Defensive sectors are starting to gather momentum, with healthcare stocks leading the way. But is it too expensive and still worth considering?

Perhaps it's not surprising that the sector is doing well. It's one of the few economic segments in the US where spending has risen faster than inflation and it has consistently outperformed the S&P 500.

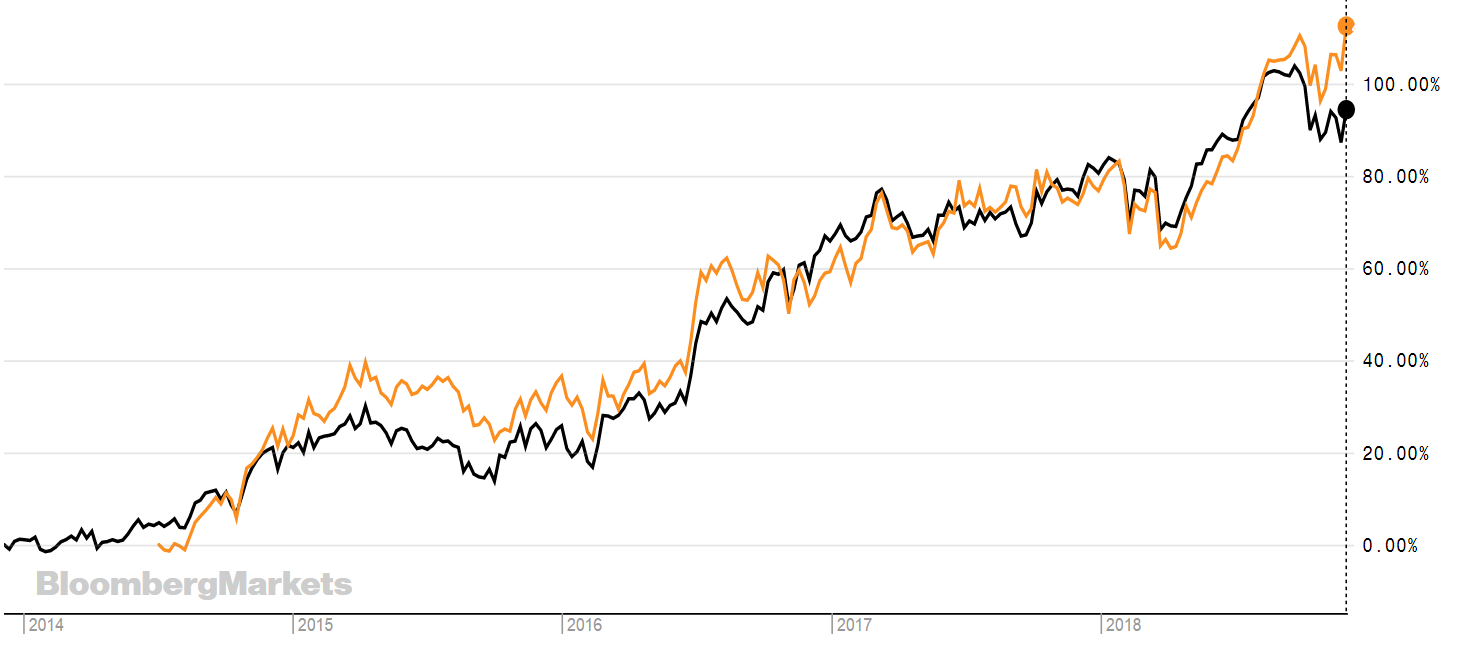

Below is Vanguard's S&P 500 ETF (VUSA) in sterling in black and Invesco's Health Care S&P US Select Sector UCITS ETF (XLVP) also in sterling in orange over the last five years.

Source: Bloomberg

With this outperformance comes an increase in the price of the healthcare sector, it's at its most expensive in a decade - possibly more - so has it reached its peak or is there more to come?

There are good supportive reasons for why healthcare is likely to continue doing well. In the US the Centers for Disease Control reported that the average life expectancy fell for the third year running. The main reasons were flu, diabetes, drug abuse and suicide.

In the UK, the ONS reported that there was an increase in deaths in 2017 as a result of mental and behavioural disorders, and diseases of the nervous system.

Vasita Patel, Vital Statistics Outputs Branch, Office for National Statistics, said that the number of deaths [in the UK] increased in 2017 to the highest level since 2003: "the population is both growing and ageing - when you take those things into account, mortality rates decreased slightly from 2016 to 2017, for both males and females…… rates increased for mental and behavioural disorders, such as dementia, and diseases of the nervous system, such as Parkinson's and Alzheimer's. This could be partly linked to a better understanding of these conditions, which may have led to better identification and diagnoses."

These reasons behind the increase in mortality rates tells us that healthcare services are going to be more in demand over the coming years.

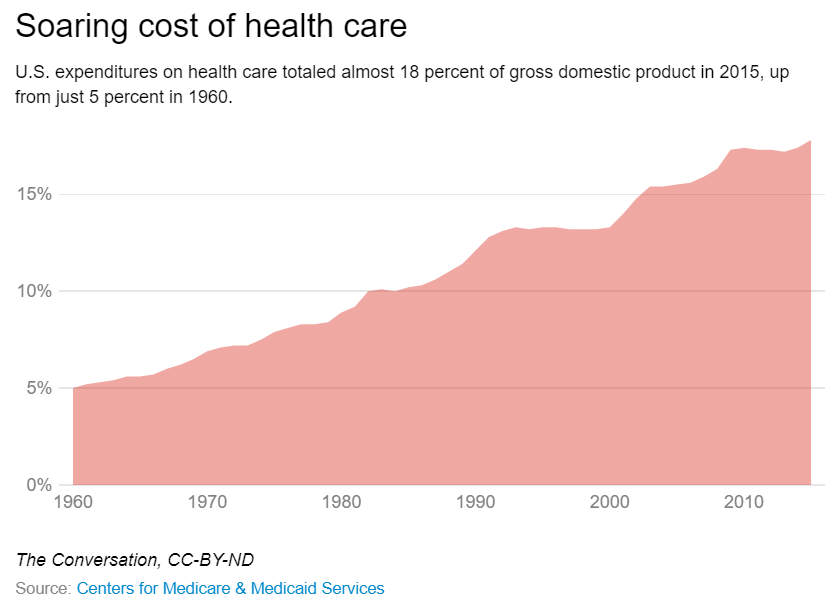

Spending on healthcare is also rising. According to The Conversation, in the US healthcare spending has doubled since 1971 (see chart below).

Access to investing in the sector is also increasingly easy with the advent of ETFs.

The ETFs on offer in the UK have had mixed returns - although all in positive territory. The best performing this year-to-date is Invesco's XLVP in sterling, which has returned nearly 20% (at the time of writing). It tracks the S&P Select Sector Capped 20% (Health Care) Net Total Return Index, which works by putting capped weights on the index constituents. The weight of each stock is based on its float-adjusted market cap but is modified so that no stock has a weight over 20% of the index. The result has been an index that has performed largely positively for the last decade.

The graph below shows the performance of the S&P Select Sector Capped 20% (Health Care) Net Total Return Index over the last ten years. The 10-year annual returns are currently at 14.32%, according to SPDJ Indices.

Source: SPDJ Indices

The majority of the ETFs track a subsection of traditional benchmarks, but the iShares Healthcare Innovation UCITS ETF (DRDR) in sterling, tracks the iSTOXX FactSet Breakthrough Healthcare Index. This means the ETF doesn't have much exposure to the big pharmaceutical companies like GlaxoSmithKline and Pfizer. Instead if focuses on stocks that are pushing the boundaries in medical treatment and technology - often biotech stocks. This thematic ETF was launched at the end of 2016 and has $431m in assets under management. In the last year it's returned nearly 14%.

It is unclear whether the healthcare sector is at the top or if there is more to come, but either way ETFs allow you to invest in the sector in a number of ways.

Several ETFs listed on the London Stock Exchange are listed below.

CH5

DRDR

HEAL

IUHC

IHUC

HLTH

HLTG

SXLV

WHEA

XSHC

XSDR

XLVP

XLVS

XUHC

XDWH

ETFYTD RTNTERINDEXAmundi ETF MSCI Europe Healthcare UCITS ETF4.57%0.25%MSCI Europe Healthcare IndexiShares Healthcare Innovation UCITS ETF (¬£)7.73%0.40%iSTOXX¬Æ FactSet Breakthrough Healthcare Index; tracks the performance of developed and EM companies focused on pushing the boundaries in medical treatment and technologyiShares Healthcare Innovation UCITS ETF ($)2.03%0.40%iSTOXX¬Æ FactSet Breakthrough Healthcare IndexiShares S&P 500 Health Care Sector UCITS ETF ($)11.34%0.15%S&P 500 Health Care IndexiShares S&P 500 Health Care Sector UCITS ETF (¬£)18%0.15%S&P 500 Health Care IndexSPDR MSCI Europe Health Care UCITS ETF (€)5.41%0.30%MSCI Europe Health Care IndexLyxor MSCI World Health Care TR UCITS ETF15.51%0.30%MSCI World Health Care IndexSPDR S&P U.S. Health Care Select Sector UCITS ETF11.38%0.15%U.S. health care companies in the S&P 500 IndexSPDR MSCI World Health Care UCITS ETF8.94%0.30%The ETF tracks the performance of companies in the health care sector, across developed markets globallyXtrackers MSCI USA Health Care UCITS ETF (¬£)n/a0.14%The ETF offers direct investment in American equities. Comprised of large and medium sized companies, covering 85% of the Health Care sectorXtrackers Stoxx Europe 600 Health Care Swap UCITS ETF4.73%0.18%Provides exposure to the European equities that are constituent members of the Stoxx Europe 600 Index and part of the Health Care SectorInvesco Health Care S&P US Select Sector UCITS ETF (¬£)19.64%0.14%S&P Select Sector Capped 20% (Health Care) Net Total Return IndexInvesco Health Care S&P US Select Sector UCITS ETF ($)11.21%0.14%S&P Select Sector Capped 20% (Health Care) Net Total Return IndexXtrackers MSCI USA Health Care UCITS ETF ($)11.48%0.14%The ETF offers direct investment in American equities. Comprised of large and medium sized companies, covering 85% of the Health Care sectorXtrackers MSCI World Health Care UCITS ETF8.73%0.18%The ETF offers direct investment in Global equities. Provides exposure to Global Developed Market equities that are constituent members of the MSCI World Index and part of the Health Care sector