Harriet Ssentongo, senior sales specialist at Franklin Templeton, has said investors have been overpaying for exposure to emerging market ETFs at a time when single-country allocation is coming into focus.

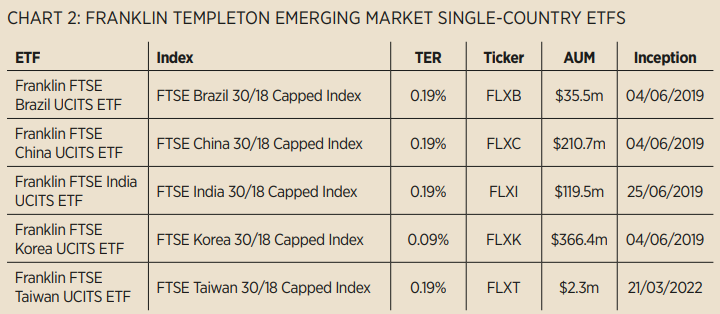

According to Ssentong, the issue is most apparent in markets such as South Korea – defined by some as an emerging market and others as a developed market – where the Franklin FTSE Korea UCITS ETF (FLKR) is five times cheaper than the next most expensive, the Lyxor MSCI Korea UCITS ETF (KRWL) with a total exchange ratio (TER) of 0.09% versus 0.45%.

FLKR is also cheaper than many broad-based emerging market ETFs, coming in one basis point lower than the Amundi Prime Emerging Markets UCITS ETF (PRAM). However, Ssentongo said she believes investors are trending towards a more granular focus in emerging markets.

“We have observed and believe that investors have been overpaying to access emerging markets. With the trend clearly on the path of disaggregating emerging market exposure, and growing appetite to explore emerging market country allocations, we felt that we are best placed to service and provide solutions for clients in this space,” she said.

“If we take a country like South Korea, we see that some investors look at this country as an emerging market and others see it as a developed market. The question is therefore how much should investors pay to access this market? We think they have been paying too much.”

Highlighting this, research conducted by ETF Stream last December found most investors – although even split – were more likely to be targeted with their allocations, with 40% stating they would be while 28% stated “somewhat” and 32% said they would not.

The case for a single country focus

While some investors may favour a more diversified approach to emerging markets, particularly in times of turmoil, recent performance dispersion between countries has highlighted the opportunities for investors who are willing to do their due diligence. For example, the Franklin FTSE Brazil UCITS ETF (FLXB) has returned 26.8% year to date compared to -15.1% for the Franklin FTSE China UCITS ETF (FLXC). PRAM has returned -6.9% over the same period. Brazil’s position as a commodity exporter has seen it make huge gains since the start of the year, compounded by the impact of the Russia Ukraine war, although it does face headwinds in the shape of higher energy and fertiliser costs.

Ssentongo said: “Recent market volatility has highlighted the difference between single countries within a broad emerging market index or fund. The war between Russia and Ukraine is yet another example of why emerging market countries should not be viewed as one homogenous group. More recently we have seen a trend of investors starting to disaggregate the individual country constituents of emerging markets and invest on a more nuanced country by-country basis.”

Another example of dispersion is a comparison of BRIC countries since the term was founded by Jim O’Neil in 2001. The annualised returns of Brazil, Russia, India and China over that period have been 7.8%, -42%, 11.2% and 8.2%, respectively.

Furthermore, each of these countries has experienced its own crisis at certain points over the past decade, more recently the removal of Russia from emerging market indices and the Chinese real estate crisis and technology clampdown.

“Single country allocations are truly beneficial if investors are comfortable in their knowledge of the underlying countries,” Ssentongo said.

Broad multi-country or regional allocations have faded in popularity as the risk and return differs so markedly for the underlying components. With knowledge and insight about individual countries investors can tailor their portfolios to suit the risk-return profiles of their clients.”

Which countries are seeing the biggest demand?

Despite China’s recent woes, FRCH has still been one of Franklin’s more popular ETFs of the range, recording $66m inflows year to date – the most across its range – taking its total assets under management to $211m, as at 18 May.

The country is considered a monolith within emerging markets, representing roughly 30% in broad emerging market indices alone, which has resulted in investors looking to separate it from their wider exposure. Ssentongo said: “This is due to a mix of increased risk appetite as investors seek yield, structural changes which have opened Chinese markets to foreign investors, and further diversification within the Chinese economy.

“China is the most prominent example,” she continued. “However, there is also a case to be made about the differing risk-return profiles in emerging markets more generally. Drivers for risk-return in emerging markets have changed and diverged significantly over the past two decades.”

Elsewhere, Ssentongo highlighted South Korea as a market that has also been seeing more interest.

“South Korea, for some clients, can be seen as a thematic exposure due to its high weighting in technology. We have also seen investors’ attention be drawn to South Korea in 2020 following how the market came out of the first wave of COVID-19 in 2020,” she said.

“This also aligned with structural changes within the South Korean markets related to how the Chaebol system may impact capital markets.”

Emerging market headwinds

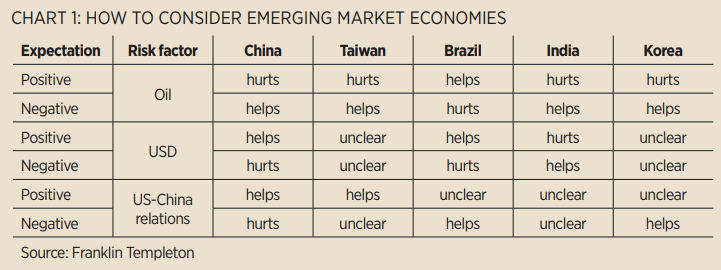

While single-country exposures in emerging markets have been growing in focus, Ssentongo argues there are macro headwinds facing the broad market which are out of the control of governments.

“For example, how will countries cope with rising interest rates around the western world? Capital is likely to be sucked out of emerging market countries to the US which can have unexpected consequences on foreign exchange rates and domestic capital markets,” she said.

“Understanding businesses fundamentals, people and valuations are generally universal across borders. So, with existing knowledge of these elements, investors looking for single-country exposure will be able to take advantage of opportunities at the single-country level.”

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.