Integration of ESG considerations into fixed income portfolios has been relatively slow compared to equities. The very first equity ESG index launched in 1990 but it was more than two decades later before the first ESG fixed income index was established.

One reason for this lag relates to historically perceived issues with engagement. Bondholders do not have voting rights like shareholders leading to a myth that they had a limited ability to engage and exert influence on companies. However, with responsible investing ever more popular, there is a rapidly increasing investor appetite for, and availability of, ESG fixed income solutions, and in particular, ETFs.

The benefits of incorporating ESG analysis into fixed income investing are clear. ESG scrutiny on a corporate issuer may for instance reveal exposure to long-term investment risks such as climate change that could take years to materialise. Indeed, it is increasingly recognised that companies with strong ESG credentials are less likely to default and more likely to be profitable over the long term. ESG factors are consequently occupying a more important role in credit ratings and we are seeing greater ESG integration and issuer engagement.

Bond investors are becoming more willing to directly communicate with companies and hold them to account on ESG issues. Bond issuers, in turn, are now far more forthcoming in supplying information and there is more data available from ESG data providers even on previously neglected areas such as government debt. The already growing demand for ESG fixed income ETFs surged in the wake of the COVID-19 pandemic which has sharpened investors’ focus on sustainability risks and highlighted ETF resilience.

In the ensuing market turmoil following the pandemic outbreak, ETFs thrived by trading without interruption and offering investors instant market access with transparent, executable prices. Regulatory bodies such as the Bank of England highlighted the role of ETFs as a means of price discovery, especially in the fixed income space where ETFs provided an indication of the bonds’ fair value.

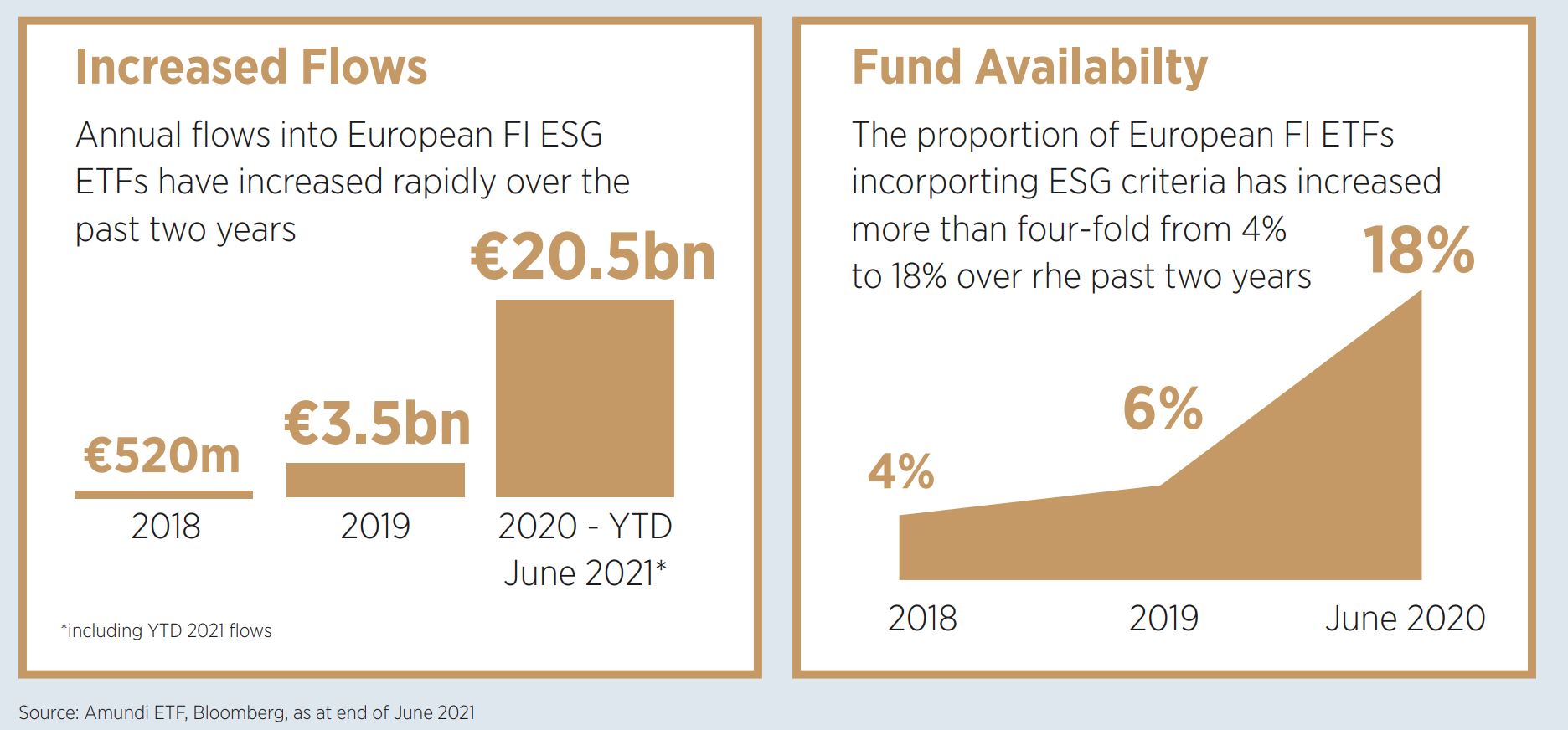

Flows to ESG fixed income ETFs have subsequently soared. Those listed in Europe attracted €20.5bn billion in the 18 months to end of June 20211, compared with €3.8bn in the preceding 18 months2. Increased demand has also driven innovation. European fixed income ETFs incorporating ESG criteria rose from 4% at the end of 2018 to 18% three years later3.

ESG progress in the fixed income market has a long way to go. There is still a lack of consistency in the level of ESG information provided by bond issuers, particularly for sovereign debt making ESG due diligence challenging. Moreover, fixed income assets still only account for a small proportion of sustainable assets globally.

However, with sustainable investing increasingly seen as a necessity not a luxury in managing long-term investment risks such as climate change, things are fast improving. And with benefits including low-costs, liquidity, transparency and diversification, ETFs are increasingly the vehicle of choice to implement ESG in fixed income.

Amundi’s fixed income range

At Amundi, we recognise that the shift from vanilla to ESG core holdings is not only underway in fixed income but it is a long way from running its course. Since the start of 2021, ESG has represented 75% of fixed income ETF net inflows4.

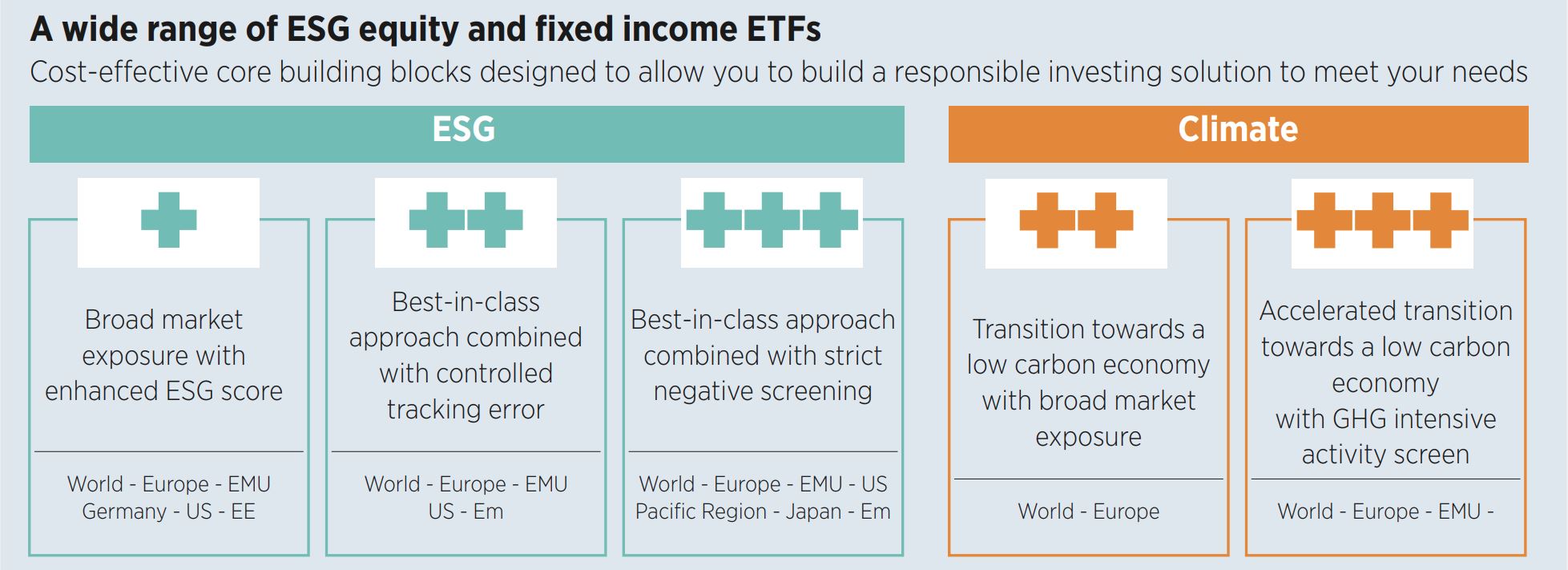

Product innovation is moving from the tracking of generic indices that have an ESG approach to more thematic approaches, most notably climate change. These are driven by the different investor needs that we can see emerging such as a desire for greater diversification or for alpha generation. In the ETF market, Amundi’s heritage as a leading fixed income player is combined with a commitment to cost-efficiency and innovation.

As a result, we have developed a comprehensive range of sustainable fixed income ETFs.

Source: Amundi

¹ Source: Amundi ETF/Bloomberg as at end of June 2021² Source: Amundi ETF/Bloomberg as at end of June 2021 3 Source: Amundi ETF/Bloomberg as at end of June 2021⁴ Source: Amundi ETF as at end of June 2021

Important Information: This promotion is issued by Amundi (UK) Limited, registered office: 77 Coleman Street London EC2R 5BJ. Amundi (UK) Limited is authorised and regulated by the Financial Conduct Authority under number 114503. This may be checked at https://register.fca.org.uk/ and further information of its authorisation is available on request. This document is not intended for citizens or residents of the United States of America or any “U.S. Person”, as this term is defined in SEC Regulation S under the U.S. Securities Act of 1933. The “US Person” definition is provided in the legal mentions of our website www.amundi.com. This article is only directed at persons who are Professional Clients (as defined in the FCA’s Handbook of Rules and Guidance), must not be distributed to the public and must not be relied or acted upon by any other persons for any purposes whatsoever. The content of this article is for information purposes only and does not constitute a solicitation or a recommendation to buy or sell.