In the world of business, there is widespread consensus on one thing: The significance of a company being innovative. Being creative and coming up with new ideas and solutions is crucial for a company not just to survive but also to thrive and do well. However, can a rules-based portfolio consisting of top innovators consistently beat the market?

To address this question, we tested the performance of a strategy investing in top-ranking innovators and compared this to a broad-based index, the S&P 500.

We aimed to test the hypothesis that innovative stocks carry higher volatility, the impact of sectors on performance and whether our systematic approach could beat an active approach to innovation – Cathie Wood’s ARK Innovation ETF (ARKK).

Data

Because a single mutually agreed-upon best measure of a firm innovativeness does not exist, for choosing the companies to be investigated, we looked at Fast Company’s list of the 50 World’s Most Innovative Companies.

This list acknowledges organisations that have introduced groundbreaking products, implemented innovative business strategies, promoted positive social impact and transformed industries through their revolutionary approaches.

In each list, we identified the top 10 publicly traded companies, except for the 2015 list where we found only nine such companies and obtained their adjusted close price.

We had to consider when the companies went public. For example, in the ranking from 2013, Uber is listed in the sixth place. However, it has been publicly traded since 2019, so we cannot include it in our portfolio from 2013.

Our price dataset thus started on June 30, 2013 or inception date of firms that went public later. On average, there were 13.4 publicly traded companies per year, but our primary focus was on the top 10 companies.

Similarly, we also collected adjusted price data for the SPDR S&P 500 ETF Trust (SPY) from 30 June 2013 and the ARK Innovation ETF (ARKK) since its inception on 31 October 2014.

Methodology

The Most Innovative Companies ranking debuted in 2008 and has been consistently updated each year around April.

To create what we term ‘Innovative Portfolio’, every mid-year – 30 June – we establish a long-only portfolio, holding the top 10 stocks of companies identified in that year’s list and rebalancing the portfolio in June of the following year.

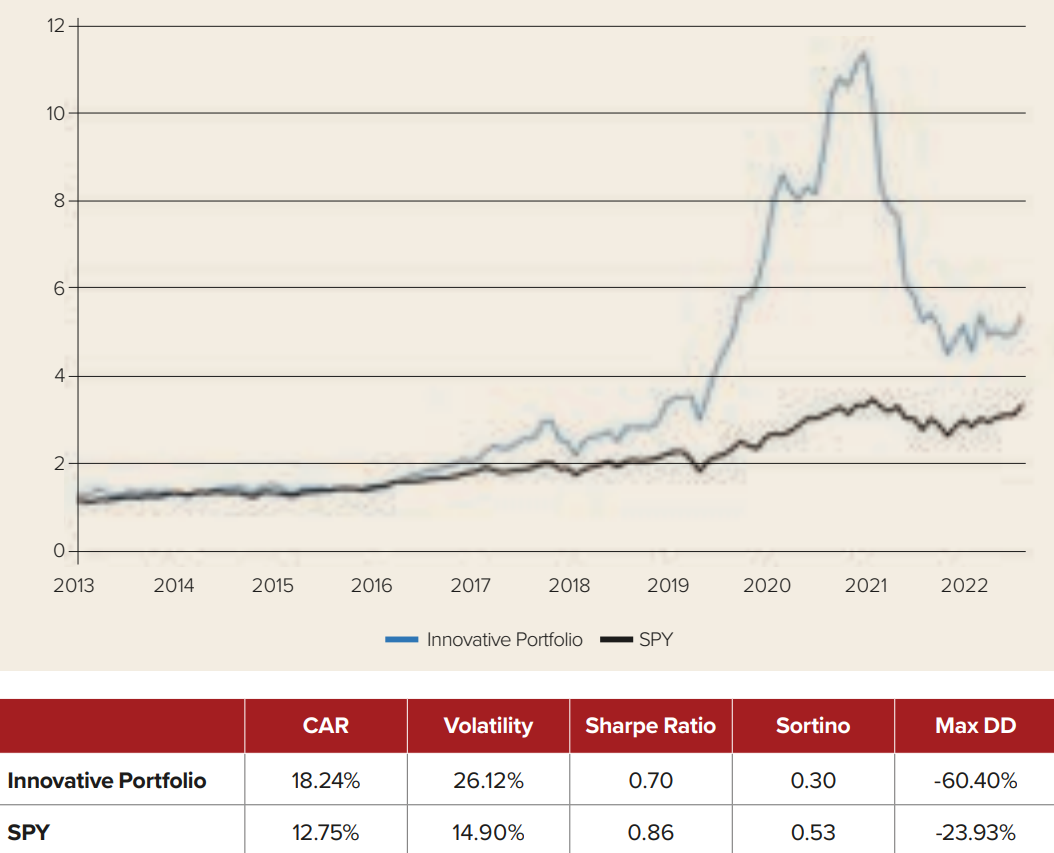

First, let us evaluate the performance of our long-only portfolio during the 2013- 2023 period compared to the broad-based index.

As indicated in the table, the Innovative Portfolio achieved a superior annualised return of 18.2% over this period, outperforming SPY at 12.8%, notably from 2019 to 2021.

Chart 1: Risk-return of Innovation Portfolio vs SPY

Source: Quantpedia

However, by the end of 2021, the Innovative Portfolio experienced a pronounced peak in performance, followed by a steep decline.

Its success in return comes with larger price fluctuations, evidenced by the Innovative Portfolio’s volatility of 26.1%, compared to the SPY’s volatility of 14.9%.

The Innovative Portfolio experienced a more significant maximum drawdown of -60.4%, contrasting with SPY’s -23.9%.

In terms of risk-adjusted performance, SPY demonstrated superiority with a higher Sharpe Ratio of 0.86 – versus 0.70 – and a Sortino Ratio of 0.53 – versus 0.30.

Factor and sector analysis

We see that innovative stocks may outperform the broad index, albeit with a high risk. However, what are the drivers of this outperformance?

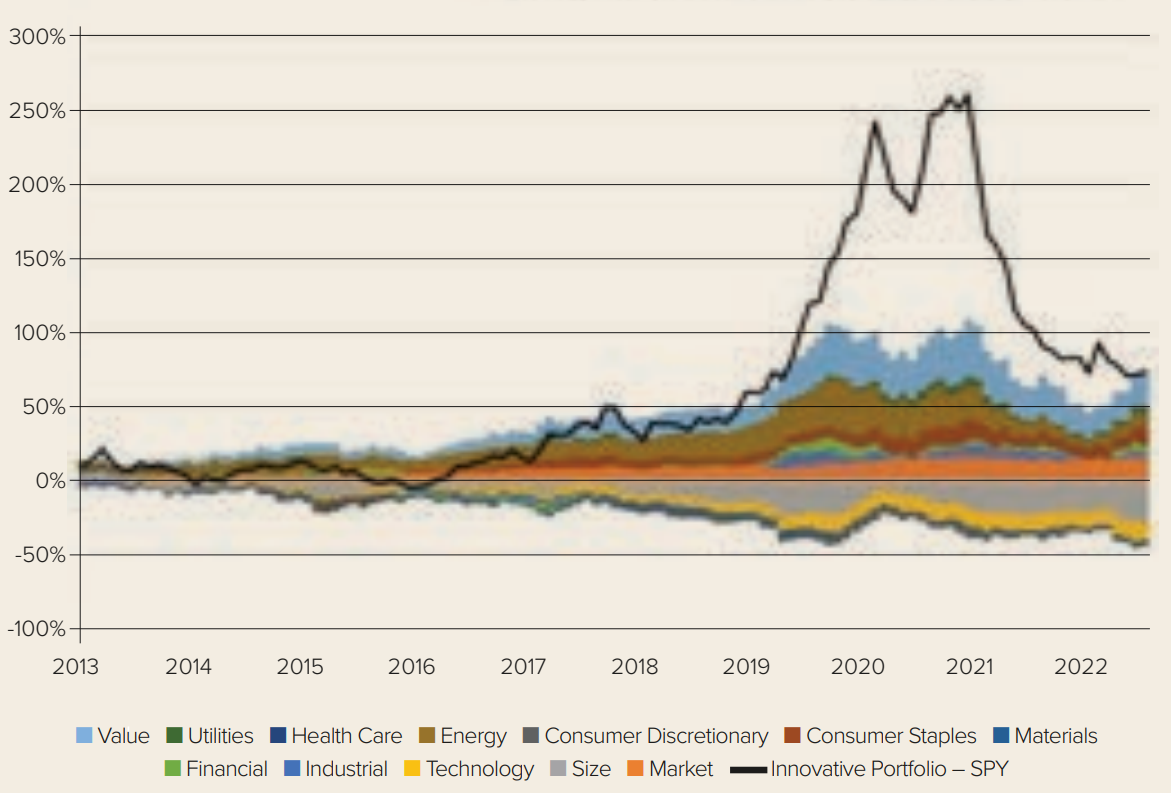

To answer this question, we took just the Innovative Portfolio’s alpha and turned our sight to ordinary least squares (OLS) factor regression.

Notably, size (t = 4.7) stands out as statistically significant while energy (t = -2.5) and industrial (t = -2.3) also play a significant role, however, on the negative side.

To visually represent the impact of the nine sector and three style factors on the performance differential between the Innovative Portfolio and the SPY index, radar chart is presented.

Chart 2: Radar chart of Innovation portfolio vs SPY

Source: Quantpedia

Positive values along the x-axis signify outperformance, with the market, materials and size factors showing positive trends.

The R-squared indicates that approximately 48.8% of the variability in the dependent variable – performance disparities between the Innovative Portfolio and SPY – can be explained by the independent variables – nine sector and three style factors.

In other words, the factors considered collectively account for almost half of the observed variation in the portfolio’s performance relative to SPY. The remaining performance variability is attributed to idiosyncratic risk.

However, for a more explicit understanding of how different sectors and style factors contribute to overall portfolio returns, we must review the cumulative contribution of given factors.

What stands out is that at the end of the sample, all of the remaining outperformance – or alpha – of the innovative stocks can be explained by systematic factors.

Only between 2019 and 2021, innovative stocks were influenced by some unknown factor – probably the true ‘innovation factor in stocks’.

Innovative Portfolio vs ARKK

Finally, we examined the performance of our portfolio against ARKK, an actively managed ETF investing in companies related to disruptive innovation, focusing on genomics, automation, energy transformation, AI, next-gen internet, and fintech. Led by Wood, ARK’s CIO, it targets high-growth sectors but is known for its high risk.

The high correlation coefficient of 0.8 between the performance of the Innovative Portfolio and ARKK suggests a strong positive linear relationship.

In practical terms, this indicates that the two portfolios tend to move in the same direction over time, as can be seen in the next figure.

It may suggest both portfolios are influenced by similar drivers – similar market factors or economic conditions. However, ARKK is discretionary, while our ‘innovation factor’ is systematic, based on publicly available dataset.

The rise of ARKK might be attributed to the accelerated impact of technological trends, including remote work and eCommerce, driven by the COVID-19 pandemic.

However, the ETF and all innovative stocks faced a significant fall in the past two years due to economic uncertainty and tightening monetary policy.

Our analysis also shows after the COVID-19 boom, what remains out of the outperformance of the innovative stocks can be explained by systematic factors alone.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.