The Investment Association (IA) has followed other organisations such as the Bank for International Settlements (BIS) and the European Systemic Risk Board (ESRB) in highlighting the key liquidity and price discovery role ETFs played during the coronavirus volatility.

The report, entitled ETF Performance During Coronavirus: An Expanded Analysis, found the discounts to net asset value (NAV), which widened to as much as 7% during the heightened volatility, were due to the ETFs reflecting the true intraday price versus the underlying market where bonds were not trading.

Highlighting this, the iShares $ Corp Bond UCITS ETF (LQDE) traded 1,000 times on 12 March compared to the underlying securities which changed hands just 37 times.

The IA argued this showed there was no obvious arbitrage opportunity for authorised participants with ETFs reflecting the tradeable price instead of representing a breakdown in the arbitrage mechanism.

“As fixed income ETFs changed hands far more than their underlying holdings, they provided unprecedented and greatly required insight into bond market pricing,” the report said.

“Throughout the crisis, market makers and APs were quoting bid prices for ETFs intraday based on the ‘real’ price at which the underlying bonds could be bought and sold. In other words, the arbitrage mechanism was working all along exactly as it should have been.”

Mutual fund liquidity mismatch pushing investors to ETFs

This was also highlighted by the ESRB last month when it said the wide discounts reflected a lack of liquidity in the underlying market which could be seen from APs’ internal pricing information.

Secondary market

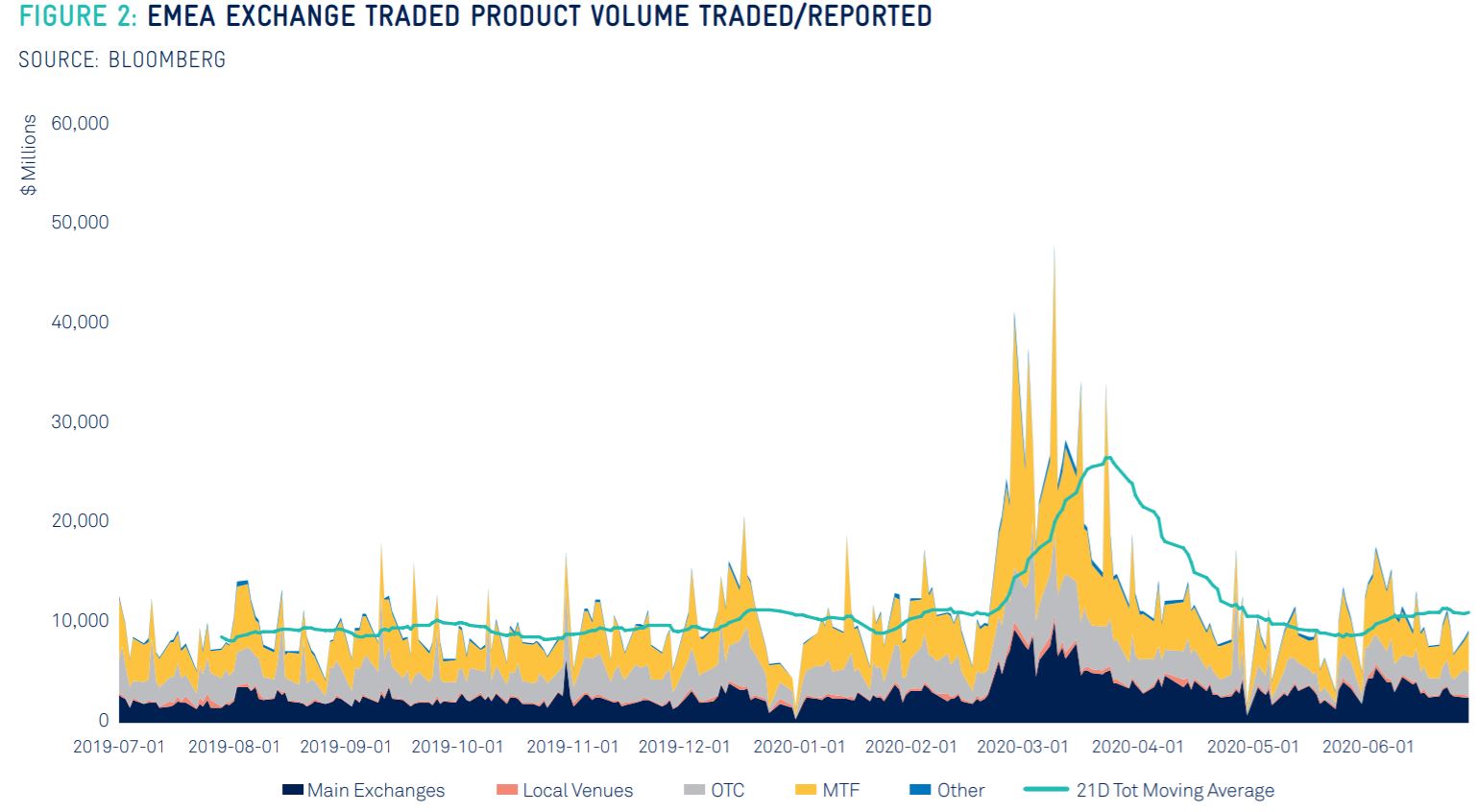

The benefits of the secondary market were also shown during the March volatility with some fixed income ETFs seeing a 270% increase in secondary to primary market activity compared to 2019 averages, the report found.

This increase in trading, the report said, enabled ETFs to provide pricing ahead of the less liquid underlying markets such as investment grade and high yield.

“Secondary market trading provided a deeper pool of liquidity even where primary market trading in the underlying securities was less frequent,” the IA explained.

“The structure of the ETF ecosystem allows ETF trading to take place in the secondary market without correlated trading of the underlying securities or the creation/redemption of ETF units in the primary market, thus enhancing overall ETF liquidity and providing investors with a means of trading shares even in the event, however remote, of a breakdown in primary market trading.”

This was highlighted by the Bank of England in May’s Financial Stability Report which found ETF trading in the secondary market lowers the risk of a fire sale versus mutual funds that only trade on the primary market.

As the IA said: “Far from dragging down the price of the underlying securities, ETFs were in fact simply providing a forecast of where the price of those underlying securities would ultimately fall to, as would indeed occur as the crisis wore on and discounting was reduced to normal levels.

“Instead, other factors created far more of an impact on bond prices and liquidity, including large outflows and mass redemptions from bond funds during the height of the crisis.”

What happens when the lights go out? An analysis of ETFs when liquidity vanishes

The IA, which runs an ETF committee chaired by Keshava Shastry, head of ETP capital markets at DWS, has become more vocal in recent months around the roles of ETFs in the wider ecosystem.

In June, the association stressed the importance of distinguishing the difference between ETFs and other ETP structures following the reactions to extreme volatility the different ETPs displayed.