Chinese share prices have been badly hit this summer as concerns about a Trump trade war have risen. In early July this came to a head when Beijing responded to Washington's import tariffs on $34bn worth of goods with similar levies.

This happened just six weeks after MSCI included some Chinese 'A' shares in its flagship emerging markets index for the first time. This was unfortunate timing as ETFs tracking China A shares fell to their lowest point this year in early July as China and the US geared up for a trade war.

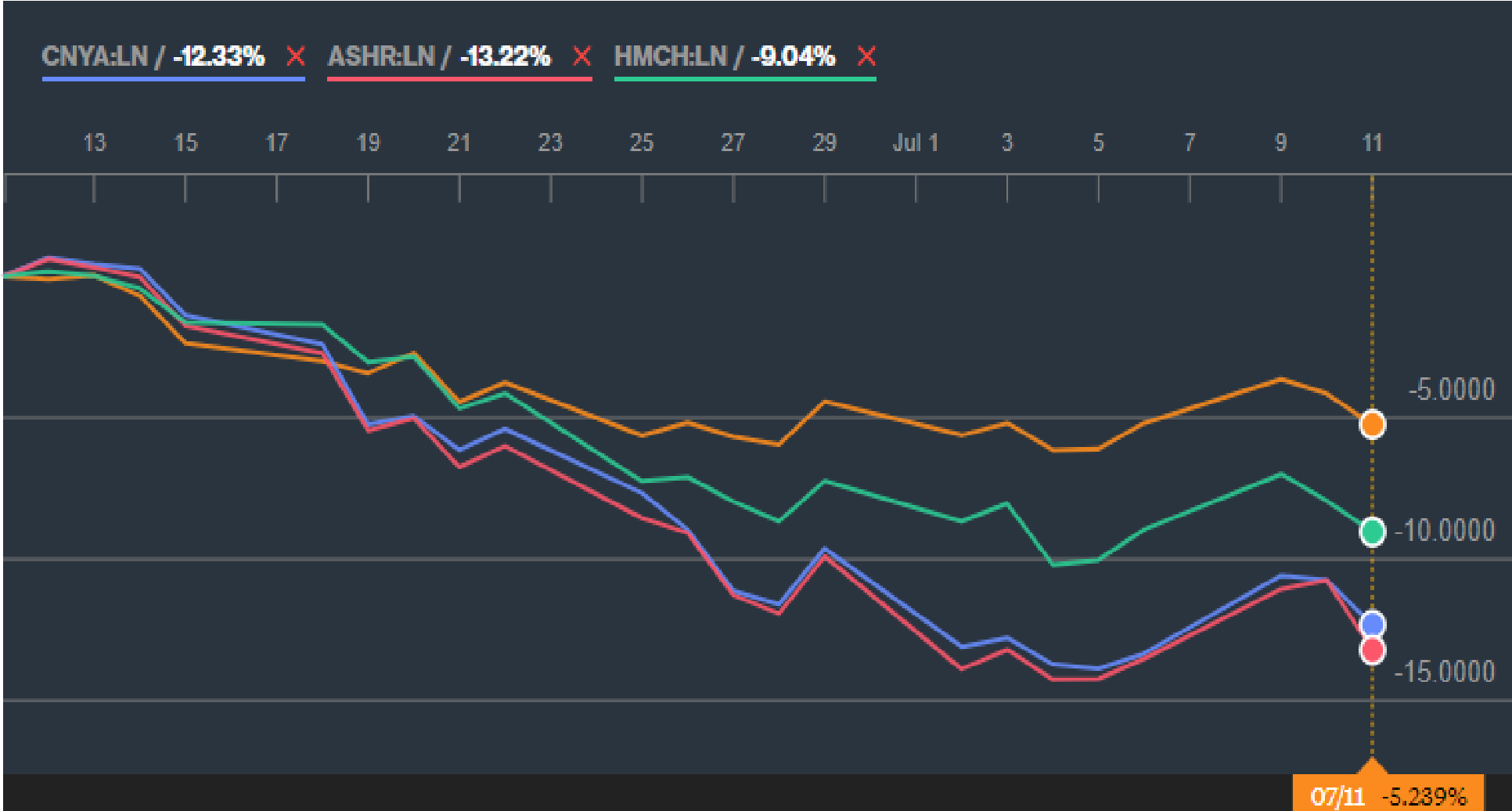

iShares CNYA (in blue) which tracks the MSCI China A Index fell -1.7% from 10th to 11th July, similarly the XTrackers ASHR (in red), which tracks the CSI300 fell 2.7%. The SPDR EMRG ETF (in orange), which tracks the MSCI Emerging Markets index fell around 1.1% over the same period, while HSBC's HMHC (in green) tracking the MSCI China index also fell 1.1%.

Source: Bloomberg

The tariffs are not just on China. The EU, Canada and Mexico have all been on the end of Trump's trade rage.

Adam Laird, head of ETF Strategy Northern Europe at Lyxor Asset Management, said: "Trump's tariffs - and the potential for trade war - are clearly a concern for the A-Share market. The rhetoric from both countries implies that there's more on the sanction pile yet to come. More uncertainty will be likely to dissuade investors from taking the plunge. So I think that there's good reason to be cautious here."

There is good reason to take a measured approach to China. Until recently it has been difficult to invest in mainland Chinese A-Shares - the securities of China incorporated companies that trade on either the Shanghai or Shenzhen stock exchanges.

It's only in the last few years that China opened its doors to foreign investors through the RQFII schemes and a small selection of ETFs.

China A shares were only included in the MSCI emerging market index last month, it is anticipated to steer billions of foreign investment into the mainland China A share market over the next decade, but the inclusion process time. The shares were initially rejected for three consecutive years for corporate governance issues.

Global funds' ownership of A-shares stocks is also not broad and is concentrated in a few companies. The top three companies comprise more than 10% of assets each; Kewichow Moutai; Midea Group; and Hangzhou Hikvision Digital Tech.

Source: The FT

However, as the market falls it could be a good time to get in and there are a lot of supportive factors for China.

Danny Dolan, MD at China Post Global UK, says: "The recent downturn has presented a good entry point because investing in China is a long term mega trend, and having a long-term allocation makes a lot of sense. The fundamentals are very strong; among others there is a growing middle class, the number of billionaires now exceeds that in the US, the economy is successfully rebalancing to a domestic-consumption-driven model, and there is additional purchasing power with the appreciation of the yuan.

"Corporate governance has improved significantly for a number of reasons, including regulatory reforms like reforms to listing rules; regulation, as well as companies themselves voluntarily adopting more stringent measures to improving transparency, for example by using the big four global auditors and proactively adopting international accounting standards, and other reforms since 2015/2016 that have meant there has been an uptick in companies voluntarily incorporating more stringent measures," he says.

The increased liberalisation of the Chinese financial system is also expected to drive more money into the domestic markets.

There are other supportive factors to investing in China. By the end of the year there is set to be a direct link between the LSE and markets in China in a bid to open up access to trade shares in each country. The connection will allow companies to sell global depository receipts in the UK, while London traded firms will list similar securities in Shanghai, according to press reports.

Chinese A-shares currently have a low correlation with developed and emerging markets. Similarly, the valuation of Chinese A-shares is relatively cheap and momentum is swinging in the right direction.

Globally it is also well positioned. It is the world's second largest economy to the US and the largest exporter globally, according to WorldAtlas.

For access to the China A Shares market investors can opt for broad exposure through the MSCI EM index or more directly through an A share focused ETF.

ETFTER TickerYTD RtnIndexiShares MSCI China A UCITS ETF USD Acc0.65%CNYA-14.76%MSCI China A IndexiShares MSCI China A UCITS ETF USD Acc (GBP)0.65%IASH-14.84%MSCI China A IndexXtrackers Harvest FTSE China A-H 50 UCITS ETF0.65%AH50-11.05%FTSE China A-H 50 IndexGF International-FTSE China A UCITS ETF0.80%PRCE-18.27%FTSE China A IndexCSOP Source FTSE China A50 UCITS ETF0.65%CHNA-16.29%FTSE China A50 IndexCSOP Source FTSE China A50 UCITS ETF (GBP)0.65%CHNP-12.24%FTSE China A50 IndexL&G E Fund MSCI China A UCITS ETF0.88%CASH-16.75%MSCI China A IndexL&G E Fund MSCI China A UCITS ETF(GBP)0.88%CASE-16.86%MSCI China A IndexLyxor Fortune SG MSCI China A DR UCITS ETF0.65%CNAA-18.86%MSCI CHINA A ONSHORE Net Return Index USDLyxor Fortune SG MSCI China A DR UCITS ETF (GBP)0.65%CNAL-17.12%MSCI CHINA A ONSHORE Net Return Index USDXtrackers Harvest CSI300 UCITS ETF (GBP)0.65%RQFI-17.40%CSI 300 Total Return Net IndexXtrackers Harvest CSI300 UCITS ETF0.65%ASHR-15.05%CSI 300 Total Return Net IndexLyxor CSI 300 A-Share UCITS ETF0.40%CSIA-17.11%CSI 300 Total Return Net IndexLyxor CSI 300 A-Share UCITS ETF (GBP)0.40%CSIL-15.43%CSI 300 Total Return Net Index

Source: LSEG and Bloomberg