Gold is beautiful. The high metallic lustre – meaning it reflects light well – gives it that beautiful shiny appearance. Lesser-known qualities include exceptional malleability and ductility, it has a relatively high melting point, around 1064°C, and is an excellent conductor of electricity and heat.

Additionally, gold stands out as one of the densest metals, contributing to its relatively heavy weight. Add to this its corrosion resistance and scarcity, and you have a highly valuable, uniquely versatile and rather rare element…one that has been a store of value for centuries.

But gold is expensive. Its value continues to rise while it does not provide any yield or income. So, this month we ask ourselves…is it time to sell the shiny stuff?

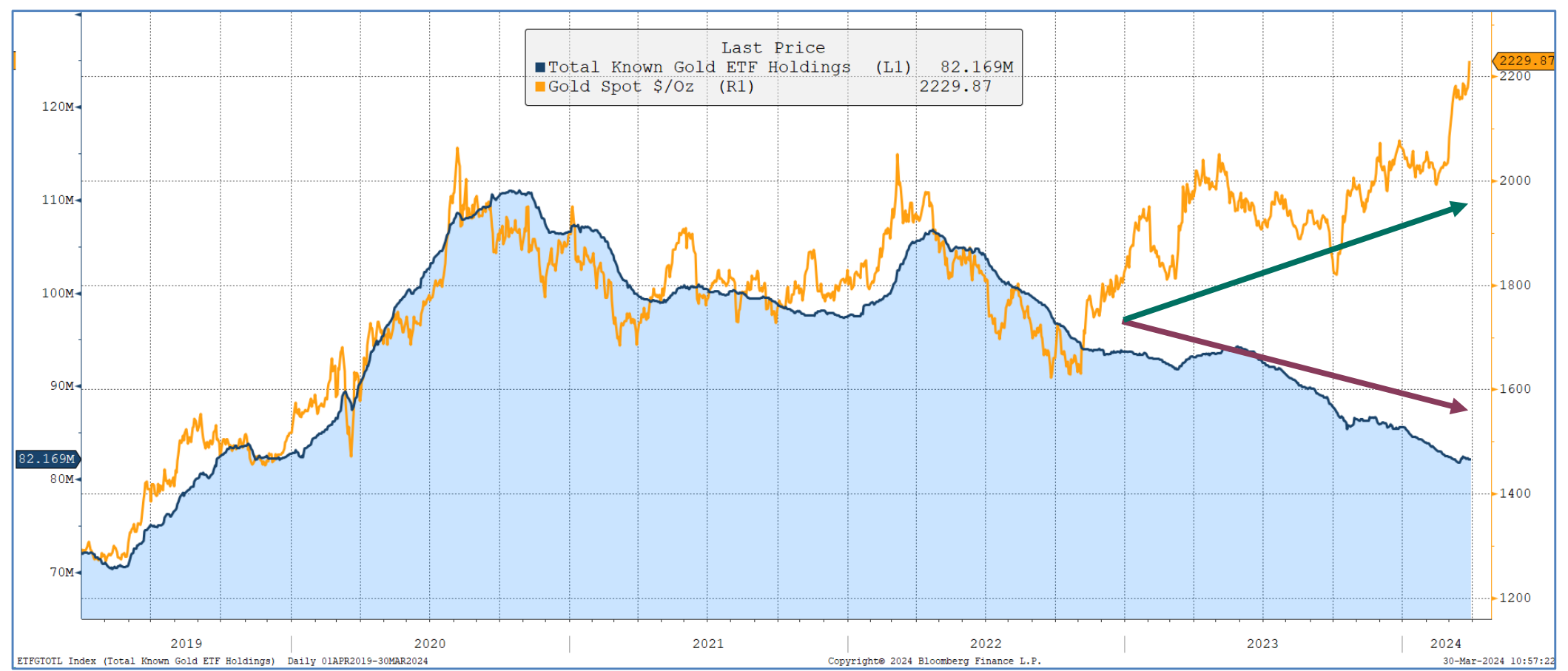

As shown in Chart 1, interest in gold from retail investors and ETF allocators in the West continues to decline, with a recent survey from Bank of America finding that 75% of advisers have less than 1% of their portfolios in gold, and less than 10% were considering increasing their exposures.

Chart 1: Despite dwindling ownership of gold ETFs, the price of gold has continued to march higher since late 2022. Where might prices go when ETF allocators return?

Source: Bloomberg, 30 March

This weakness in demand, however, has been more than offset by central governments and retail investors in Asian markets such as China.

Despite interest rates at levels not seen in well over a decade, we believe there are several reasons why the price of gold is likely to continue to rise. Government liabilities continue to rise as demographic tailwinds of the last four decades become headwinds.

At the same time, fiscal spending and government deficits are increasingly likely to be funded by money that does not exist. That is, governments will most likely fund their liabilities by printing money.

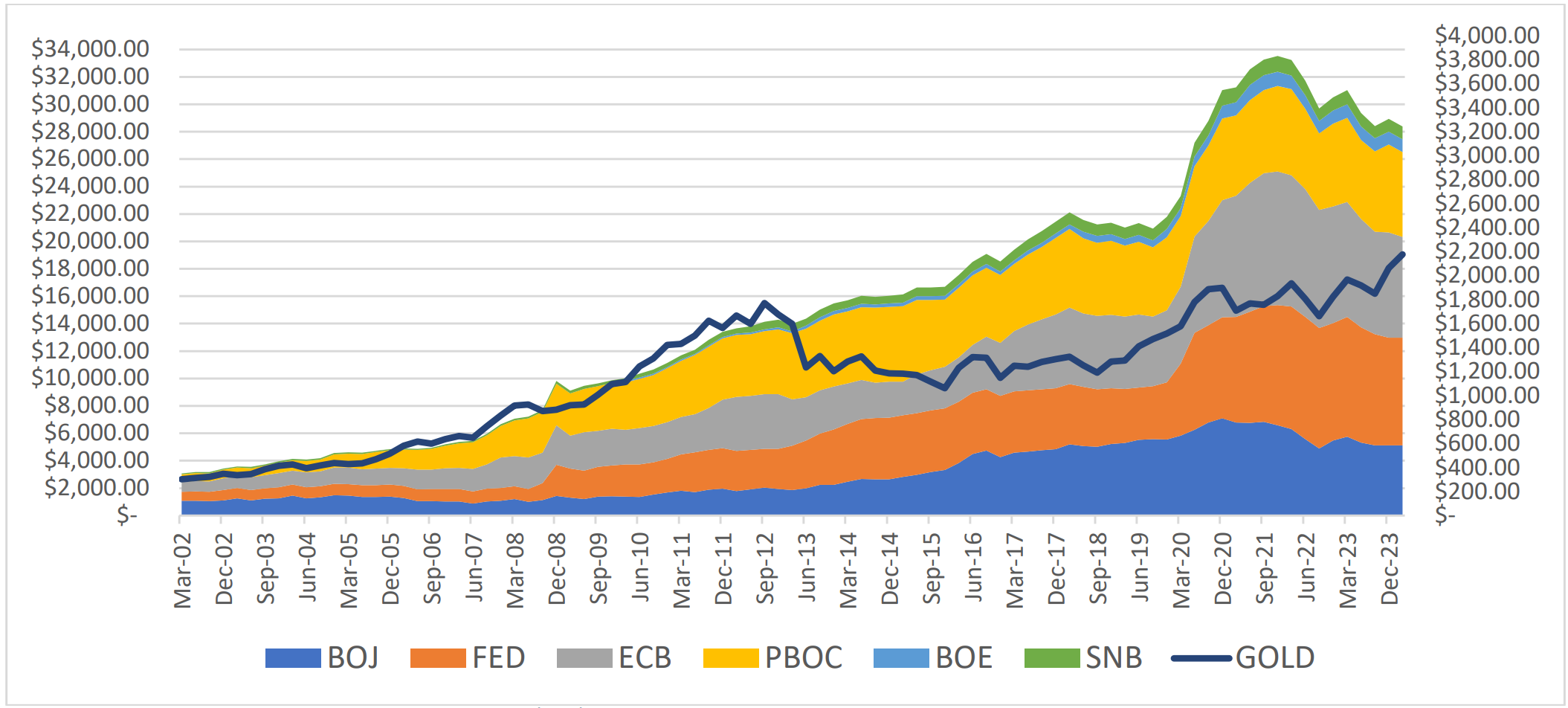

This debt monetisation devalues the value of fiat currencies, the direct consequence being asset price inflation. Chart 2 shows how the increase in the price of gold has not held up with the enormous amount of money printed by central banks.

Chart 2: Growth in global central bank assets has far outstripped the growth in the value of gold since the end of the euro-crises

Source: Bloomberg, Shard Capital, 29 February Right axis: Gold price in US dollars/ounce; Left Axis: Central bank assets in billions of US dollars

Considering more government debt is likely to end up on the balance sheets of central banks, the upper bound for gold is still a long way off!

Gold also offers protection against unpredictable and potentially significant events that can have a sudden and adverse impact on financial markets, economies or geopolitical stability.

These events may include political turmoil, wars, terrorist attacks, natural disasters, pandemics, economic crises, or unexpected shifts in monetary policy.

Finally, given the arbitrary nature of the fair value of gold, we believe a technical approach is the most practical and useful valuation methodology to price gold.

Specifically, we employ a trend-following strategy to determine exposure to the commodity based on the strength and significance of the underlying price signals. The trend remains very strong and would suggest investors increase exposure.

In conclusion, we believe the inevitability of financial repression is misunderstood, macroeconomic and geopolitical event risks are under-appreciated, gold is generally under-owned by institutional and retail investors in the West while the underlying trend remains robust.

The outlook for gold is as shiny as the metal itself and we retain significant conviction and exposure.

Ernst Knacke is head of research at Shard Capital