Private equity has attracted trillions of dollars1 for a simple reason. Over the past two decades, we believe it has provided investors with enhanced returns by taking advantage of opportunities to capture high growth and improve the efficiency of existing businesses.

For many investors, however, tapping into those opportunities has proved difficult. Most private equity funds can have significant barriers to entry. They may demand multi-year financial commitments, require high minimum contributions and charge fees well in excess of those levied on public equity funds.

Beyond that, private equity firms that are successful in generating positive contributions for their investors are likely to attract capital, grow and as a result, garner attractive market valuations.

Fortunately, there is an alternative called listed private equity. By investing in the individual stocks of publicly traded firms that specialise in private equity, investors may be able to participate in private equity without many of the drawbacks normally associated with this asset class.

The FlexShares Listed Private Equity UCITS ETF (FLPE)* was created specifically to provide access to listed private equity in a highly liquid vehicle. It may be a good fit for investors looking to add private equity exposure to their portfolios.

A track record of performance

Several studies have demonstrated the strong performance of private equity. A March 2021 study from Cliffwater2 found that in the 20 years ending 30 June 2020, private equity allocations by US state pensions earned a 3.8% premium over investments in public equity.

Researchers attribute that alpha generation to the illiquid nature of the asset class, the skill and experience of the funds’ managers and the ability of private equity firms to invest in promising companies, especially early-stage growth businesses, that have yet to go public.

Listed private equity historically has also outperformed. The Global Listed Private Equity index, which holds shares in leading global private equity companies, earned higher returns than the MSCI World over three years, five years, 10 years and 15 years3.

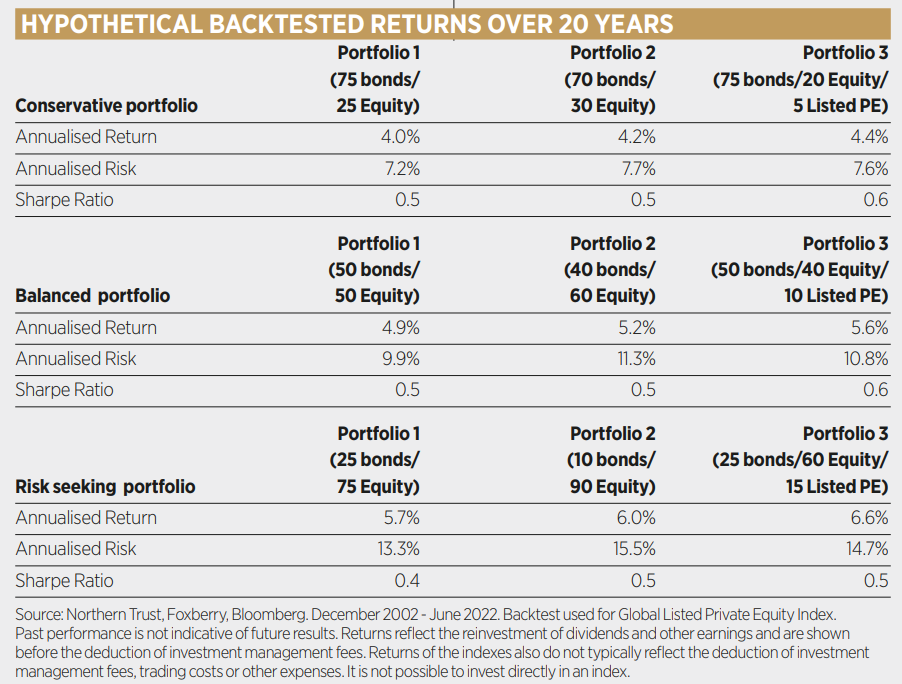

Work done by FlexShares makes clear that adding listed private equity to a portfolio may also improve absolute returns and may be a superior alternative on an absolute basis to enhancing returns by adding more equity exposure in a blended portfolio.

To show this, FlexShares studied three hypothetical portfolios with three different blends of stocks and bonds over a 20 year-period. Then we substituted listed private equity for a portion of the equity component and compared that with an option where a return enhancement is being targeted through adding more equity exposure to the portfolio. In all three cases, the relative returns and the risk-adjusted returns as measured by the Sharpe ratio, were higher than those in the portfolios with higher equity exposures4.

We believe an investor has the potential to generate alpha through listed private equity. And if they make that investment through a fund or an ETF that holds a basket of private equity stocks, we believe they can access that opportunity in a vehicle that offers:

Greater liquidity and transparency than traditional private equity. Instead of tying up money for years, the investor owns a security that is traded and priced on an exchange each day.

Greater diversification. A fund or ETF that holds a group of listed private equity managers may get around the potential “picking the winners” issue by providing exposure to a range of the

industry’s premier players.

An investment that suits today’s environment

While no one can predict how the economy and markets will perform, most forecasters are anticipating that economic growth will slow and that stock and bond returns may be muted in the years ahead. In that kind of environment, an asset class that has the potential to generate alpha like private equity could be particularly attractive.

Historically, private equity firms have been able to take advantage of periods of slow growth to find investment opportunities in companies that temporarily may have fallen out of favour. Listed private equity is a long-term investment but there are reasons to think today’s environment makes it an especially good fit.

Why FlexShares

As we have said, FLPE is an ETF that was created to give investors a liquid and affordable way to add a new asset class to their portfolios. It is broadly diversified, with dozens of holdings in the world’s leading private equity.

Like all FlexShares products over the past 10 years, it is actively constructed, and passively managed while being backed by Northern Trust, an over 130-year-old global financial services firm with more than $1trn total assets under management**.

To sum up, private equity has grown to be a $5.3trn asset class on the strength of its performance over the past 20 years. Many investors have had to watch that growth from the sidelines because private equity funds are difficult to access. Listed private equity, buying shares of publicly traded private equity firms in an ETF, can be a way to participate in growth of the asset class and enhance returns in investor portfolios.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

* FlexShares Listed Private Equity UCITS ETF (FLPE) is registered for marketing and sales in Austria, Denmark, Finland, Ireland, Germany, The Netherlands, United Kingdom and Sweden.** As at 30/03/2022.1 Source: Prequin, Global Private Equity, 01/12/ 2022. Preqin is the foremost provider of data, analytics, and insights to the alternative assets’ community2 Source: Cliffwater, N. Long Term Rewards from Private Equity. March 20213 Source: Foxberry, Bloomberg, Hypothetical backtest of Global Listed Private Equity Index, 31/12/2002 - 30/06/20224 Ibid

Important legal informationThis is a marketing communication. Please refer to the prospectus and to the KIID before making any final investment decisions. This information does not constitute a recommendation for any investment strategy or product described herein. This information is not intended as investment advice and does not take into account an investor’s individual circumstances. Investing involves risk – no investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Northern Trust Asset Management (NTAM) is composed of Northern Trust Investments, Inc. (NTI), Northern Trust Global Investments Limited (NTGIL), Northern Trust Fund Managers (Ireland) Limited (NTFMIL), Northern Trust Global Investments Japan, K.K. (NTKK), NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Belvedere Advisors LLC, Northern Trust Asset Management Australia Pty Ltd and investment personnel of The Northern Trust Company of Hong Kong Limited (TNTCHK) and The Northern Trust Company (TNTC). © 2022 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Issued in the United Kingdom by Northern Trust Global Investments Limited. Issued in the EEA by Northern Trust Fund Managers (Ireland) Limited.