For Professional Clients/Qualified Investors only – not for Retail use or distribution.

Travis Spence, head of ETF distribution, EMEA, at J.P. Morgan Asset Management (JPMAM), has said the future of ETF innovation is in active management, with active ETFs playing an increasingly important role in the ecosystem’s growth story.

According to data from JPMAM, active assets currently account for about 1.5% of the entire UCITS ETF market while net flows have punched above their weight, with just below 3% in 2022 and, year-to-date, close to 6%, with $5.6bn inflows into active ETFs.

There is a similar trend underway in the US market where active assets represent about 5% of the ETF market, and account for 25% share of net flows.

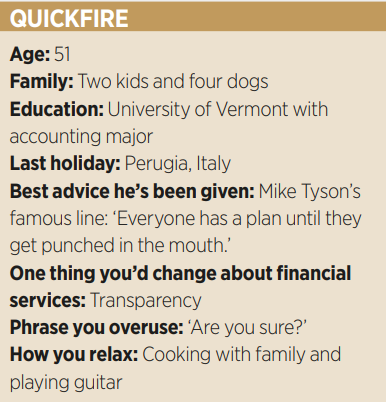

“Investors are very comfortable with the benefits of ETFs such as transparency, price discovery, daily trading and price,” Spence (pictured) continued. “We have reached a point where innovation will be around bringing active management to the ETF wrapper.”

“Active ETF growth is not just a US story,” Spence continued. “It has been equally as relevant in the UCITS environment. The future of ETFs is in active.”

Spence, who was appointed head of ETF distribution, EMEA, at JPMAM, ETF Stream revealed in February, said the firm’s product development will be specifically focused on developing its active ETF range. In particular, he is bullish about JPMAM’s Research Enhanced Index (REI) ETF range which now totals $8bn AUM across 13 equity and fixed income products including the JPMorgan US Research Enhanced Index Equity ESG UCITS ETF (JREU) which now houses over $3bn AUM.

“We have established ourselves as a pioneer in the active ETF market through our unique approach. Our objective now is to continue to lead the active ETF revolution,” he added.

“Our biggest success this year has been the REI ETF suite as the active narrative starts to take shape across European ETF investors. The REI suite, an Article 8 solution with active ESG integration and engagement, offers a compelling solution for investors taking the first step beyond passive index ETFs.”

Active fixed income

Spence, who switched to ETFs after seven years in JPMAM’s fixed income team, sees an important opportunity which brings the firm’s active capabilities within bonds to the ETF wrapper.

‘Bonds are back’ has been the mantra of 2023 as investors look to take advantage of the spike in yields. Highlighting this, fixed income ETFs in Europe saw a record €31bn inflows in H1, according to data from Morningstar.

Despite the demand, ETF investors in Europe remain “underserved” from a product perspective, according to Spence, with a gap particularly prevalent in the active space.

“Bringing the best of our active fixed income platform to ETFs is going to be a key strategy for us,” he added. “Across every region in Europe, active and fixed income are the two areas that are interesting clients at the moment.”

Spence believes active managers have specific advantages within fixed income due to inefficiencies in the market and the way passive strategies are typically constructed.

He warned it is difficult to accurately replicate an index due to the sheer number and availability of bonds within the index, while traditional market cap-weighted fixed income ETFs tend to expose investors to the most indebted companies in the index.

“Fixed income is now a far bigger focus in portfolios with yields so much higher. And it is easy to see why an active approach to fixed income makes sense. Even passive ETFs are arguably active due to the availability of bonds. Having an active approach in fixed income, where you do not automatically hold the most indebted issuers, fully integrate ESG and actively manage turnover and transaction costs, can offer an attractive solution for investors across the region.”

Overall, Spence highlighted growing ETF adoption including retail investors, active management and fixed income as the three key drivers of the European ETF market.

“The ETF industry is an exciting space to be in given the overall adoption,” he continued. “The future of ETFs is active, and we will continue to lead the active ETF revolution.”

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full magazine, click here.