Investors have poured over $350m into BlackRock’s Europe small cap ETF after European Central Bank (ECB) president Christine Lagarde hinted at a first rate cut in the summer.

According to data from ETFbook, the iShares STOXX Europe Small 200 UCITS ETF (EXSE) saw $357m inflows this month, as at 21 March. EXSE tracks the STOXX Europe Small 200 index which offers exposure to the 200 smallest companies in the STOXX Europe 600.

The inflows come after the ECB held interest rates at its March meeting, however, the policymaker cut eurozone inflation projections and growth forecasts, leaving the door open to a potential cut later in the year.

“We are making good progress towards our inflation target and we are confident of a result,” Lagarde said. “We clearly need more evidence and more data. We will know a little more in April but…a lot more in June.”

Carsten Breski, global head of macro at ING, predicted the first rate cut will be in June.

“The worsening of the eurozone’s economic outlook and further fading away of (headline) inflationary pressures would argue for rather imminent smaller rate cuts to bring some relief,” he said.

“As much as the central bank hastily and sharply hiked rates on the way up, we think it will be cautious and gradual on the way back down.”

In response, European equities have rallied, with notable outperformance from risk-on parts of the market including small-cap value, banks, retail sector and Spanish equities.

The SPDR MSCI Europe Small Cap Value Weighted UCITS ETF (ZPRX), for example, which offers exposure to small-caps with lower valuations based on sales, book value and earnings, is up 10.3% over the past month, as at 27 March.

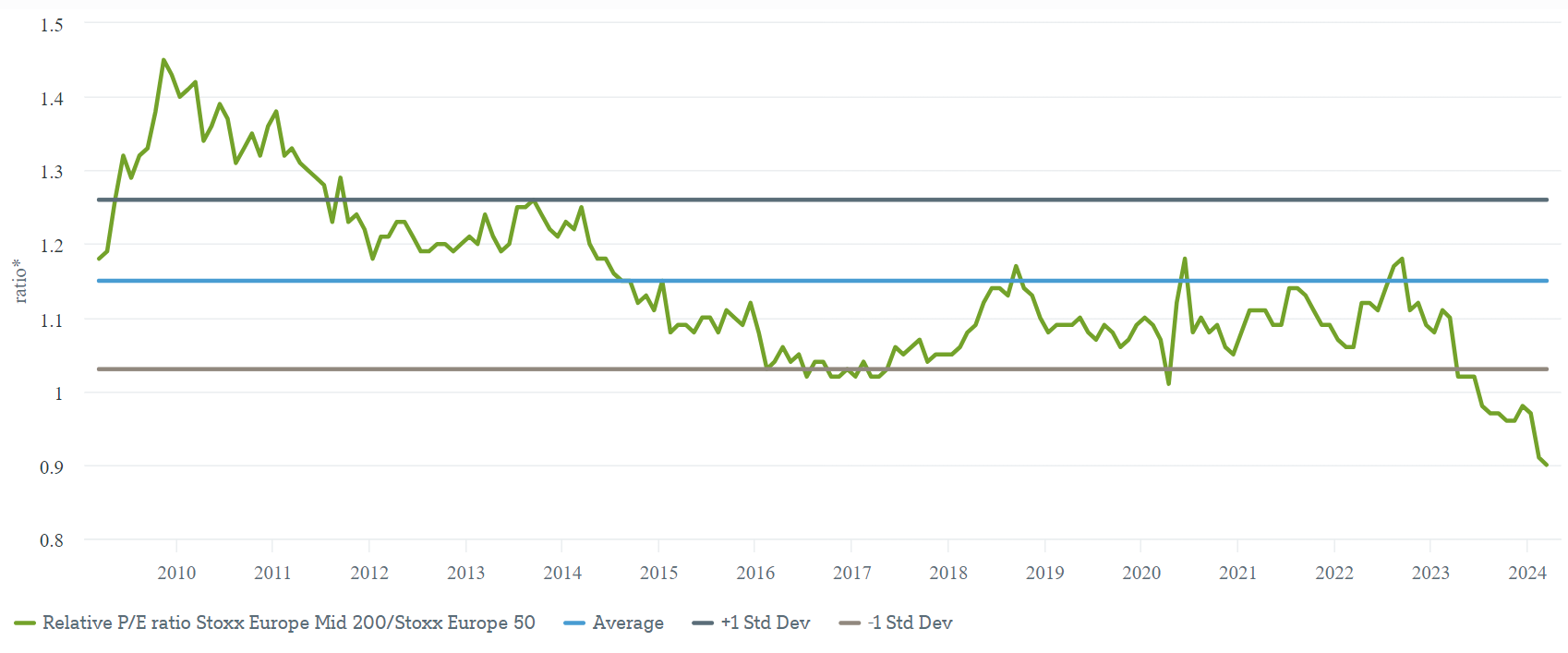

Chart 1: The valuation discount of small caps is below one standard deviation on the 15-year-average

Sources: LSEG and DWS

Commenting on European small caps, Björn Jesch, global CIO at DWS, said: "With each passing day, the number of investors seeking to protect themselves against the dangers of this level of concentration is likely to increase.

"For over a year now, earnings estimates for small caps have been continuously revised upwards, while those for blue chips have at best moved sideways. Earnings growth of well over 10% is expected in 2025.

"Measured in terms of relative earnings growth, a considerable gap has opened up between the performance of blue chips and small caps."

The SPDR MSCI Europe Small Cap Value Weighted UCITS ETF (ZPRX), for example, which offers exposure to small-caps with lower valuations based on sales, book value and earnings, is up 10.3% over the past month, as at 27 March.

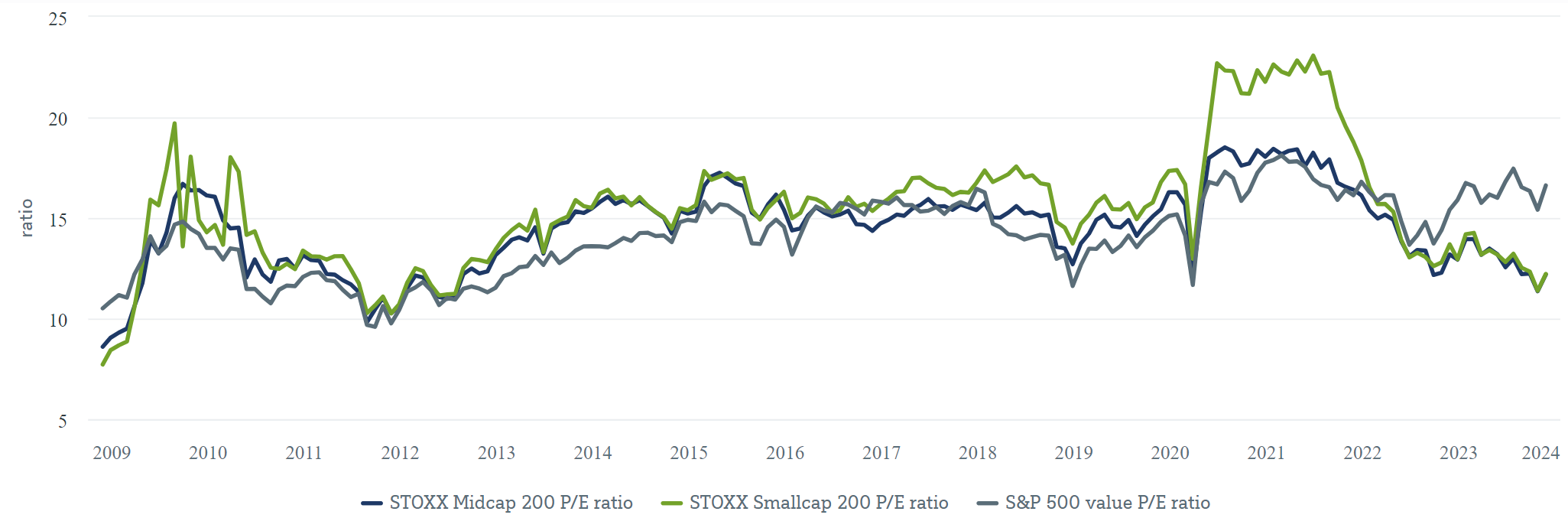

Chart 2: Even compared to US value stocks, Europe’s small and mid-caps have underperformed in 2023

Sources: LSEG and DWS

Elsewhere, more defensive plays including the SPDR MSCI Europe Health Care UCITS ETF (HLTH) and the Amundi Index Euro Corporate SRI 0-3 Y UCITS ETF (ECR3) saw outflows of $262m and $221m, respectively, highlighting the bullish sentiment in the region.