More than 3.5 billion people currently experience water scarcity, and 10% of the global population lives in countries that the United Nations considers to have high or critical levels of water scarcity.1,2 Unfortunately, water shortages are expected to proliferate, with as many as five billion people forecasted to experience water scarcity by 2050.3 However, companies are working to improve the water cycle and promote more thoughtful approaches to our precious water resources.

Xylem: Using every drop of water

Fundamental vulnerabilities in how clean water and wastewater are transported result in needless water loss. Globally, there is a roughly 30% disparity between the volume of water utilities deliver and the amount of water billed. According to the World Bank, the water lost costs the global economy $14bn annually.4

To improve water management, Xylem deploys smart water innovations that use sensors, automation and data analysis. Its virtual district metering areas (vDMAs) interpret information from flow meters to detect when leaks occur.

Accordingly, Xylem aims to derive 50% of total revenues from digital products and services by 2025, up from 35% in 2021.5 Further adoption of digital water equipment could act as margin catalyst for Xylem, as digitally augmented gear and accompanying service contracts are often more profitable than other business lines.

Mueller Water Products: Upgrading decrepit water infrastructure

In the United States, six billion gallons are lost annually due to leaky pipes, amounting to $7.6 billion in losses in 2019.6 As many as 22 million Americans still drink water delivered by lead pipes, even though lead pipes were outlawed for use in the country’s public water systems in 1986.7,8

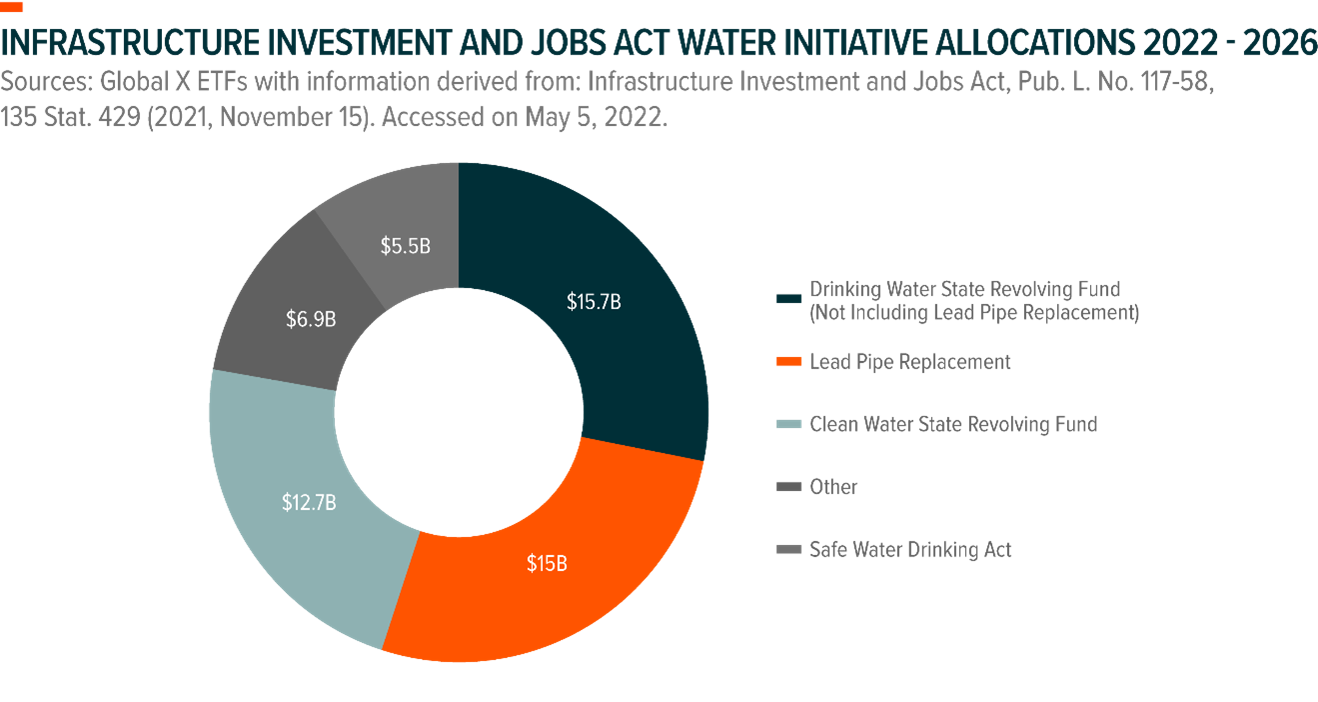

The recently passed Infrastructure Investment and Jobs Act (IIJA) directs $55bn over five years toward various water initiatives in the United States and addresses outdated water infrastructure.9 One of the largest water-related line items in the bill is $15bn to remove and replace lead pipes, which is enough to eliminate an estimated 25% of the lead pipes in the US.10

Mueller Water Products is a company that specialises in flow control equipment in North American markets, with over 90% of revenues derived from the US.11 Relevant products include iron gates, service brass products, pipe repair components, and speciality valves to control water pressure in pipelines. This focus on US markets and key offerings may position the Mueller Water Products to support some of the water initiatives set forth by the IIJA.

Ecolab: Boosting global water hygiene

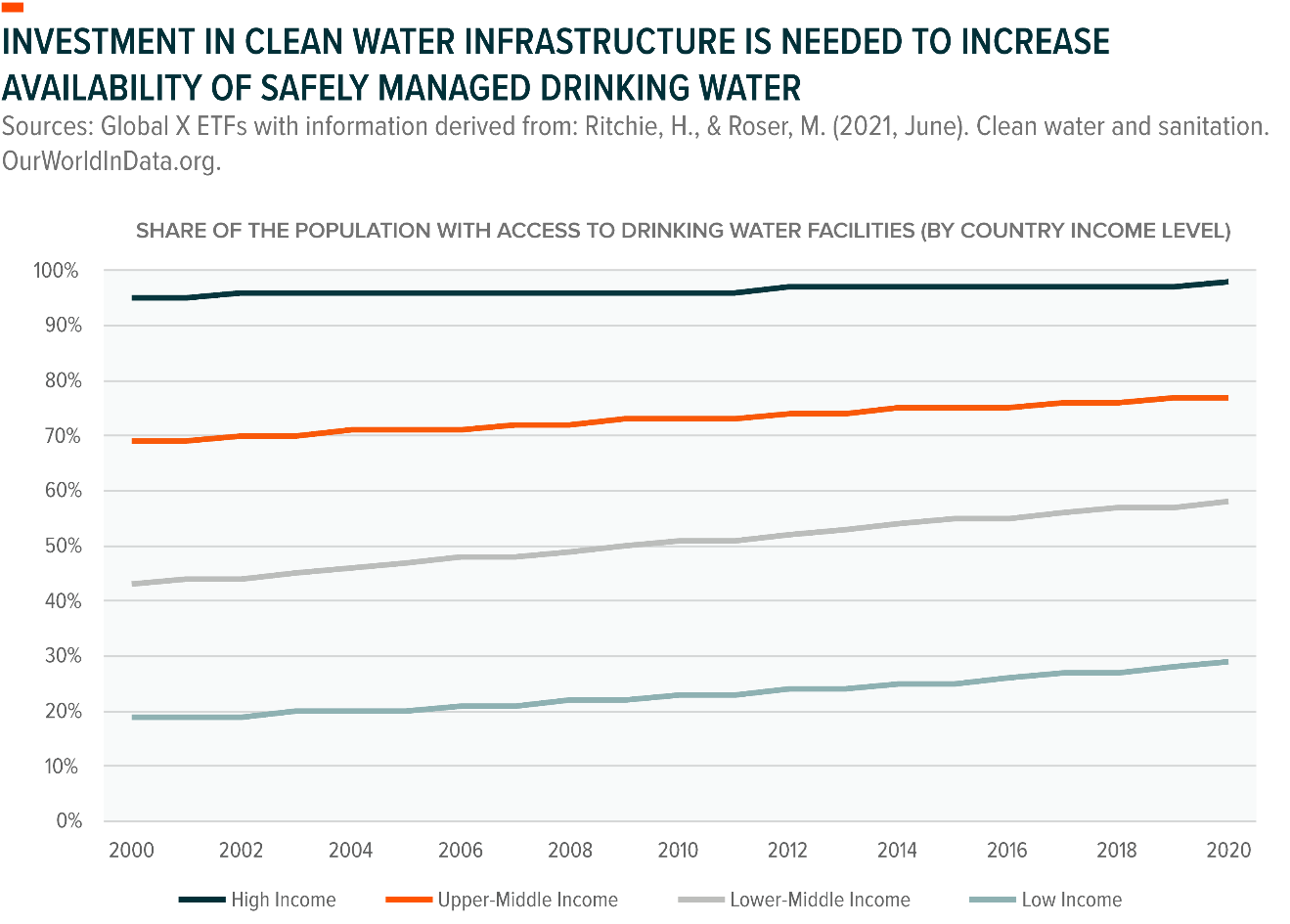

At least two billion people lack access to safely managed drinking water, and only about half of the world’s population use safely managed sanitation services.12,13

Sanitation coverage has improved in recent decades, with 74% of the world’s population having access to safely managed drinking water as of 2020, compared to 62% in 2000.14 However, in 2020, only 29% of people living in countries the World Health Organisation (WHO) classified as low-income had access to clean drinking water facilities.15

A diverse business model has allowed Ecolab to accommodate a wide array of needs within the clean water space. Wastewater treatment is a complex process that often can be improved upon at multiple points. Ecolab’s integration allows the company to address multiple needs from the same customer, which can lead to repeat revenue streams. Growing corporate emphasis on sustainability could also act as a tailwind.

Ecolab focuses on boosting the efficiency of sanitation processes, an attractive prospect for companies who are likely to pursue incentives for reducing their energy and water footprints. Ecolab is estimated to serve a potential market of $150bn worldwide, up from $100bn in 2011.16,17

Energy Recovery: Sourcing drinking water from the ocean

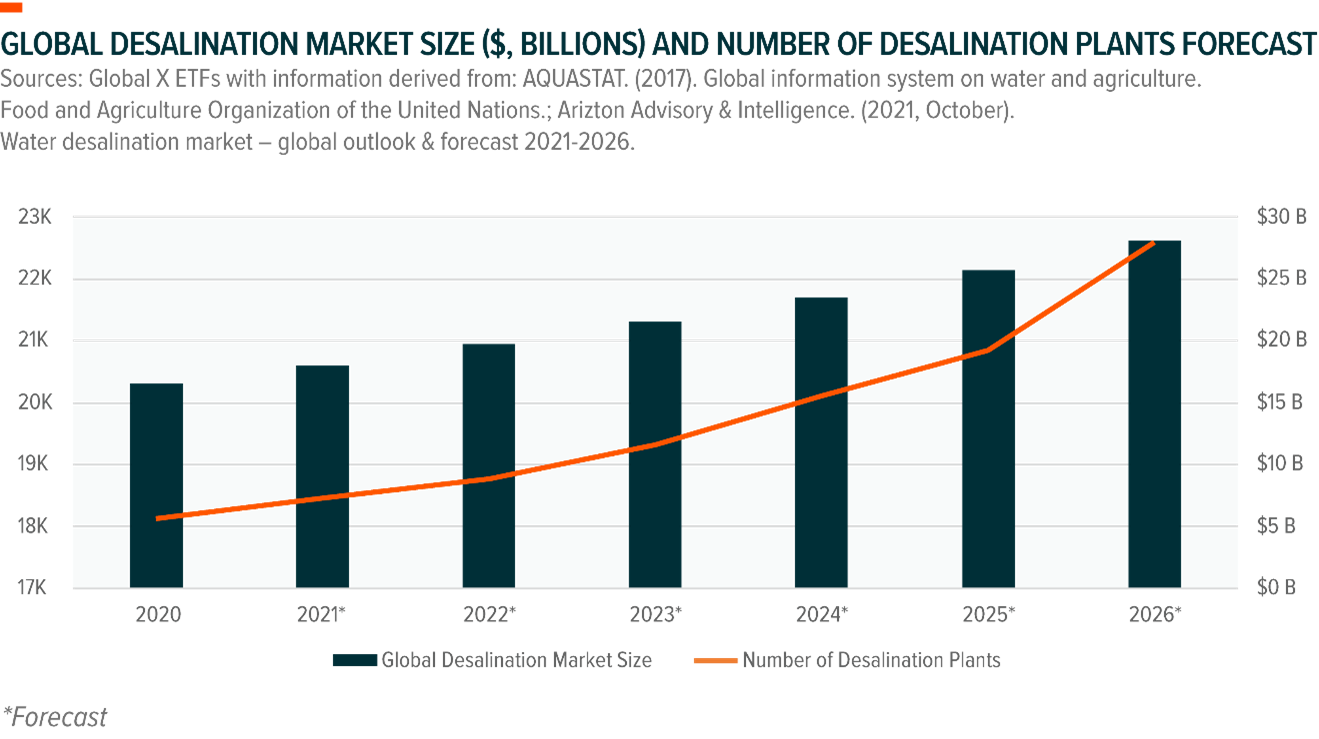

Desalination is a process that removes salt and other minerals from seawater or brackish groundwater and converts it to fresh water. Although the desalination industry remains in its early stages, it is a technology deployed at scale that already provides clean water to more than 300 million people globally.18 Further adoption of desalination could tap into the 97.2% of the world’s water that is contained in the ocean and greatly expand the amount of fresh water available.19

Energy Recovery provides equipment meant to bolster efficiencies of industrial fluid-flow markets worldwide, with a primary focus on reverse osmosis seawater desalination. Energy Recovery’s product suite includes pumping systems, turbochargers and pressure exchangers for desalination plants. Such products specifically seek to mitigate one of the biggest issues with desalination: high energy intensity. Energy use accounts for 50-60% of total desalination costs, thus power conservation could decrease costs and encourage adoption of the technology.20 In 2020, the company’s line of pressure exchange devices saved desalination customers $2.6bn in energy costs and avoided 12.5 million metric tons of carbon emissions.21

The increasing impact of water scarcity and the threat of further shortages cannot be ignored. Fortunately, the private sector continues to innovate in areas such as smart water optimisation, infrastructure replacement, advanced water purification, and water sourcing. In our view, companies in these spaces, like Xylem, Mueller, Ecolab and Energy Recovery, could benefit as the world increases its investments in strategies designed to avoid the worst water shortage outcomes.

Footnotes

UNESCO World Water Assessment Programme. (2021, March 21). The United Nations world water development report 2021:Valuing water. United Nations Educational, Scientific and Cultural Organisation. https://unesdoc.unesco.org/ark:/48223/pf0000375724

Food and Agriculture Organisation of the United Nations & United Nations Water. (2021). Progress on level of water stress:Global status and acceleration needs for SDG indicator 6.4.2. Rome. https://doi.org/10.4060/cb6241en

Samel, M. (2022, February 17). Global water agenda: What to expect in 2022. Economist Impact. https://impact.economist.com/sustainability/ecosystems-resources/global-water-agenda-what-to-expect-in-2022

(2021, September 9). Optimising leak detection with a virtual DMA: Progressive utilities are leveraging technology to improve the economics of water management [White paper]. https://www.xylem.com/siteassets/support/white-papers/white-paper-resources/wp_optimisingleakdetection_0921.pdf

Latino, M., Hackett, G., & Pilla, M. (2021, September 30). Xylem: 2021 investor day. Xylem. https://xyleminc.gcs-web.com/static-files/f705f8b0-7c6e-4af8-bdee-2e90fcb7d7c2

ASCE Members & Staff. (2021). A comprehensive assessment of America’s infrastructure. American Society of Civil Engineers. https://infrastructurereportcard.org/wp-content/uploads/2020/12/National_IRC_2021-report.pdf

Environmental Protection Agency. (2022, April 27). Use of lead free pipes, fittings, fixtures, solder, and flux for drinking water. https://www.epa.gov/sdwa/use-lead-free-pipes-fittings-fixtures-solder-and-flux-drinking-water

Rosenthal, L., & Craft, W. (2020, May 4). Buried lead: How the EPA has left Americans exposed to lead in drinking water. APM Reports. https://www.apmreports.org/story/2020/05/04/epa-lead-pipes-drinking-water

Infrastructure Investment and Jobs Act, Pub. L. No. 117-58, 135 Stat. 429 (2021). https://www.congress.gov/117/plaws/publ58/PLAW-117publ58.pdf

Mueller Water Products, Inc. (2021, September 30). Form 10-K. United States Securities and Exchange Commission. Retrieved from http://otp.investis.com/clients/us/mueller_water_products/SEC/sec-show.aspx?FilingId=15367987&Cik=0001350593&Type=PDF&hasPdf=1

World Health Organisation. (2022, March 21). Drinking-water. https://www.who.int/news-room/fact-sheets/detail/drinking-water

World Health Organisation. (2022, March 21). https://www.who.int/news-room/fact-sheets/detail/sanitation

Ritchie, H., & Roser, M. (2021, June). Clean water. Our World in Data. https://ourworldindata.org/clean-water-sanitation

(2022, January). Impacting what matters: 2021 annual report. https://s24.q4cdn.com/931105847/files/doc_financials/2021/ar/Annual-Report-2021.pdf

(2012, February). Working as one: Annual report 2011. https://s24.q4cdn.com/931105847/files/doc_financials/annual/2011-annual-report.pdf

Robbins, J. (2019, June 11). As water scarcity increases, desalination plants are on the rise.Yale Environment 360, Yale School of the Environment. https://e360.yale.edu/features/as-water-scarcity-increases-desalination-plants-are-on-the-rise

Mullen, K. (d.). Information on Earth’s water. National Ground Water Association. Accessed on June 2, 2022 from https://www.ngwa.org/what-is-groundwater/About-groundwater/information-on-earths-water

Zarzo, D., Prats, D. (2018, February 1). Desalination and energy consumption. What can we expect in the near future? Desalination, 427, 1-9. https://doi.org/10.1016/j.desal.2017.10.046

Energy Recovery. (d.). Scalable solutions for global desalination. Accessed on June 2, 2022 from https://energyrecovery.com/water/

This document is not intended to be, or does not constitute, investment research as defined by the Financial Conduct Authority.

The value of an investment in ETFs may go down as well as up and past performance is not a reliable indicator of future performance.

Trading in ETFs may not be suitable for all types of investors as they carry a high degree of risk. You may lose all of your initial investment. Only speculate with money you can afford to lose. Changes in exchange rates may also cause your investment to go up or down in value. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Please ensure that you fully understand the risks involved. If in any doubt, please seek independent financial advice. Investors should refer to the section entitled “Risk Factors” in the relevant prospectus for further details of these and other risks associated with an investment in the securities offered by the Issuer.