The return of ‘risk-on’ sentiment saw blockchain ETFs book electric returns in January, however, a 60% performance dispersion across the product class – including those from Invesco and VanEck – shows blockchain ETFs can differ greatly despite their seemingly identical labels.

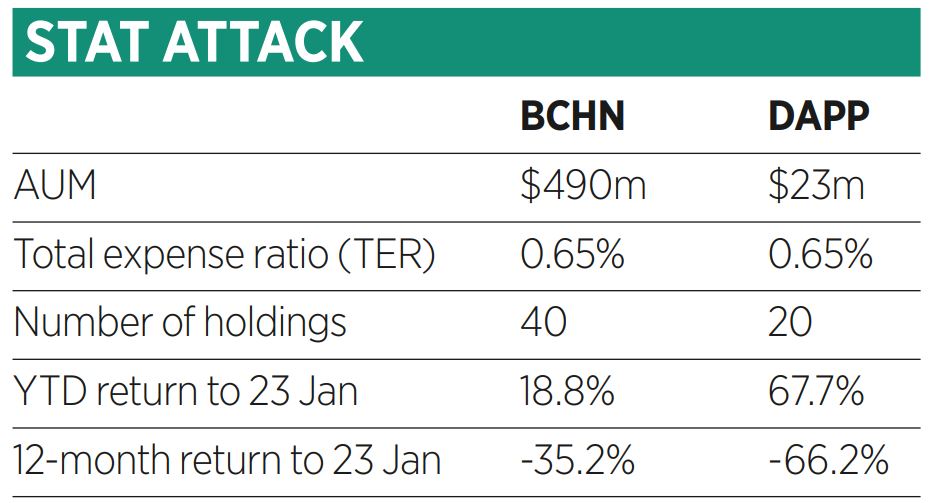

The $490m Invesco CoinShares Global Blockchain UCITS ETF (BCHN) is the dominant candidate within the theme in Europe, standing as the continent’s second-oldest and by far the largest blockchain ETF.

Launching two years later, in April 2021, is BCHN’s plucky challenger, the $23m VanEck Crypto and Blockchain Innovators UCITS ETF (DAPP).

While only a fraction of the size, DAPP boasts punchier returns figures, largely by virtue of being nothing like Invesco’s ETF when one looks beneath the bonnet of both products.

According to data from justETF, VanEck’s DAPP returned a blistering 67.7% between the turn of the year and 23 January. Meanwhile, Invesco’s BCHN rallied by an impressive but more modest 18.8% during the same period.

However, DAPP’s recent performance owes to factors such as cooling US Consumer Price Index (CPI) and the Federal Reserve slowing its pace of interest rate hikes in December, which have been supportive to borrowing-intensive tech players, including small blockchain and crypto mining companies.

With inflation and the pace of Fed hikes spending most of last year at levels not seen for four decades, Invesco’s BCHN returned -35.2% in the 12 months to 23 January. VanEck’s DAPP blew this out of the water with a collapse of -66.20%.

Invesco's BCHN

Invesco’s strategy tracks the CoinShares Global Blockchain Equity index – run in partnership with Solactive – which captures 40 companies in several industries that “participate or have the potential to participate” in blockchain, with the intention to “evolve with the potential growth” of the theme.

BCHN’s top positions include allocations to South Korean communications firm Kakao, financial companies Monex, SBI Holdings and Block, semiconductor firms TSMC and Intel and companies offering crypto trading including Coinbase and GMO Internet.

While some of its weightings go to companies closely involved in blockchain, others go to companies whose core business is in other sectors but investing in blockchain to enhance their operations, such as Norsk Hydro and Rio Tinto.

VanEck's DAPP

Taking the opposite approach, VanEck’s ETF offers concentrated exposure to blockchain’s already established role in mining, validating and operating cryptocurrency protocols, via the 20 companies in its underlying MVIS Global Digital Assets Equity index.

While holding Block and Coinbase, DAPP’s basket is dominated by crypto miners including Bitfarms, Riot Blockchain, Marathon Strategy, Hut 8 Mining Corp and Hive Blockchain Technologies.

In effect, DAPP is a bet on the growth of the crypto asset industry and the role of blockchain within this. Interestingly, like metal mining, crypto mining stocks also seem to offer amplified exposure to the returns of the assets they are involved in. While the price of bitcoin is down 37.4% in the 12 months to 23 January and up 38.4% year to date, DAPP’s returns have been almost twice as extreme on both time horizons.

Meanwhile, Invesco’s BCHN takes a less pure-play approach to blockchain and companies based on the technology. While it has exposure to crypto and companies investing in the blockchain theme, it gives most of its weight to non-blockchain companies attempting to integrate the technology in some way.

Whether ‘intensive blockchain within crypto’ or ‘blockchain investment as a determinant of a company’s future success’ is preferable depends on investors’ views on where the technology will play a more significant role in future.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles