As rates rise, they threaten risky assets on both sides of the Atlantic. Yet, government bonds represent an opportunity for cautious investors looking to hedge against the stock market's volatility.

The yield offered by safe havens in the US, Europe and the UK presents a more significant upside than a downside. Entering in 10-year US Treasury and gilts at current levels would still positively contribute to one's portfolio despite yields rising to 5% and 5.25%, respectively.

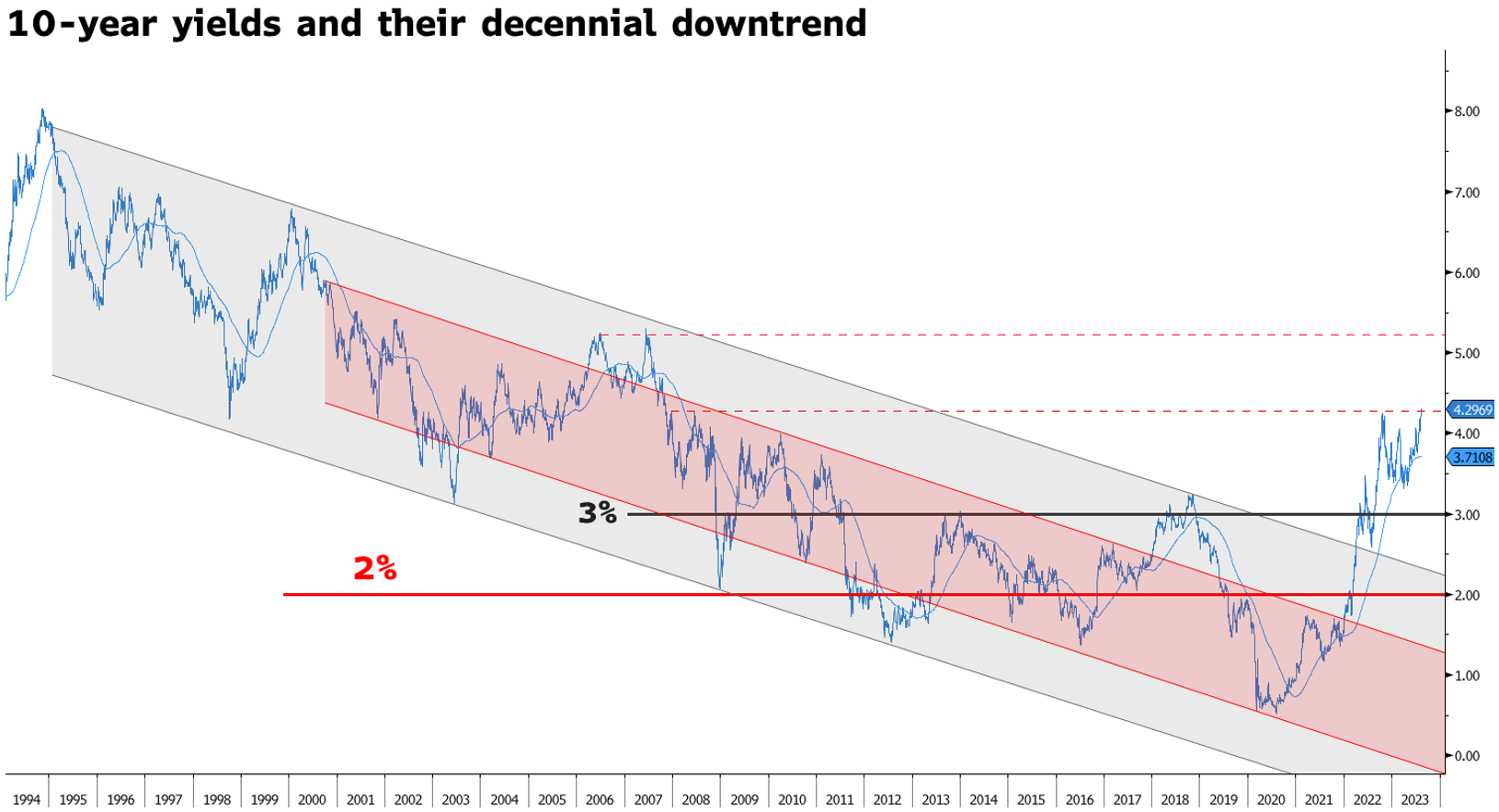

Bond yields continue to soar, and government bonds are now testing key resistance levels worldwide, which, if broken, might take them higher.

It is not investors dumping government bonds pushing yields higher but the overall macroeconomic and supply picture contributing to the bearish trend.

Looking at US Treasuries, yields move higher because:

The increase in US Treasury bonds and bill supply. By the end of this quarter, the US government is looking to borrow $1trn. Net issuance is forecasted to increase in the following year.

Quantitative tightening (QT). Federal Reserve is engaging in a passive form of QT, which lets $95bn mature without reinvestments each month, adding to the pressure from Treasury auctions.

Resilient economic data. Although the economy is losing steam, it does not seem that it is weakening fast enough to suggest a recession. That means that while inflation remains elevated, the Federal Reserve might continue to tighten the economy.

Japanese investors’ retreat home. As the Bank of Japan looks to abandon its yield curve control (YCC), Japanese investors will leave the foreign bond market, putting further upward pressure on yields.

As a result, 10-year yields broke above their descending decennial downtrend in April 2022 and continue to rise.

Source: Bloomberg

Although rates might go higher, the safe havens finally become a feasible alternative for those investors who want to create a hedge against stock market volatility. Indeed, the correlation between US Treasuries and the stock market became negative in July after being positive four months after the SVB collapse.

Adding government bonds to one's portfolio might be sensible when rates increase. While higher rates threaten risky assets as borrowing costs rise, they represent an opportunity for cautious investors seeking assets that might diversify one's portfolio in case of a tail event.

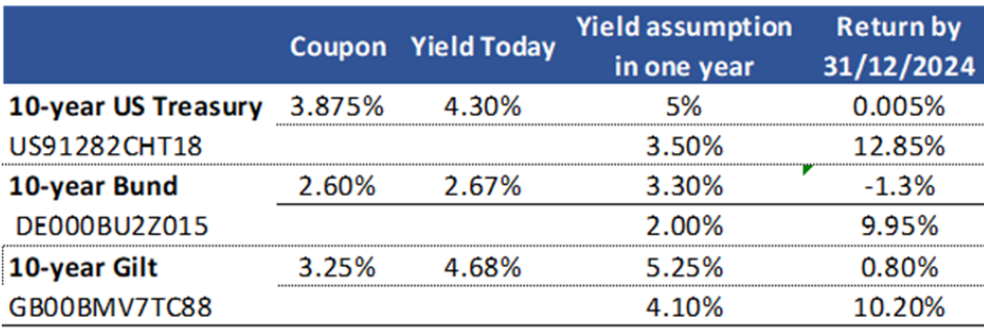

Current US Treasury yield levels are attractive. If one buys 10-year US Treasuries today at 4.3% and holds them for one year, one would still record a profit of 0.005% if yields move to 5% - considered capital depreciation and coupon income). Yet, returns would be significant in case of a downturn. If 10-year yields dropped to 3.5%, one would make 12.8%.

European and the UK sovereign bonds

The same reasoning is valid for European sovereigns and UK gilts.

Although European sovereign bonds are also vulnerable to Japanese investors' repatriation and quantitative tightening is impossible to ignore that Germany and the Netherlands are already in a recession. That poses serious questions concerning the European Central Bank’s (ECB’s) hawkish stance and whether it can keep rates higher for longer.

Investors buying a 10-year bund at 2.67% today and holding them until the end of 2024 will lose – 1.3% if rates rise to 3.3% but gain almost 10% if rates drop to 2%.

Things might be more complex for gilts. Inflation in the UK is the highest among the G7 and the Bank of England might need to hike rates further to get a hold of inflation.

Source: Bloomberg and Saxo Bank

Yet, buying 10-year gilts at 4.68% today and holding them until the end of 2024 will still return 0.8% if yields go to 5.25% and 10.2% if yields drop to 4.1%.

Althea Spinozzi is senior fixed income strategist at Saxo Bank