Ireland has quietly established itself as the place to domicile ETFs in Europe amid a favourable tax treaty with the US, the reputation of the Central Bank of Ireland (CBI) and the institutional knowledge of Dublin’s ETF industry.

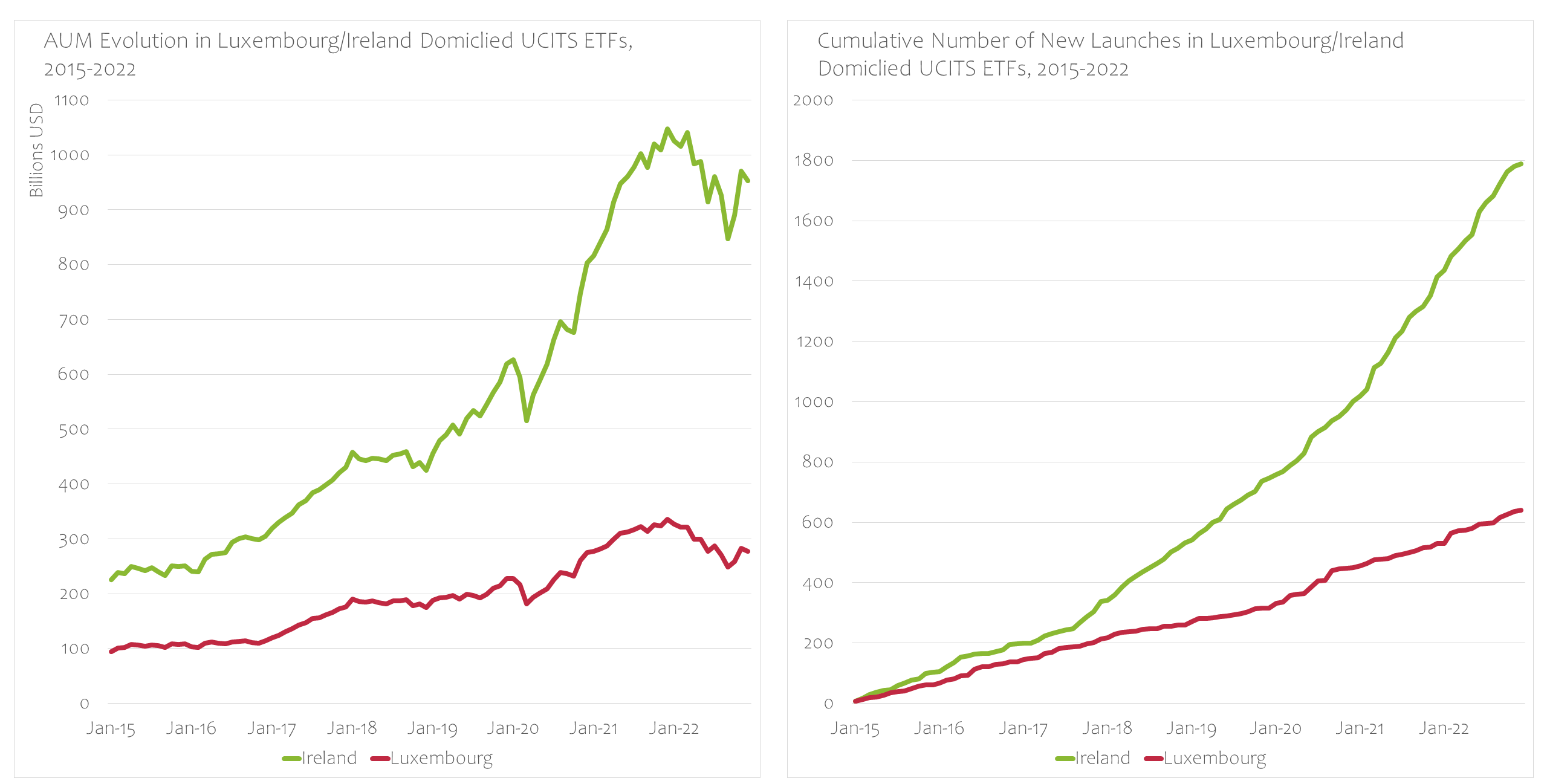

In Europe, there are two key jurisdictions where issuers domicile ETFs. Ireland and Luxembourg were once on a relatively level playing field in terms of both assets under management (AUM) and the number of ETFs domiciled, however, Dublin has surged ahead as the venue of choice for ETF issuers.

At the start of 2017, there were 199 ETFs with $305bn AUM domiciled in Ireland, ahead of Luxembourg which had 146 ETFs with $115bn AUM, according to data from ETFbook.

However, this has changed dramatically with Ireland now housing approximately 1,789 ETFs with $953bn AUM, approximately 67% of the total European ETF market, and far ahead of its rival which has $277bn.

Source: ETFbook.com

“Ireland and Luxembourg are two major European domiciles of choice for UCITS ETFs, with excellent expertise and experience in establishing and servicing a broad range of funds across asset classes,” Pawel Janus, co-founder and head of analytics at ETFbook, said.

“It is Ireland, however, that is clearly taking the leading position in terms of asset growth, attracting new fund promoters and therefore new launches.”

This is highlighted recently by Amundi – Europe’s second-largest ETF issuer – which started domiciling ETFs last May.

Furthermore, ETF Stream revealed earlier this year that BNP Paribas Asset Management (BNPP AM) is currently seeking regulatory approval from the CBI to begin domiciling strategies as well.

As Lorraine Sereyjol-Garros, global head of ETF and index sales at BNPP AM, said: “In order to compete with other providers, and be attractive to investors, we need to have an [Irish collective asset management vehicle] (ICAV) to offer US and global equities.”

The favourable tax treaty in the US is one of the key drivers behind the reason ETF issues favour Ireland over other jurisdictions.

US equity ETFs domiciled in Ireland have a 15% withholding tax rate on dividends versus 30% for ETFs in Luxembourg and other jurisdictions.

This is also the case for global equities where the US accounts for a significant portion – 68% of the MSCI World index – of the market.

According to ETFbook, given the dividend yield on the S&P 500 is currently around 2%, choosing to domicile in Ireland will result in an annual 30 basis points of annual tax savings.

While the favourable US tax treaty is a key factor, Shane Coveney, partner at Dillon Eustace, also pointed to the CBI’s role as a thought leader within the European market.

In particular, he highlighted the Irish regulator’s Discussion Paper 6 – released in 2018 – which the International Organisation of Securities Commissions (IOSCO) based much of its latest ETF Good Practices proposal last year.

Furthermore, Coveney added the process of gaining approval when registering ETFs usually takes 6-8 weeks and ETF issuers do not have to raise €1.25m assets in the first six months post-approval which is the Commission de Surveillance du Secteur Financier’s (CSSF) requirement in Luxembourg.

“For new ETF issuers, six months is a narrow time frame,” Coveney added. “The CBI is a thought leader within the market and Ireland’s reputation [as an ETF hub] proceeds itself.”

Related articles