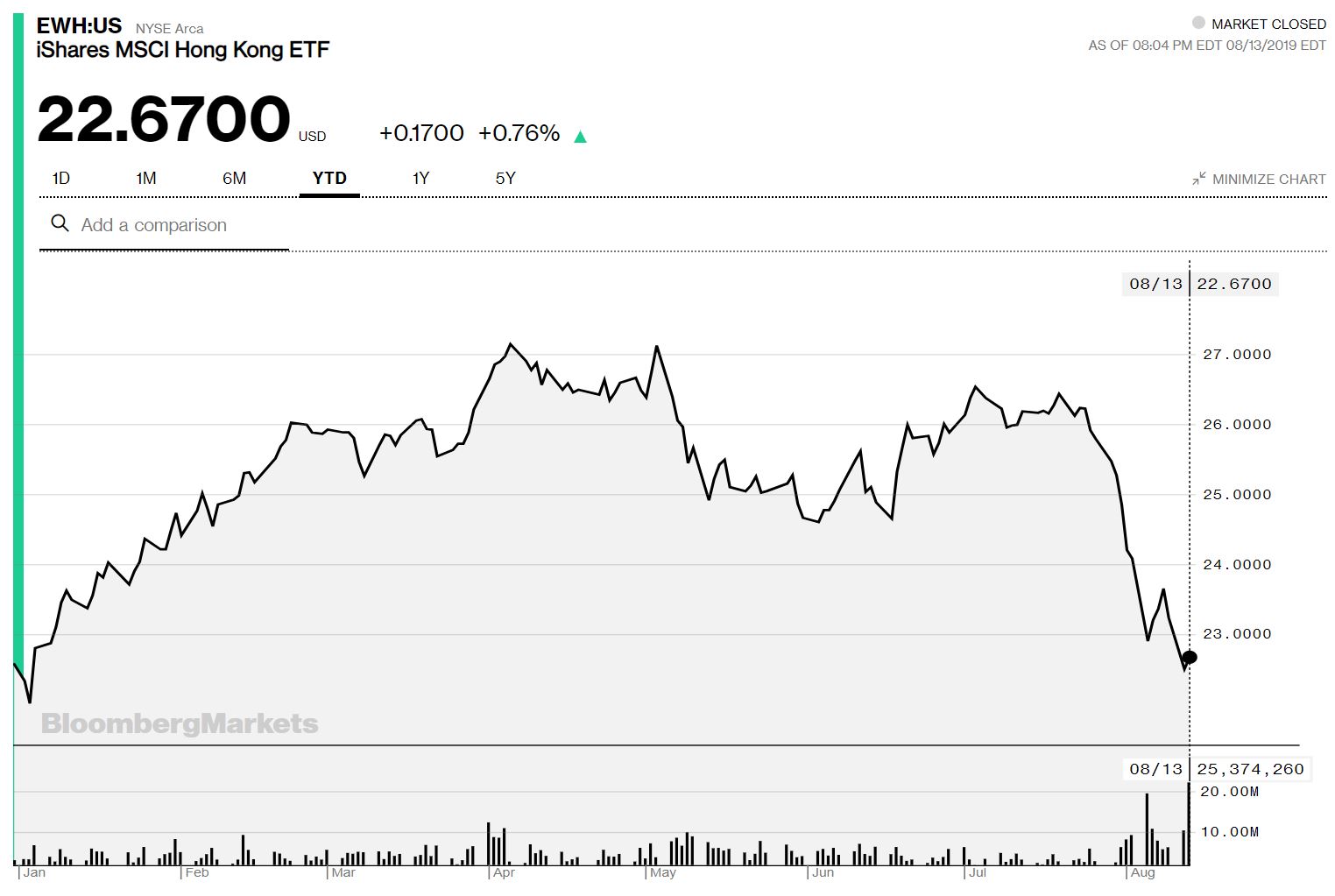

Trading in the largest ETF tracking Hong Kong stocks surged to a five-year high amid ongoing protests in the city.

According to data from Bloomberg, trading in the iShares MSCI Hong Kong ETF (EWH) jumped to 25 million shares in New York on Tuesday, the highest level since August 2014.

Since protests began in June, the $1.4bn ETF has seen around 40% of its assets redeemed with EWH losing $59.8m and the Lyxor Hong Kong UCITS ETF (HSI) losing $24.3m in the week starting 17 June.

Weeks of anti-government rallies in the city reached their climax on Tuesday after flights out of Hong Kong were suspended after protestors overran the airport.

In recent weeks, EWH has fallen to its lowest level since January as protests combined with growing trade tensions between the US and China dampened investor sentiment.

Source: Bloomberg