ETFs now appear in half of all French life insurance contracts, a sign the wrapper is becoming “essential” to the market, according to a recent survey.

A joint report, published by Quantalys Harvest Group and BNP Paribas Asset Management (BNPP AM), found the number of life insurance contracts containing at least one ETF rose by 6% in 2023 to 50% of contracts.

The number of ETFs in individual contracts also rose, with those holding 50 or more ETFs in a contract rising from 11% to 16%.

Life insurance contracts in France are similar to annuities in the UK pension market.

By entering the contract with a bank or insurer, savers are committing to make regular or lump sum payments to achieve capital appreciation which is then paid out at the end of the contract.

“ETFs are becoming essential in life insurance contracts,” the report said.

“The number of life insurance contracts that contain at least one ETF jumped by over 6% in one year and over 12% in two years to reach 50%. For these contracts, an average of 40 ETFs are referenced.”

BNPP AM said it expects the trend to continue in 2024, with flows increasing into the product class, partially driven by the recent approval of active ETF listings on Euronext Paris.

Wealth managers are also upping their use of ETFs, according to the report.

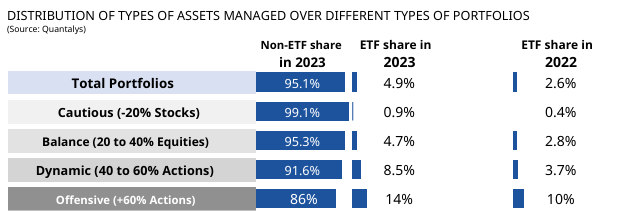

ETF weightings in portfolios managed by financial advisers via Quantaly’s platform doubled across almost all portfolio types, except for offensive portfolios, those which allocate over 60% to equities, which rose from 10% to 14%.

Chart 1: ETF usage in managed portfolios

Source: Quantalys

Pierre Miramont, head of fund analysis and model portfolios at Quantalys Harvest, said: “This breakthrough is as much due to the wealth management industry, which has set itself up to offer accessible and innovative products, as it is to savers who are now familiar and seduced by these products.

“Digitalisation and increasing demands in terms of transparency of investment products, costs and performance have also favoured ETFs.”

France has also seen retail investors embrace the ETF wrapper in recent months.

The number of retail investors using ETFs in the country hit record highs in 2023, growing by 18% year-on-year, according to data from the Autorité des Marchés Financiers (AMF) Active Retail Investor dashboard.