Summary:

Marijuana ETFs have more than $2bn under management, yet the industry is probably in a bubble

Marijuana businesses have no franchise value because marijuana is a backyard weed with zero barriers to entry

Anyone, anywhere, can grow a marijuana plant in their backyard. Marijuana is not tobacco or coffee -- which are capital and labour intensive. Less still is it a complex pharmaceutical protected by IP laws.

A lot of Australians don't like the nation's capital -- Canberra. Most don't like its politics. But nearly everyone hates the weather: 700 metres above sea level and cased in the Great Dividing Range, Canberra winters are cold.

You wake up July mornings and its -8 degrees. When tourists think 'Australia' they think sunshine and beaches -- this is not true of Canberra.

Yet Canberra is different from the rest of the country in one other crucial respect: it's marijuana laws.

Personal marijuana is decriminalised in Canberra. Canberrans can grow and smoke marijuana and receive no criminal conviction (up to a limit). Full legalisation is currently being tabled.

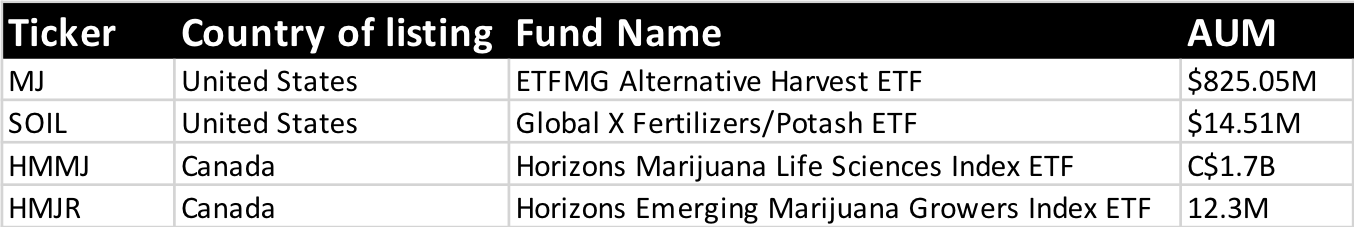

Which brings us to marijuana ETFs.

Marijuana ETFs are the flavour of 2018; much like bitcoin ETFs were the flavour of 2017.

Both sell stories and are predicated on what they'll do in the future, rather than what they do at the present. Both appeal to the countercultural, the young and futuristic. ETFs targeting both have gathered a lot of assets very quickly while delivering a highly volatile performance.

But they're also similar in one more respect: they're both possibly in bubbles.

Bitcoin was (and is still) in a bubble because it claimed to be a currency - yet placed no claim on states. Fiat currencies - like the Aussie dollar or Japanese yen - will always store value because states demand their taxes are paid in them. Tax means there is always demand.

Marijuana is likely a bubble because it claims to be a drug - yet in reality is just a weed. Let's walk through this.

Drugs and medicines have value because they have barriers to entry. I will always pay for aspirin because I cannot make it myself. Producing it requires capital like lab equipment that I don't have. The more sophisticated drugs have two barriers to entry: the fixed capital, your plant and lab equipment, but also the patent and IP laws.

Your 'addictive substances' - like caffeine and tobacco - have barriers to entry too. Growing tobacco is capital-intensive and requires fertilisers, pesticides, irrigation and more. Even the most committed cigarette smokers don't grow their own tobacco: they can't.

Coffee has barriers to entry because it is labour intensive. Growing a coffee plant takes 3 - 4 years. You then have to process the cherries, dry them, mill, roast and grind the beans. Do you have time for that? Me neither.

But marijuana is not like this. It's a weed that can be grown anywhere with little difficulty. You can grow it in your backyard without any capital or labour. There are no barriers to entry and there is no franchise value.

Which brings us back to Canberra.

In my old job as a local journalist, I had to report on people who broke the decriminalisation thresholds, i.e. drug dealers. The police picked up one guy that managed to grow about 6 plants, each 2 metres tall, in his backyard shed. All it cost him was a bag of fertiliser. In hot summers, I was told, marijuana plants can grow one foot taller every month, meaning his backyard business could have been put together in six months.

The point of this is not to detail the specifics of home-grown marijuana - only to question what value investors see in an ETF that tracks this backyard weed.

There is currently more than $2bn in marijuana ETFs worldwide - which is more than double the amount stashed in Sweden's bitcoin ETFs. My feeling is investors in marijuana ETFs could be in for a disappointment.