The number of institutional and wholesale factor investors using ETFs has continued to grow over the last 12 months, according to a survey conducted by Invesco.

Some 60% of institutional and 67% of wholesale respondents said they use factor ETFs in their portfolios, up from 53% and 63%, respectively, from the previous year.

The Invesco Global Factor Investing Study 2020 interviewed 238 factor investors about their strategies across various asset classes and the tools they use.

Source: Invesco

On average, half of a wholesale investor’s factor allocation is held using ETFs compared to just 14% for institutional. The most common reasons by EMEA investors for using the ETF wrapper is because of its ease of use and efficient pricing.

Lessons from smart beta ETFs’ performance during the coronavirus crash

Of the 138 institutional investors surveyed, 98% agreed factor investing can be extended to fixed income. This figure is up from just 70% in 2019 and 62% the year prior.

Invesco said that there is a similar pattern that occurs when investors look to adopt the usage of factors in fixed income.

The report said: “Investors first look at how they can apply a more systematic approach to their fixed income portfolio across these traditional return drivers, before moving to look at the role of additional style factors.”

Across both institutional and wholesale respondents, some 40% already implement factors in fixed income with a further 35% considering the implementation.

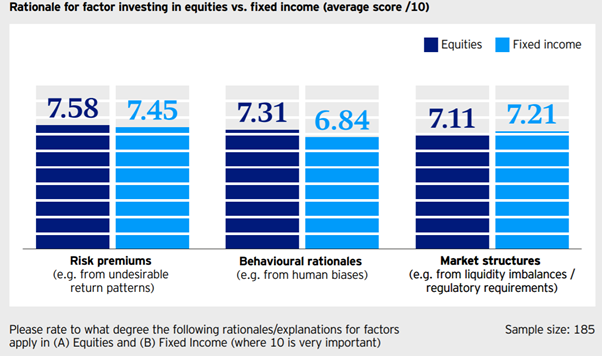

The reasons for using factors in investing in fixed income, compared to equities, showed that investors believe risk premia is the most important for both asset classes. However, market structures such as liquidity imbalances and regulatory requirements are more associated with factor investing in fixed income compared to equity.

Source: Invesco

Breaking down the fixed income asset classes, respondents from the EMEA region said that they use factor strategies more for their high yield corporate bond exposures with 85%. This is compared to 76% for investment grade corporate bonds and just 56% for emerging market debt.

Furthermore, the most popular factors to use in fixed income are value and quality, with 67% and 65% of respondents using these strategies, respectively.

ETF investors call for better product education and transparency

The report highlights a correlation between factor adoption with environmental, social and governance (ESG) adoption among institutional and wholesale investors. Some 84% of institutional respondents and 71% of wholesale said they have an ESG policy implemented.

The institutional side of the market is looking to continue increasing the implementation of ESG within factor portfolios. Some 59% of respondents already include ESG in their factor portfolios with a further 24% are considering integrating.

Notably, the most common stage of integrating ESG is before executing investments such as modelling and screening with 62% of respondents agreeing. However, a significant volume of investors is introducing ESG during the investment process such as valuation and afterwards through engagement.

However, not every investor is sold on the fact that ESG aids factor strategies, as 8% of institutional respondents and 12% of wholesale believe it hinders.