In a year defined by the Herculean rise of ESG ETFs, it is the handful of products that manage to contribute to these ends in new and impactful ways that should be celebrated most.

Embodying this is my favourite ETF launch of the year, the SparkChange Physical Carbon EUA ETC (CO2), which broke through $100m assets under management (AUM) less than four weeks after launching on 4 November.

The product tracks the price of EU Carbon Allowances (EUAs) issued by the European Commission and purchased by companies as “permits to pollute”, which translate into a cost incurred by companies as a result of their polluting activities.

Each year, the European Commission reduces its issuance of new allowances, with EU law dictating that when credits are held for 12 months, additional permits are cancelled in future years.

This inbuilt scarcity mechanism means that as companies lag behind energy transition and pollution targets, they are punished by the need to purchase increasingly expensive carbon allowances.

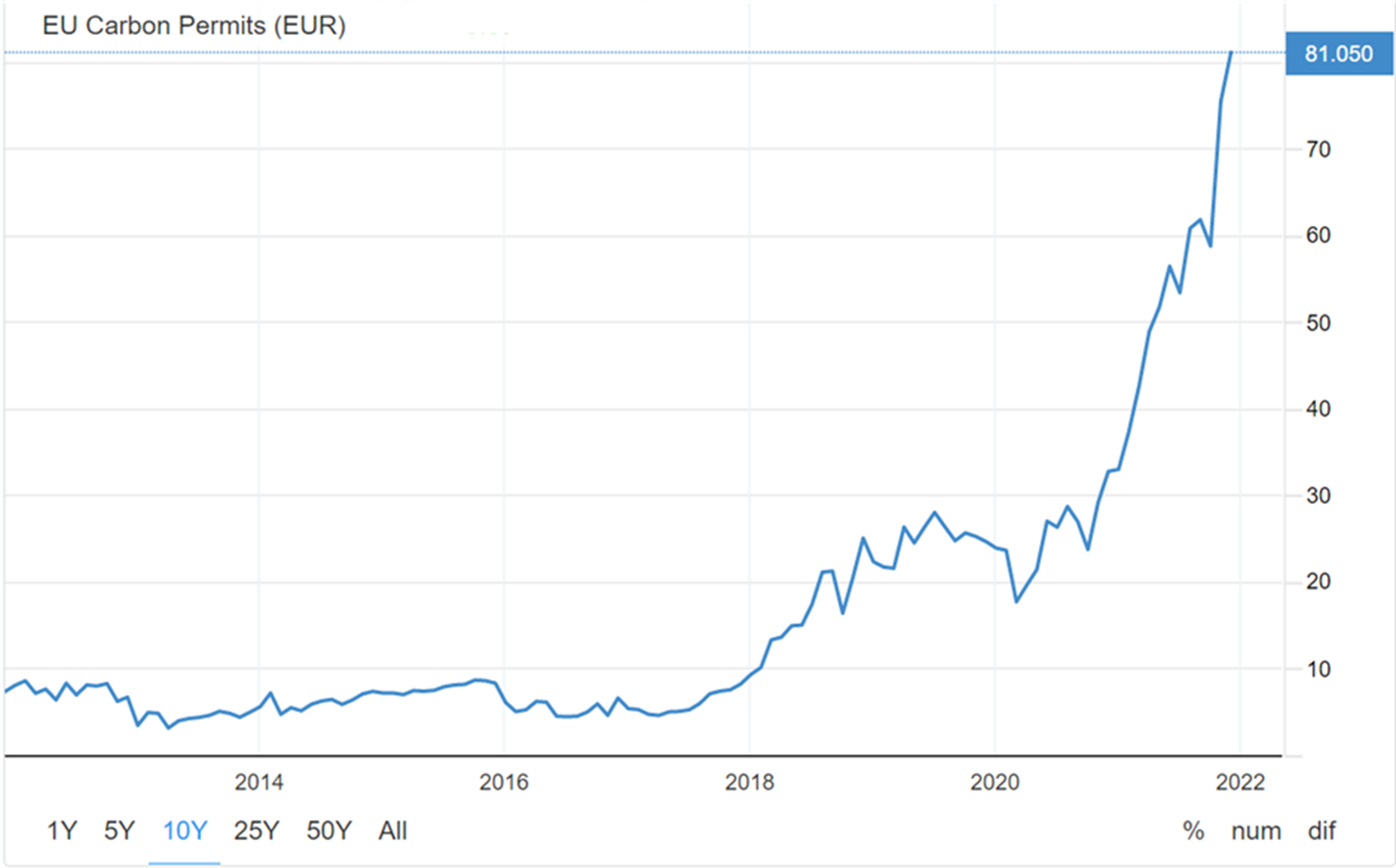

This creates a tangible and direct benefit for carbon investors, who track the price of carbon credits as it rises. In fact, the price of EUAs shot up 192% in the three years prior to the arrival of SparkChange’s ETC.

Prior to the last few years, the price of EUAs was hampered by the Global Financial Crisis – which reduced economic activity – and the use of international credits (non-EUAs) set up under the Kyoto Protocol.

Source: Trading Economics

As economies tentatively exit pandemic mode, extractive, manufacturing and travel industries will continue to recover, increasing the demand for carbon permits. The European Commission has also excluded CER and ERU credits since the introduction of EU Emissions Trading System (ETS) Phase 3 and said it “does not currently envisage” using international credits for ETS compliance from 2020.

These dynamics benefit all exchange-traded products (ETP) tracking the price of EU pollution permits, including CO2’s peer, the WisdomTree Carbon (CARB), which re-launched in August.

A physical presence in the EUA market

Where SparkChange’s strategy differentiates itself is with its position as the world’s first ETP offering physically-backed exposure to EUAs.

In practice, this means rather than merely being affected by price movements in its underlying, CO2 adds tangible strain to the supply of EU carbon credits. For instance, CO2’s $203m asset under management (AUM) means it is withholding EUAs corresponding to 2.25 million tonnes-worth of carbon from the market, as at 21 December.

Furthermore, while some critics of carbon credits draw comparisons to Catholic “indulgences” – paying to absolve a sin without committing to not sin again – EUAs have a tangible, positive impact. In fact, the European Commission said the 11,000 power plants and factories covered by the ETS (that contribute 41% of the EU’s total emissions) reduced their overall emissions by approximately 35% between 2005 and 2019.

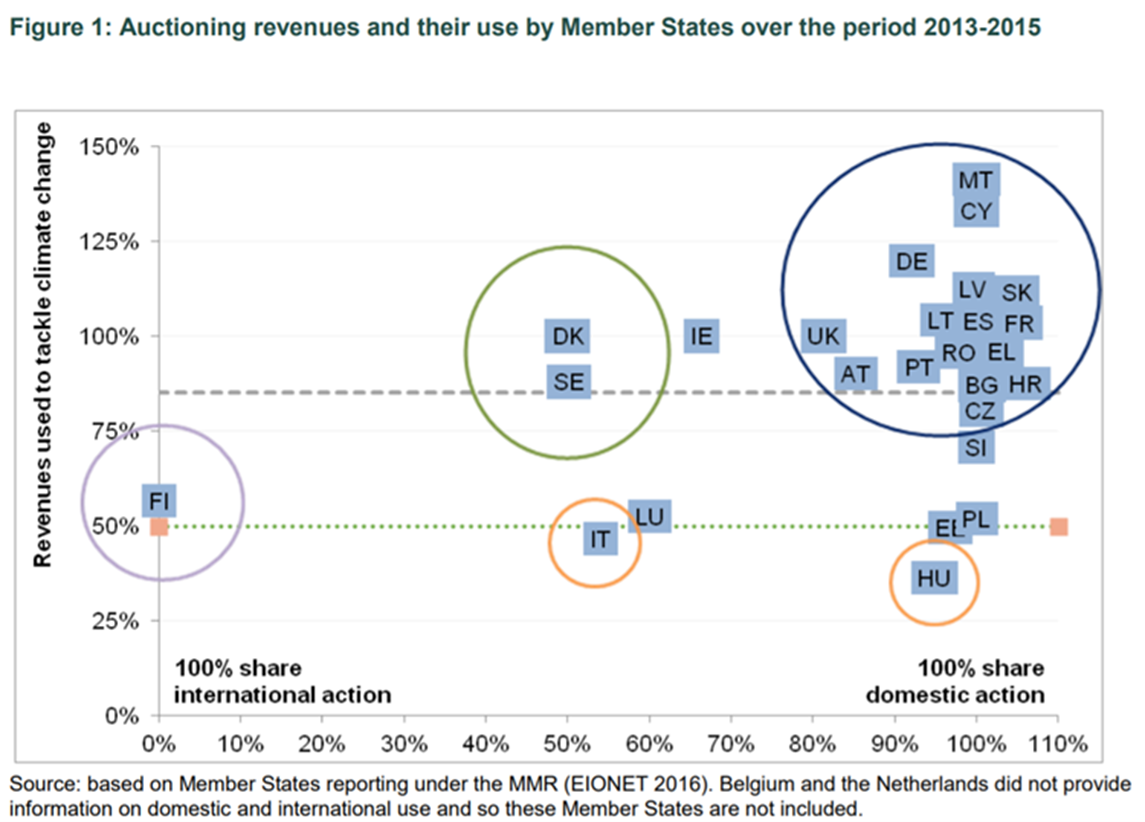

Added to this, the revenues the European Commission generates from EUA auctions are then funnelled back into funding decarbonisation projects, with 17 of 25 reporting EU member states allocating at least 80% of their EUA revenues to investments in domestic or international cross-cutting activities, renewable energy and energy efficiency between 2013 and 2015.

Between these positive narrative elements and the physical role CO2 offers investors in the EUA market, Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence said what product the product is doing is “real impact investing”.

“These, along with thematic ETFs, are better ways to play ESG investing,” he added.

SparkChange benefits most from EUA price appreciation

While the impact investing angle of physical exposure is attractive, a practical advantage is unlike futures-based product from WisdomTree, CO2 only stands to benefit from taking a long position on carbon permit prices.

When the price of EUAs is expected to rise, this creates an upward slope in the forward curve of EUA futures – contango – which risks EUA futures trading at a higher price than spot when they are not close to expiry.

The degree to which this occurs and impacts performance in EUA futures varies and is contested between sources. Naturally, the opposite is true when EUA futures are in backwardation, however, betting on recouping lost gains during downturns does not make much sense when one is allocating to long-only strategies – which indicate they believe the value of the underlying will increase more than it decreases.

Another talking point is CO2’s total expense ratio (TER), which is considerable at 0.89%. This looks pricey compared with CARB’s management expense ratio (MER) of 0.35%, however, CARB also has a portfolio transaction cost impact of 0.45% and other ongoing costs coming to five basis points, resulting in a total cost of ownership of 0.85%, only marginally lower than CO2’s.

Of course, no product is perfect. For instance, Bloomberg Intelligence’s Psarofagis favours the global rather than Europe-specific exposure offered by the US-listed KraneShares Global Carbon Strategy ETF (KRBN). Furthermore, the price of EUAs is incredibly erratic, with volatility of more than 40% in six of the last seven full years. Finally, the outlook for EUAs remains uncertain, with S&P Platts Analytics set to update their outlook as the COVID-19 Omicron variant disrupts economic activity and coal plants continue closing following COP26.

Overall though, CO2 remains a strong pick for ETF launch of the year. Not only does it offer a new and tangible way to play ESG investing, it provides investors click-and-purchase access to an asset class traditionally reserved for institutional investors. Providing transparency and new access to investing niches is crucial for the perception of ETFs to evolve beyond being tools for low-cost beta.

Related articles