The price of gold has surpassed $2,000 an ounce as investors seek haven from market volatility caused by coronavirus.

The value of the gold metal has been on a continuous climb since coronavirus rocked markets in March and caused uncertainty among investors.

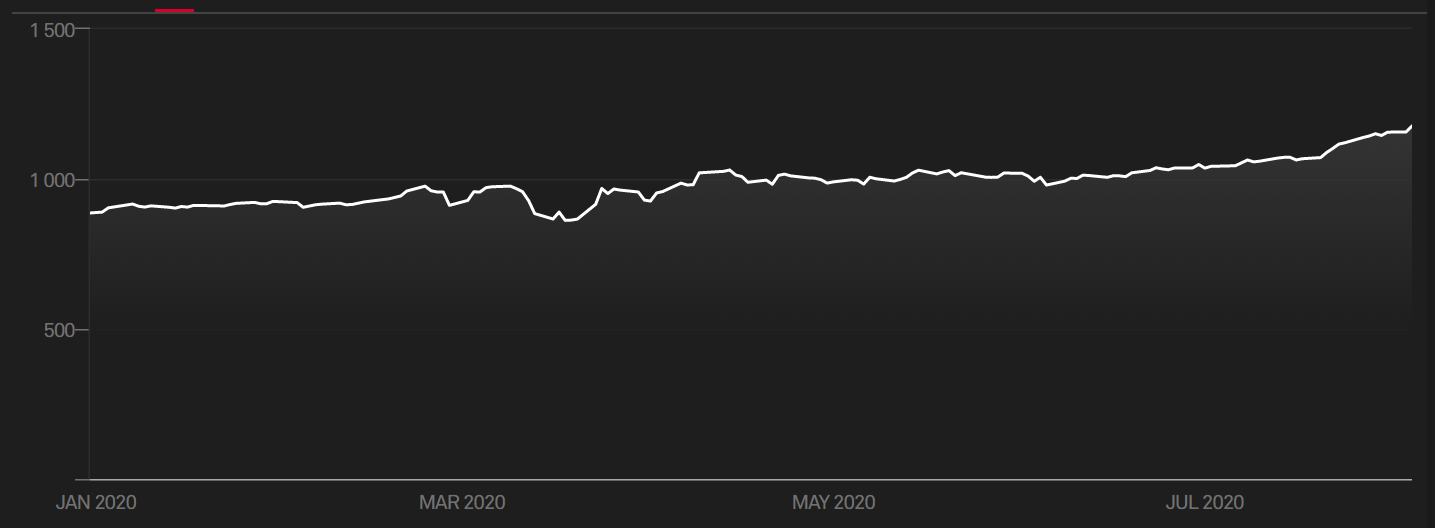

The S&P GSCI Gold index, a benchmark tracking the COMEX gold futures, has climbed roughly 30% year-to-date.

S&P GSCI Gold index YTD performance – Source: S&P Dow Jones Indices

In the first six months of 2020, inflows into gold-backed ETPs reached 734t, according to the World Gold Council. This bolstered total assets under management to a record $205.8bn.

In Q2 2020, European-listed gold ETPs saw inflows with $4.4bn, led by UK investors with $2.9bn.

European investors have continued flocking to gold ETPs into the second half of the year.

The $13.5bn Invesco Physical Gold ETC (SGLD) and the $15.1bn iShares Physical Gold ETC (IGLN) saw inflows of $409m and $227.6m last week, according to data from Ultumus.

Record low gold jewellery demand to put pressure on spot price

Fiona Boal, head of commodities and real assets at S&P Dow Jones Indices, said: “The first seven months of 2020 has been gold’s time to shine.

“YTD gains have outpaced equities and other safe-haven assets.”

Boal highlights that the fact gold is a financial asset that offers no income has become increasingly irrelevant as many government bonds are yielding negative returns.

“Ongoing rally is a sign that investors are suffering a new bout of nerves over the outlook for the global economy and a second wave of COVID-19 cases,” Boal added.