New index offerings can often shoot the lights out before losing much of their outperformance soon after funds launch to capture their magic, research by Morningstar has found.

Based mostly on backtest data, new indices tend to outperform their respective benchmarks by 1.4% annually over the five years before being targeted by a fund, however, the report found excess returns drop to just 0.39% a year after funds begin tracking them.

Daniel Sotiroff, senior manager research analyst at Morningstar, said: “A typical index’s backtested performance looks great, but it usually fails to live up to those historical expectations once it goes live.

“Within the sample of indexes used for this paper, most outperformed their corresponding category index before a fund started tracking them; but absolute and risk-adjusted performance subsequently declined in the years after they became the target of a fund.”

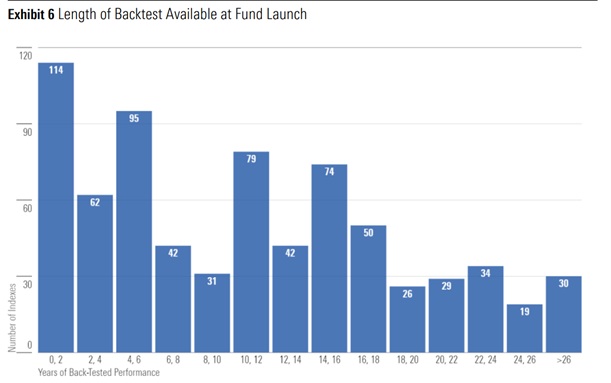

The report highlights two key considerations with backward-looking data – one being the length of available backtested data, which provides a hypothetical, flattering track record.

The median index in the sample of 782 indices had 10.5 years of backtested performance data, however, the distribution of backtests stretched from 44 years, right down to the most populous grouping of 114 indices with just two years of less of backtested performance data.

Source: Morningstar

This short lookback is problematic given the tendency of different investment styles or factors performing well during different market and policy backdrops, such as more indebted technology-focused equities outperforming value stocks in the low interest rate post-Global Financial Crisis (GFC) era.

Next, the report pointed to the time between index inception and funds launching to track an index – a time it argued was more valuable than backtests for providing an in-the-field view of live performance rather than the hindsight view that informed the underlying rules they are based on.

This liminal period between index and fund debut was predominantly less than a year long, it said, with the median index live for less than four months before an ETF or mutual fund began tracking it. In fact, one in six was live for less than 30 days before being captured by a passive vehicle.

Source: Morningstar

“Said another way, investors placing money into new index funds must often rely on an index’s backtested data – not its live performance – to gauge the trade-off between risk and reward,” Sotiroff added.

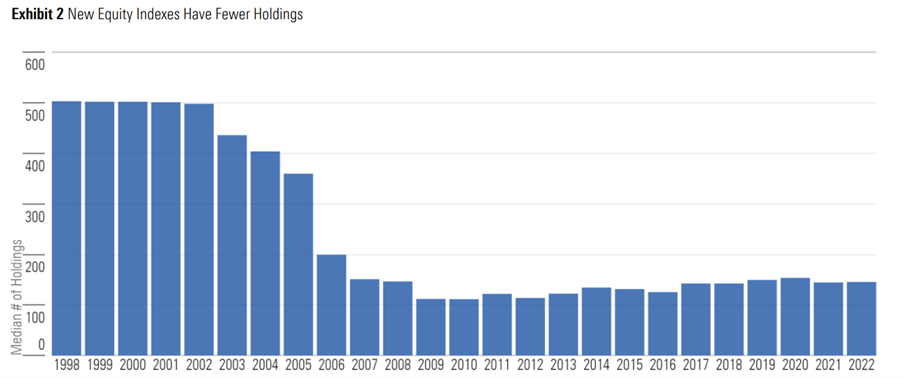

The report also highlighted how newer indices have moved further from the broad beta-capturing model to offer narrower and more specialist exposures.

Whereas a typical passive fund held around 500 stocks in 1998, this number had slipped to fewer than 150 stocks by the end of 2022.

Likewise, around 85% of funds market cap-weighted their holdings in 1998 versus only 42% by the end of last year.

The combination of these two factors saw the median fund from Morningstar’s sample incur a tracking error of 4% versus its corresponding category index, resulting in increased active risk.

Source: Morningstar

“The composition of index funds has changed dramatically over the past 25 years, and not necessarily for the better, Sotiroff said.

“On average, today’s index funds have fewer constituents and employ a wider range of approaches to weight their holdings. Many look and perform very differently from their corresponding category index and their respective markets.

“They are passive in the sense that they track an index, but they are active in the risks they take and rewards they seek.”

However, perhaps providing increasingly esoteric index exposures is just the economic reality of asset management, with tens of trillions of dollars already parked in broad market benchmarked vehicles operated by a handful of dominant players. Challenger issuers look to make a name for themselves by offering access to the fringes – or nascent markets – and index providers are happy to facilitate this.

There are also only so many ways to slice a market currently dominated by a handful of large tech companies. With the ‘FAATMAN’ top seven US equities currently comprising 27.4% of the S&P 500, it should come as little surprise investors call for new and differentiated rules-based solutions.