There is a gap in the market for ETFs labelled Article 9 under the Sustainable Finance Disclosure Regulation (SFDR), presenting a “great opportunity” for issuers, Rumi Mahmood vice president of ESG and climate research at MSCI has said.

Speaking to ETF Stream, following the publication of a new MSCI report, Funds and the State of European Sustainable Finance, Mahmood (pictured) said the only Article 9 ETFs currently available are in the global and European equities space as well as green bond ETFs, presenting a challenge for investors looking to diversify their portfolios in the highest-rated ESG category.

It comes after almost all ETFs tracking Paris-Aligned Benchmark (PAB) and Climate Transition Benchmark (CTB) indices have been reclassified over the past nine months, due to being deemed unlikely to meet the 100% sustainability requirements under ‘level 2’ of SFDR.

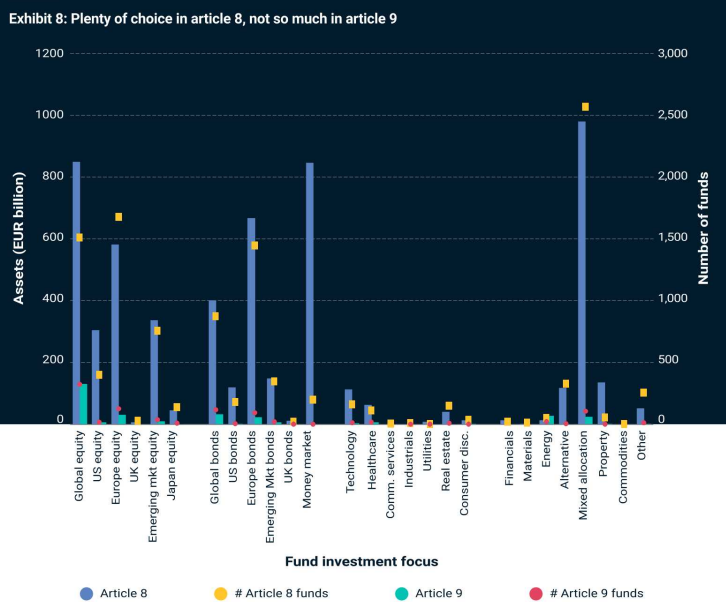

“There is a lot of diversity when it comes to the types of investment options within Article 8. You have global, US, Europe and regional equities, you have regional bonds and sector-based strategies. You even have mixed allocations, alternatives, properties, commodities,” Mahmood said.

“However, if you look at the Article 9 funds universe, including ETFs, it is pretty much only global equity, European equity, global bonds and European bonds.”

Source: MSCI ESG Research

Roughly $57bn of assets across more than 70 ETFs were reclassified from ‘dark green’ Article 9 to ‘light green’ Article 8 in Q4 2022 ahead of the ‘level 2’ SFDR update on 1 January, according to Bloomberg Intelligence.

In essence, Article 8 became a catch-all classification for ETF issuers launching ESG products.

MSCI said Article 8 funds account for €5.9trn of the €6trn fund universe with 12x more ‘light green’ funds for investors to choose from.

“It is challenging for any ETF investor who is looking to achieve a globally diversified portfolio using Article 9 funds,” Mahmood said.

“Currently, it is not possible and while that presents a challenge for investors, it also presents a great opportunity for providers, including ETF providers, to service this massive gap that exists in the Article 9 fund universe.”

Data challenges

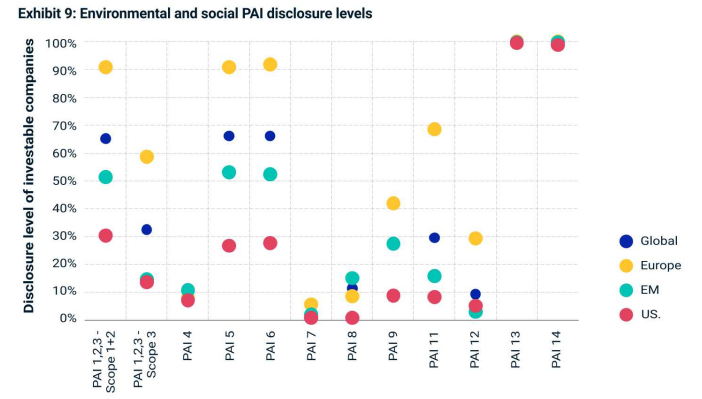

One current barrier to creating a viable Article 9 product is the level of data currently being disclosed by European companies, including emissions-based such as Scope 1,2 and 3.

While European firms lead the way in this form of disclosure, with over 90% disclosing Scope 1 and 2 emissions, emerging markets and US companies are some way behind, resulting in a “European or developed market bias in product construction”, according to Mahmood.

“One potential solution is to estimate data for areas, regions and companies where the disclosure is not coming through yet. That would be one way to bridge the gap and create more Article 9 strategies,” he said.

Source: MSCI ESG Research

Despite this, the billions of euros worth of ETFs downgraded from Article 9 to Article 8 over the past few months could find themselves reclassified back to Article 9, following a clarification from the European Commission.

“Under Article 9 of SFDR, products tracking PAB or CTB, often based on portfolios of shares or bonds of companies, are deemed to make sustainable investments,” the Commission said back in April.

Mahmood added: “The regulator has indicated recently that some strategies could have a safe harbour in Article 9, such as PAB and CTB strategies, which may be reclassified in due course while other strategies seek to gain regulatory clarity.”