White-label ETF issuer HANetf has partnered with Algo-Chain to launch six model portfolios offering access to its thematic equity, commodity and crypto exchange-traded products (ETPs).

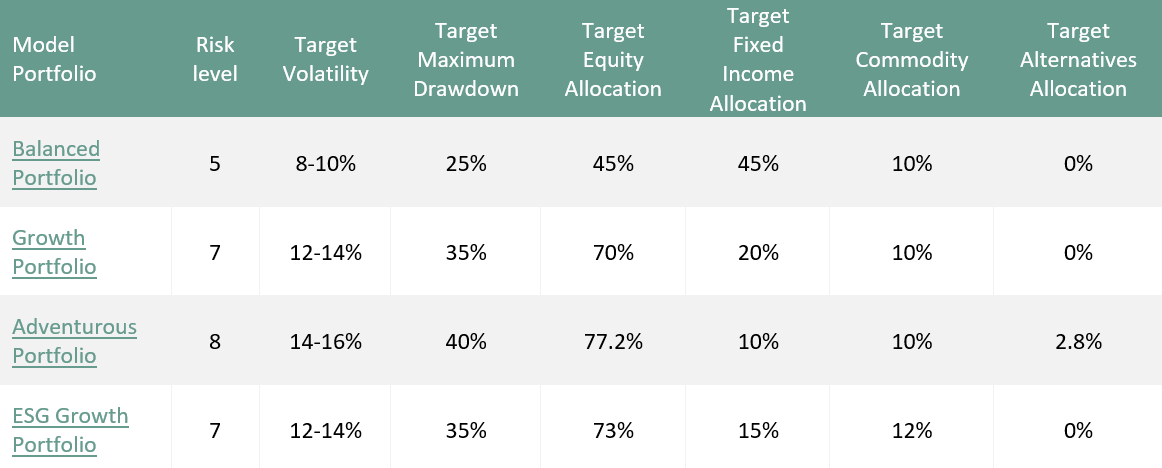

Four core allocation portfolios – the Balanced, Growth, Adventurous and ESG Growth – contain a mixture of HANetf products and third-party core ETFs from Vanguard, Amundi, Legal & General Investment Management and HSBC Asset Management to provide exposure to equities, fixed income, commodities and alternative assets.

Each portfolio is built using Algo-Chain modelling to provide differing risk levels and target volatility and maximum drawdown.

Source: HANetf, Algo-Chain

The Future Trends Themed Equity Model Portfolio invests exclusively in HANetf thematic ETFs, providing exposure to digital infrastructure, electric vehicle charging, eCommerce, the metaverse, fintech, decarbonisation and space.

The Digital Assets and Crypto Model Portfolio allocates to eight ETC Group crypto ETPs and a 20% weighting to its blockchain thematic ETF, developed in partnership with HANetf.

All six portfolios rebalance quarterly to adjust to market cycles and risk appetite in markets.

The models are targeted at professional investors looking to offer ETF portfolios to end clients and are accessible through Algo-Chain’s website.

Hector McNeil, co-CEO and co-founder of HANetf, commented: “I have long been of the opinion that to catch up with the US ETF market there needs to be more provision of solutions that help investors construct intelligent ETF portfolios taking advantage of the lower costs of ETFs versus mutual funds and other wrappers.

“In the US, we have seen a huge growth in ETF model portfolios and Europe is lagging. Offering free licences to financial advisers and asset managers who want to use these models is extremely powerful in further democratising using ETFs.”

The model portfolios are HANetf’s first new product since launching the Sprott Uranium Miners UCITS ETF (URNM) last April.

It is Algo-Chain’s second model portfolio launch in recent months after it partnered with Leverage Shares to offer portfolios wrapped within an ETP structure, ETF Stream revealed last October.

Related articles