The case for gold beyond a store of value, how the commodity performs during interest rate hiking cycles and the impact of the current macro environment on gold were topics discussed at ETF Stream’s recent webinar with HANetf.

The webinar, titled Gold ETFs: Hunting for protection against market volatility, started by assessing how investors are using gold to hedge against inflation and geopolitical risks, with retail investors also upping their exposure to the precious metal following the onset of the COVID-19 pandemic.

Steve Jones, business development manager at The Royal Mint, said: “For retail investors the pandemic was pivotal. We saw a record number of people buying gold bars in 2020 and again in 2021 and 2022.

“The mindset for retail investors appears to have changed; our customers are telling us they are looking to diversify their portfolios with an allocation to gold exchange-traded commodities (ETCs) to hedge against inflation, geopolitical risks and ultimately a store of value.”

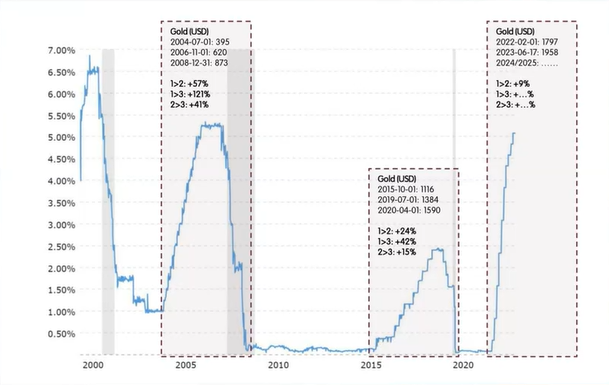

Eric Strand, founder of AuAg Funds, added gold has continued to beat expectations during the current rate hiking cycle, with the commodity up 9% since the US Federal Reserve started raising interest rates last year.

“Historically, gold has performed well in rate hiking cycles and of course, even better when they are coming down, something we will see soon,” he said. “Gold has gone up 9% since we started seeing rates go up, but this is actually driven by the direction of real rates.”

Source: AuAg Funds

According to Jones, wealth managers in the UK are looking to up their exposure to gold but are dependent on some very fluid macro drivers.

“We have been seeing great demand for our product,” he said. “A lot of it depends on developments of the Russia and Ukraine conflict and whether there will be some sort of reconciliation there. Unfortunately, gold does perform well in times of turmoil and uncertainty.”

It comes after the Royal Mint removed all Russian refined gold bars from the Royal Mint Responsibly Sourced Physical Gold ETC (RMAU) following the onset of the conflict in February 2022.

Macro risks and drivers

Away from the Russia and Ukraine war, other macro trends are also having an impact on the take up of gold ETCs.

Strand said both de-globalisation and de-dollarisation were particularly concerning, with the US losing influence and power globally. “The dollar has a premium because of its status as a world currency, but if it loses that, it will drag on the dollar in the end.

“The US has also taken on a lot of debt and will have large interest payments to make, so maybe they are in a little bit of trouble. This makes gold cheaper for European and Asian investors, which is good for the asset as well,” he said.

Elsewhere, the webinar also assessed the impact of the recent banking crisis on gold.

Jones said the impact of the regional banking crisis in the US and Credit Suisse in Europe increased demand for gold, which topped $2000 per ounce in early April as contagion fears spread. “We definitely saw increased demand for gold bars and flows into RMAU on the contagion.”

Strand added he does not think the end of the banking crisis is over, noting that gold, unlike bank deposits, does not have counterparty risks making it a much safer proposition.

The speakers also touched on the impact a recession would have on gold, with high-interest rates restricting the gold price in the short term before finding a “new bid” if the economy takes a downturn.

“Historically, recessions have led to gold increasing in value, though with interest rates rising, it is not always that clear cut,” Jones said.

A gold mining alternative

Away from holding the physical asset, investors can also consider gold mining equity ETFs which tend to have a “slight leverage” on gold, according to Strand. “It used to be the case if a miners ETF had a leverage of two compared to gold,” he said.

Launched in July 2021, the AuAG ESG Gold Mining UCITS ETF (ESGO) was the first gold mining ESG ETF in Europe for investors who what to access the industry with a sustainable tilt.

Strand added: “It has been hard to gold mining ETFs AUM. Even though miners have good cash flows, lower debt and high dividends of 7-8%, they have not been popular.

“It is an opportunity because it is a good value play with low risk. When we see the money rotation from overpriced AI-driven stocks, gold and miners will fly.”

To watch the full webinar, click here.