“Be fearful when others are greedy and greedy when others are fearful.” After Italy elected its most right-wing government since World War Two, it would take a brave investor to heed Warren Buffett’s advice, however, there are signs now could be as good a time as any to be eyeing Italian government debt.

Last Sunday, the right-wing alliance of the Brothers of Italy, League and Silvio Berlusconi’s Forza Italia claimed victory in the Italian elections with approximately 44% of the vote with 25% going to the Brothers of Italy.

This means the party’s leader Giorgia Meloni looks set to become Italy’s first female prime minister in history and unleash the country on a course of loose fiscal spending and potential heightened tensions with the European Union.

While the result was largely forecasted in the exit polls, the incoming eurosceptic government, with Meloni at the helm, is a far cry from former Prime Minister Mario Draghi, responsible for guiding the bloc through the eurozone crisis in the early 2010s, who resigned in July.

During the campaign, Meloni warned her government would renegotiate with the EU the terms of its recovery plan which throws into question whether Rome will receive the planned €200bn support package from Brussels.

As Benedek Voros, director, index investment strategy at S&P Dow Jones Indices, said: “The new government has its work cut out to convince investors and – at least as importantly – EU leaders and European Central Bank policymakers about their credentials in the weeks and months ahead.”

In response to the elections, the euro plummeted to a fresh 20-year low on Monday at $0.961 while the Italian 10-year Buoni Poliennali del Tesoro (BTP) yields spiked to 4.73%, its highest level since 2013.

Meanwhile, the spread between 10-year German bunds and Italian BTS jumped to 250 basis points (bps), the widest since March 2020 when markets plummetted following the rapid spread of coronavirus.

Saxo Bank analysts warned pressures to deliver on promises made during the campaign could see the new government call for larger deficit spending, something Draghi refused to consider.

“Meloni has promised to roll back some of the reform measures introduced by Draghi, a move that could risk the EU withholding some portion of the €200bn of extraordinary EU pandemic budget funds targeted for Italy,” the analysts added.

This fiscal expansion comes at a time when Italy has the world’s third-largest balance sheet of $2.65trn, behind the US and Japan. This will come under even further pressure as the ECB hikes interest rates in a bid to tackle record-high inflation across the eurozone.

George Lagarias, chief economist at Mazars, added: “Unlike Greece, Ireland or Portugal, Italy’s debt obligations are way above any commitment the ECB, or the eurozone itself, can make should a default become reality. Italy is both ‘too big to fail’ and, consequently, ‘too big to save’.”

This has been the sentiment over the past nine months with ETF investors currently extremely bearish on Italian government bonds. Highlighting this, the iShares Italy Govt Bond UCITS ETF (ISOM) has seen $413m outflows in 2022, as at 26 September, according to data from ETFLogic.

However, could this represent an opportunity for investors? There are signs the political headwinds have been overblown by the market meaning Italian BTS yields are currently trading at relatively attractive levels.

It is clear the ECB is extremely focused on fighting fragmentation. The central bank introduced an anti-fragmentation backstop – the Transmission Protection Instrument – in July which allows it to purchase an unlimited amount of a country’s bonds in order to “counter unwarranted disorderly market dynamics”.

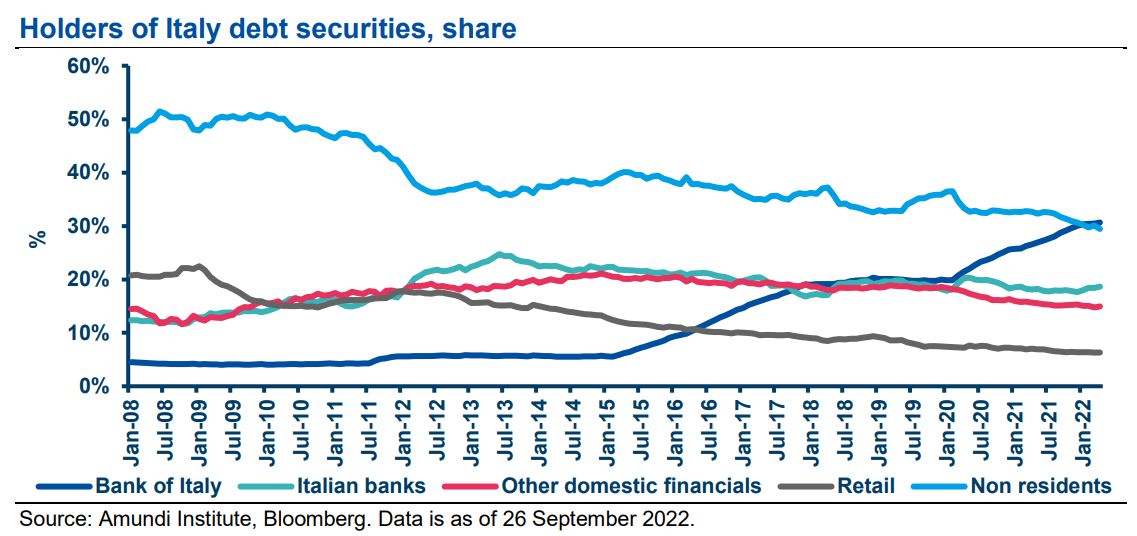

Furthermore, the ECB has become the main holder of Italy’s marketable debt this year – surpassing foreign investors – in a bid to support Italy’s flailing economy, according to a research note from Amundi.

Source: Amundi

“Foreign positioning is low by historical standards,” Sergio Bertoncini, senior fixed income research strategist at Amundi Institute, added. “At the same time, marginal foreign flows look to be less of a spread-driver than they were in previous phases of rising volatility and uncertainty, thanks to the ECB’s role and rolling investors’ high investment.

“These factors, together with the TPI, should help counterbalance the hawkish ECB stance.”

In terms of political concerns, the fact the right-wing coalition has not gained a two-thirds parliamentary majority means it will be unable to vote for constitutional amendments, a result that gives the parties less bargaining power when dealing with Brussels.

Bertoncini predicted the incoming government is likely to stick to EU fiscal targets and “avoid clashes with EU institutions”.

“We believe that idiosyncratic risks will remain contained,” he continued. “Investors may consider raising their exposure to BTPs if the [10-year bund-BTS] spread returns to the 250bps area.”

With this level reached, a move into the most unloved sovereign debt in the eurozone could be an option for investors that are looking for opportunities to “be greedy when others are fearful”.

Related articles