Common sense says ETFs are cheap everywhere - but cheapest in the US, where Vanguard, BlackRock and Charles Schwab lead the charge downward. While Fidelity provides market tracking funds for free.

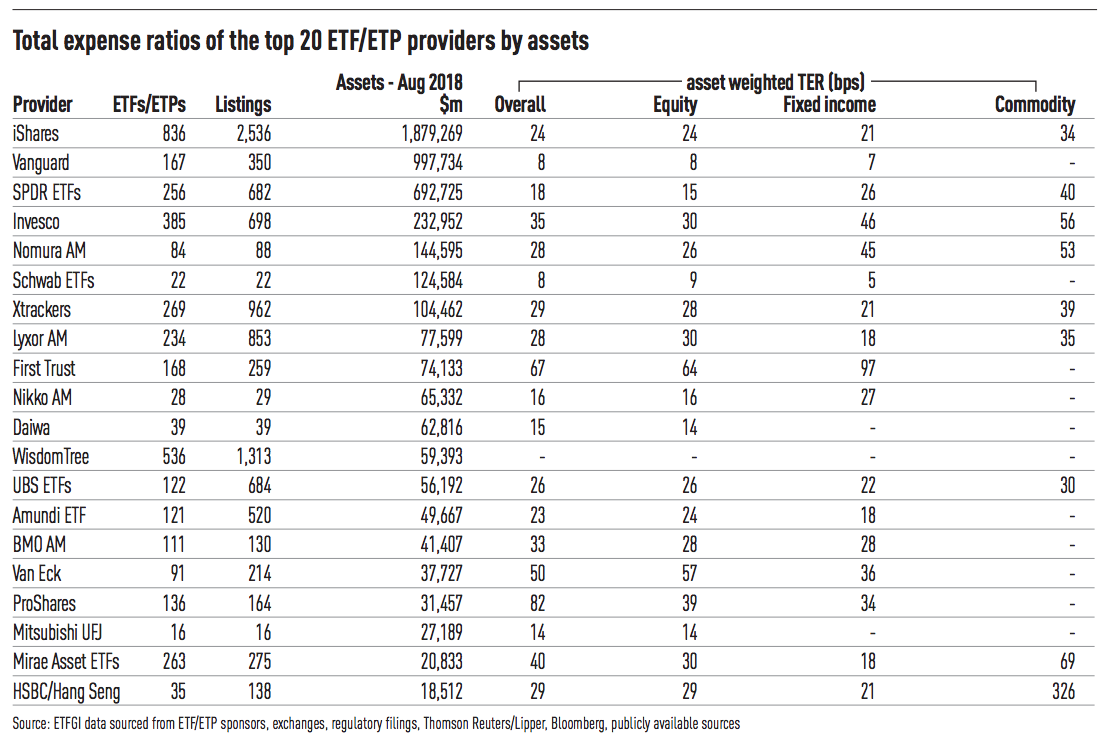

Yet it's Japan and not the US, that's the real king of cheap ETFs a new survey has suggested. The asset-weighted average fees of Japan's four biggest ETF providers - Nomura, Nikko, Daiwa and Mitsubishi - are all below 28 basis points. And the average of the four is 19 basis points, implying Japan's ETFs are cheaper than those in the US, where the average cost incurred by an ETF is 21 bps.

Why are Japan's ETFs so cheap? Partly because cheap funds act as a barrier to entry. But also because low fees help lure in Japan's swelling pool of retail money, which has ballooned thanks to the introduction of tax-exempt Nippon Individual Savings Accounts. (In Japan, as elsewhere, headline management fees are more important to retail investors and advisers.)

The low fees come with reports from the Japanese press that Asian ETF providers are struggling to find sufficient scale to make money from their ultra-cheap products.

"In the short term, most Asian retail markets face the hurdle that ETFs don't pay commission to distributors in a region where the classic distribution model is fully incentivized to sell high-fee funds. But in this low returns world, investors are becoming more fee-conscious," a report in Nikkei Asian review said.