Diversifying across a set of volatile stocks makes sense until everyone else has the same idea and the vehicle offering this diversification becomes large enough to influence the performance of underlying stocks, as seen with VanEck’s junior gold miner ETFs.

On the surface, small gold miners are an ideal exposure to wrap into ETF format. Mining stocks are often viewed as a way of getting amplified exposure to physical gold but they also carry the addition of idiosyncratic risks associated with mining, with small companies operating just a handful of projects particularly at risk when faced with operational and political barriers.

By capturing 99 of these companies, the $369m VanEck Junior Gold Miners UCITS ETF (GDXJ) and its $3.7bn US equivalent allow investors to play a large number of these potential moonshots while offering enough diversification if one of them suffers a setback.

This narrative has struck a chord with investors both sides of the Atlantic, with the strategy amassing more than $4.1bn since entering the respective markets. While an ETF being a hit with investors is not a bad outcome, there are naturally some structural issues to consider when a strategy is larger than a good portion of the companies it tracks.

A tilt to midcaps

In fact, VanEck notes the weighted average market cap of GDXJ constituents is $2.3bn, with 68.6% of its basket being mid-caps between $1bn and $5bn in size and 28.9% being smaller than $1bn.

This tilt to mid-caps is also a feature that has not always existed. GDXJ began by capturing only the smallest 10% of companies in the gold mining universe but after facing capacity issues in the past, its index provider MarketVectors upped this to 20% in 2014 and then the smallest 40% of gold miners in 2017.

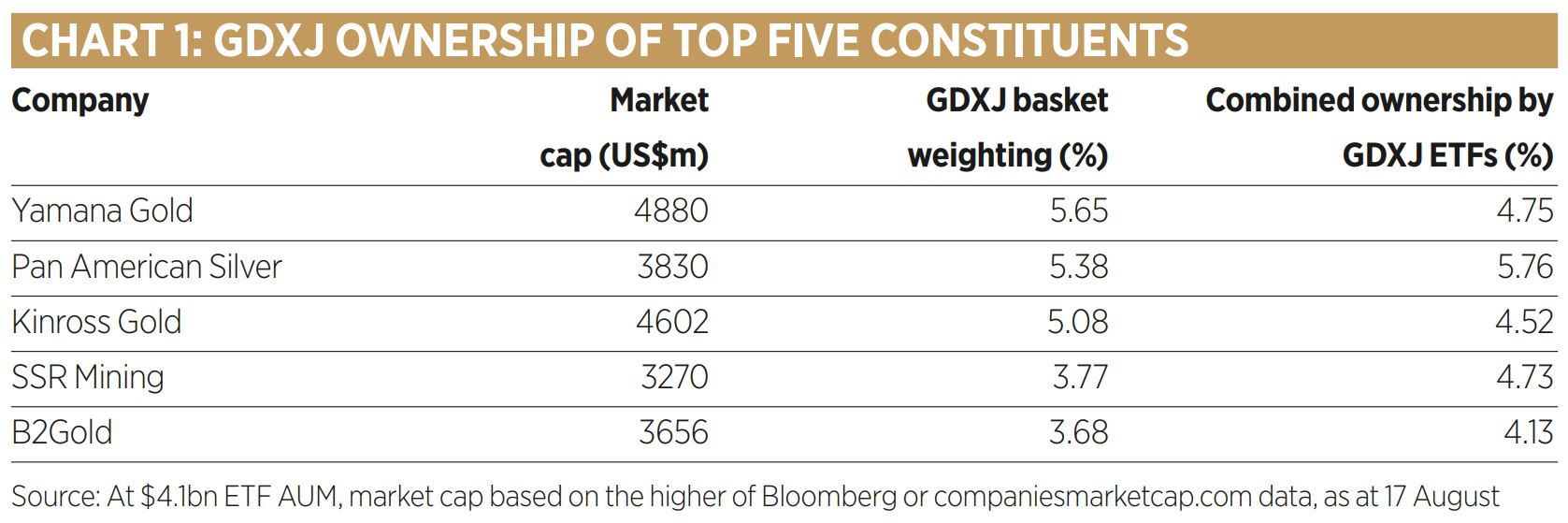

Even after these changes, GDXJ still owns at least 4% of its top five holdings – based on market cap, ETF assets and basket weightings – although these companies are among the largest it captures.

In little over a year, at least three other companies have issued notices to let shareholders know GDXJ has ‘significant’ ownership of their shares.

Last March, Caledonia Mining announced it had been added to GDXJ’s benchmark, which saw the ETF buy around 4% of its shares.

This June, $568m mining small cap Greatland Gold announced it was 5% owned by the two GDXJ ETFs. Earlier this month, Centamin revealed it was more than 4% owned by the GDXJ strategy and more than 10% owned by VanEck products as a whole.

When asked whether high levels of ownership by a single strategy could influence the performance of the underlying as assets enter and exit, Joy Yang, global head of index product at MarketVectors, said this is highly dependent on flow activity and the underlying investor.

Zero-sum game

Yang told ETF Stream: “Markets are a zero-sum game, therefore, the answer also depends who the other holders are and who is selling.

“In general, index fund flows should not have price impact. If they do, active managers step into arbitrage the relation between price and fundamental value.”

The GDXJ ETFs have seen a manageable $131m inflows over the past two months, as at 16 August. It will be interesting to see whether this changes as policymakers such as the Federal Reserve start softening their rate hiking cycles and the strength of currency havens such as the US dollar begin to weaken, which have taken some of the sheen off gold so far this year.

Investors started predicting less hawkishness from the Fed since its last meeting in the final week of July. Over the month to 16 August, GDXJ has returned 12.3% after falling more than 25% between the start of the year and mid-July.

Interestingly, one of the top institutional buyers of GDXJ is Rafferty Asset Management, according to data from ETFLogic. Rafferty AM is the adviser for Direxion ETFs’ short and leveraged junior gold miner ETFs tracking the same MarketVectors index as GDXJ with a combined $396m assets under management (AUM) – and using GDXJ as an avenue to gain physical exposure to the basket.

When asked about Rafferty buying GDXJ to use in the Direxion ETFs, MarketVectors declined to comment.

Over the past 60 days, VanEck and Direxion ETFs had an average daily combined trading volume of more than 13 million shares per day.

While the inclusion of more mid-cap and some large cap stocks in the junior gold benchmark should prevent liquidity issues from occurring, it will be interesting to see whether periods of elevated assets and higher turnover begin impacting ETF constituents, meaning MarketVectors would have to broaden its basket for a third time.

If such a scenario played out, the next question would be how far the benchmark would reach up the market cap spectrum of gold miners before it began losing its focus on the ‘junior’ segment of the market.

Such concerns were raised against S&P Dow Jones Indices when it was forced to broaden its clean energy market to include non-pure play stocks after BlackRock’s clean energy strategies broke through $12bn AUM while tracking a concentrated basket of 30 stocks, many of which had a market cap of below $1bn.

While GDXJ’s situation is less drastic – and MarketVectors having been quick to address capacity issues in the past – these kinds of situations remind us of the limits of open-ended structures. ETFs tracking small caps can only become so big before structural issues come into play and index providers are forced to dilute their desired exposure.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles