Global ETFs have broken the psychologically significant $10trn assets under management (AUM) mark, in a further sign of the ongoing shift from mutual funds to ETFs.

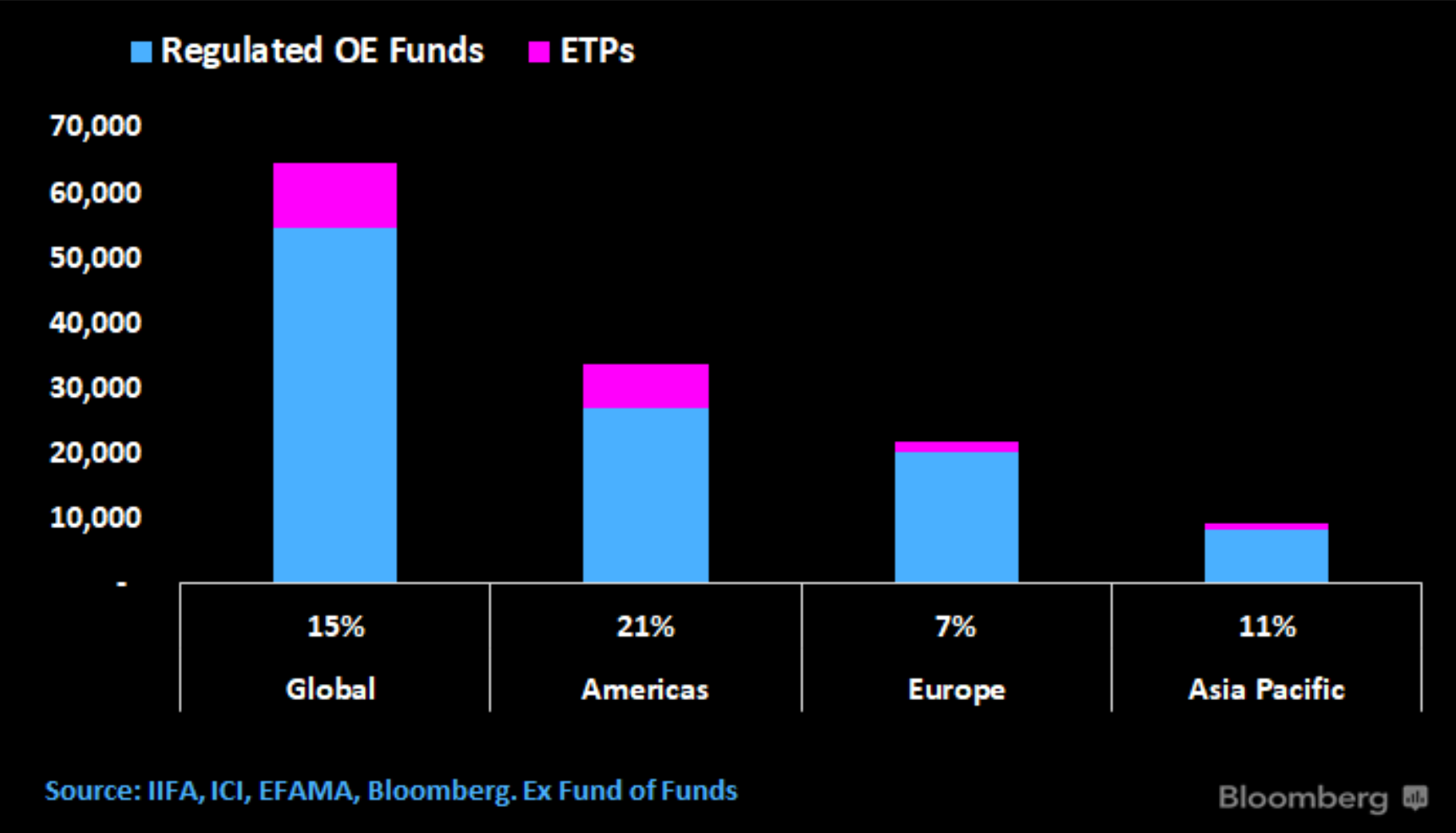

According to data from Bloomberg Intelligence, exchange-traded products (ETPs) have taken in more than $1trn new assets since the start of the year, meaning they now represent 15% of all fund assets globally.

The role ETFs play is particularly significant in the Americas, where ETFs make up 21% of fund AUM. The US in particular is home to the world’s largest ETF, the $426bn SPDR S&P 500 ETF Trust (SPY), and this year’s fastest-growing product, the $276bn Vanguard S&P 500 ETF (VOO).

According to data from ETFLogic, VOO has added $49.6bn assets year-to-date to 15 November, more than $10bn ahead of the runner-up, also issued by Vanguard.

While seven of the eight ETFs with over $100bn AUM are US-listed, a notable mention is the Japan-listed NEXT FUNDS TOPIX Exchange Traded Fund (13060), whose $12.9bn inflows in 2021 have taken it to AUM of $109.1bn. Overall, ETFs listed in Asia-Pacific and China (APAC) represent 11% of the region’s fund assets.

Commenting on the news, Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, said: “It is a big deal because even though we are hitting so many records, there is still lots of room for upside.”

Meanwhile, despite ploughing through their previous annual flows record with four months to spare, European ETFs make up a more modest 7% of total fund assets in the continent, Bloomberg Intelligence said, a third of the share claimed by the asset class in the US.

Europe’s largest ETF, the $55.8bn iShares Core S&P 500 UCITS ETF (CSPX), is also little more than an eighth of the size of SPY.

Immovable objects in Europe

Discussing some of the recurring issues in the European ETF market, Psarofagis said the continent demonstrates the problem with fragmented markets and the importance of distribution channels. He added Europe risks being left behind by high-growth regions such as Asia if it does not make changes soon.

Echoing his thoughts, Michael O’Riordan, founding partner at Blackwater Search and Advisory, said: “Fragmented markets, tax and retrocession fees and not disappearing anytime soon unfortunately and there are still plenty of vested interests in the mutual fund world that do not want the status quo disrupted as they have too much to lose from it.

O’Riordan argued two tailwinds will be vital in driving a cultural shift in the continent’s ETF industry. First, he said better education is needed as ETFs are still oversimplified as being a purely passive and cheap vehicle, versus mutual funds which are viewed as active. He added even professional investors and fund selectors are guilty of forgetting ETFs are just a wrapper.

Second, he has faith the generations of millennial investors will drive a shift towards ETFs as the financial adviser of the future will more often than not be an algorithm, rather than a human manager receiving kickbacks.

Chart 1: Differences between US and European ETF markets

Comparison

US

Europe

Markets

A single market: One culture, one main exchange and one language

A fragmented market: Multiple cultures, multiple exchanges and multiple languages

Tax

Tax efficient: The ETF has capital gains tax benefits vs the mutual fund wrapper

ETFs and mutual funds have the same tax profile

Retrocessions

A level playing field: Retrocessions fees banned in the US

Retrocessions fees still allowed in numerous countries

Investor behaviour

Self-directed investors: Individuals manage their 401k plans themselves and are used to making their own investment decisions – often expressed via ETFs

Individuals tend to rely on advice and less engaged in making investment decisions themselves

Investor perception

Paves the way for active

ETFs perceived as low cost, passive

Source: Blackwater Search and Advisory

Despite these barriers, European ETFs have enjoyed explosive growth over the last decade, with 2021 inflows likely to equal the entire industry’s AUM in 2010.

Chris Mellor, head of EMEA ETF and commodity product management at Invesco, previously told ETF Stream a number of factors remain supportive for the European industry’s continued growth, including the simplicity and transparency of the wrapper, typically low management fees and easy access via on-exchange and over the counter (OTC) trading.

While upside potential might exist for ETFs globally, the relatively low base of the European industry suggests there is plenty of room for further growth.