflation Reduction Act and the Chips Act have a heavy focus on domestic manufacturing and construction including “billions of dollars of subsidies and tax breaks”.

On how this supports automation, Moufti said: “This is happening at a time when it is already difficult to fill existing jobs and near full employment in the US and high employment elsewhere.

“We think robotics and automation will be key beneficiaries of these trends, bringing much-needed certainty to production.”

Taking a slightly different angle on the theme, Pedro Palandrani, director of research at Global X, told ETF Stream headline-grabbing technologies such as ChatGPT are just the tip of the iceberg in the “new heights” being reached by robotics, AI and automation.

“As innovation continues apace, it is no surprise that robotics more broadly continues to grow. In fact, the Association for Advancing Automation (A3) announced last week that North American robot sales hit another record high in 2022, increasing 11% year-on-year to 44,196 robots, valued at $2.38bn.

“This should be further supported by China’s economic reopening, given that the country is the world’s largest demander of robotics.

“In 2023, we expect service robots to surpass industrial robotic sales for the first time ever. This is a result of cheaper robotics and greater dexterity because of improvements in end of arm tooling. While global recession fears loom, strong capex should help these robotics companies across geographies to weather the storms.”

Rare earths

Offering a unique way of playing the energy transition story, Kamil Sudiyarov, product manager at VanEck, highlighted the potential of the often-overlooked components powering developments in renewable power, atomic energy and battery storage.

“Due to climate change being on the agenda of so many governments around the world, one could expect the demand for low-carbon energy generation to continue growing, accompanied by demand for ‘shovels’ – materials crucial for the transition – including copper, cobalt, lithium and rare earths,” Sudiyarov stressed.

“What is often forgotten in the pursuit for renewable energy are the high resource requirements of the relevant hardware, which means the potential fallout from producing necessary materials and discarding used equipment might be underestimated. This could bring tailwinds for companies that are focusing on recycling services for transition-relevant materials.”

Space

Finally, offering a less defensive theme for more adventurous investors, Tom Bailey, director of research at HANetf, said the space economy has the potential to “define the coming decade”.

First, Bailey said there is increasing demand for global connectivity, with more data being transferred via video calls, eCommerce, video gaming, streaming, internet-of-things and more.

“All these applications do and will devour lots of data. In addition to terrestrial infrastructure, space offers a way to transfer data via satellites,” he said.

Next, he pointed to the “return of Great Power politics”, with the coming decades to be dominated by the geopolitical contest between the US and China.

“Space is a core part of this geopolitical struggle,” Bailey argued. “Therefore, leadership in space technology is increasingly viewed as a strategic priority for both countries.

“President Xi Jinping has declared that China’s ‘Space Dream’ is to take the place as the world’s leading space power by 2045. This, in turn, should spur on US efforts to maintains it edge and develop space technology."

While the previous space race between the US and USSR was defined by vast government spending, Bailey said the key tailwind for this century’s space race will be the increasingly commercialised space opportunity, with private actors leading the way in the US and Europe.

“Whereas in the 1960s government spending represented around 100% of all space spending in the US, today it only accounts for 20%.

“This largely stems from the Augustine Commission in 2010, in which the US concluded that NASA should not just work more extensively with the private sector but should do so in a broader manner. As a result, we see more private sector firms partnering with NASA to help develop the space capabilities of the US, making the space economy an investible theme.”

The bottom line

Regardless of an investor’s thematic proclivities, Morningstar’s Lamont offered a simple takeaway on the product class.

“Valuations can fluctuate dramatically. If 18 months ago investors were convinced by areas such as cloud computing, cybersecurity and digital payments – and the valuations are far lower now – then I would be looking at it even more closely."