The Federal Reserve’s gift-wrapped ‘pivot’ may have been framed as Christmas come early, however, the disproportionate market response – and managing the subsequent whiplash – is a trial fund selectors will contend with through 2024.

The Federal Open Market Committee’s (FOMC’s) verbal ending of further policy rate hikes was accompanied by the policymaker guiding three rate cuts totalling -0.75% by the end of 2024.

Before the fateful November meeting, forward market prices had already taken the liberty of factoring in a cut from 5.25%- 5.50% to 4.25%. After the meeting, markets priced in cuts to 3.75%-4%.

This hypothetical dovishness sent investor confidence in fixed income to a 15-year-high, accompanied by the Bloomberg Global Aggregate index booking 10% gains, marking its best two months of gains in data going back to 1990.

Unsurprisingly the giddiness was not confined to fixed income, with a Bank of America Global Fund Manager Survey at the end of the year revealing broad sentiment to be at its most upbeat since January 2022 – as indicated by cash versus equity allocations.

Chart 1: Implied cash allocation by non-bank investors globally

Source: Bank of America, Bloomberg

The momentous ‘Santa rally’ also coincided with the S&P 500 gaining 16.7%, or $6.49trn in market cap, in eight weeks.

Meanwhile the Nasdaq 100 booked its strongest year since the ‘dot-com’ bubble and the MSCI ACWI gained for seven consecutive weeks, marking its longest winning streak in almost six years.

Perhaps more of a red flag, however, was the Russell 2000 – home to small caps with lower profitability and higher leverage – gaining 26.8% in eight weeks, while the IPOX SPAC index added 20%.

Scanning a frothy landscape, JP Morgan’s global strategy report described markets appearing “overbought and sentiment in complacent territory” as investors piled into a year-end performance chase.

This was driven by the emergence of the “immaculate disinflation" thesis – a narrative it warned would be “challenged” in H1 as the disinflation faces hurdles.

George Granville, partner at Courtville Partners, warned “many factors” suggest inflation will remain above 2% target levels meaning the Fed funds rate is likely to settle at 4% or above and those hoping for a return to post-2008 low rates “will be disappointed”.

Fixed income mini-correction

Some of these warning lights began flashing in the opening weeks of the year, with December prints revealing US new jobs coming in 46,000 above expectations, while retail sales growth and consumer price inflation (CPI) both 20 basis points higher than predicted.

Following a speech by Fed Governor Christopher Waller, who said there was “no reason to move as quickly or cut as rapidly as in the past”, US 10-year Treasury yields saw their largest daily increase in over two months, according to Deutsche Bank Research.

With CME Fedwatch pricing of a March cut by the Fed falling from 90% to 42% within a fortnight, JP Morgan noted long duration trades have taken a “tactical respite”, with 889,000 contracts taken out by hedge funds against 10-year Treasuries in mid-January marking the largest short position on the duration in history.

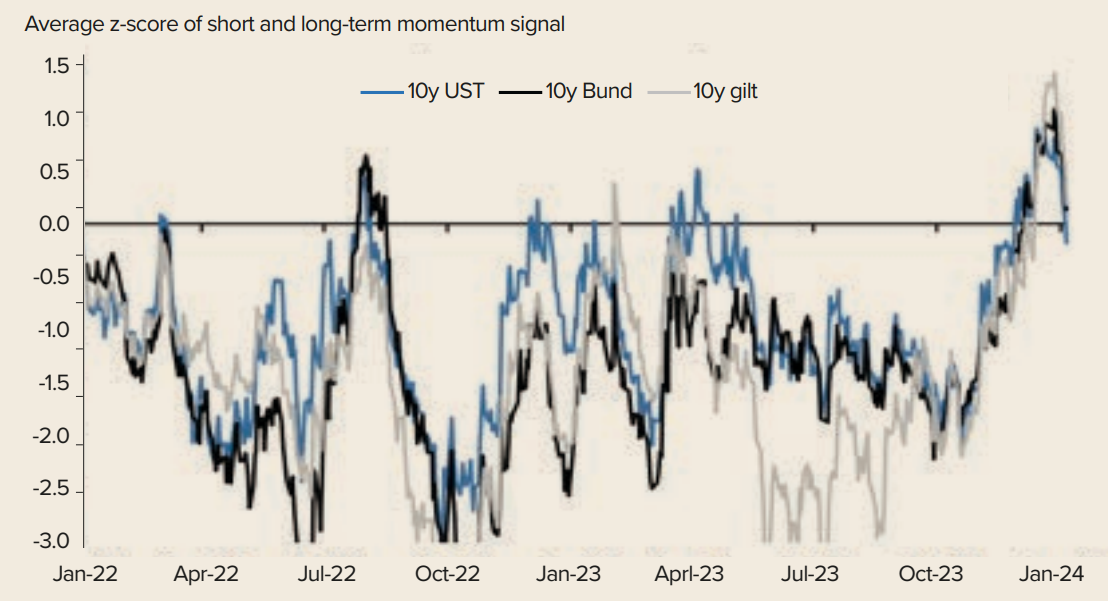

Chart 2: Momentum signals for 10-year sovereigns

Source: JP Morgan, Bloomberg

However, a delayed timeline on cuts and a less straight path to deflation could suggest yet more to be shaken out of last year’s pivot rally in fixed income. Wei Li, global chief investment strategist at the BlackRock Investment Institute, warned markets are still pricing in six quarter-point rate cuts by the Fed.

“We still see market pricing of rate cuts as overdone given the inflation rollercoaster we expect, but the quick shift in expectations underscores the importance of managing macro risk as market narratives can suddenly flip flop,” she said.

This goes some way to explaining why investors allocated $440m to the iShares $ TIPS UCITS ETF (ITPS) between the turn of year and 19 January, according to data from Bloomberg Intelligence.

Speaking on the merits of inflation protection ETFs, Stephen Kemper, chief investment strategist, team advisory desk at BNP Paribas Wealth Management, said: “Investors could look to inflation protection, particularly in the US, which could be tempting in terms of not taking too much interest rate risk at this point.”

Alex Brandreth, CIO at Luna Investment Management, suggested combing inflation protection and short duration – by allocating to ETFs such as the iShares $ TIPS 0-5 UCITS ETF (TIP5) – could offer “a positive real yield in the US, which is attractive”.

Equities less reticent

In equities, rate-sensitive small-caps have read the Treasury yield tea leaves, with the Russell 2000 index falling 1.5% in the year-to-date to 24 January.

However, this has not carried across to US large caps, with the S&P 500 and Nasdaq 100 recently booking fresh all-time-highs.

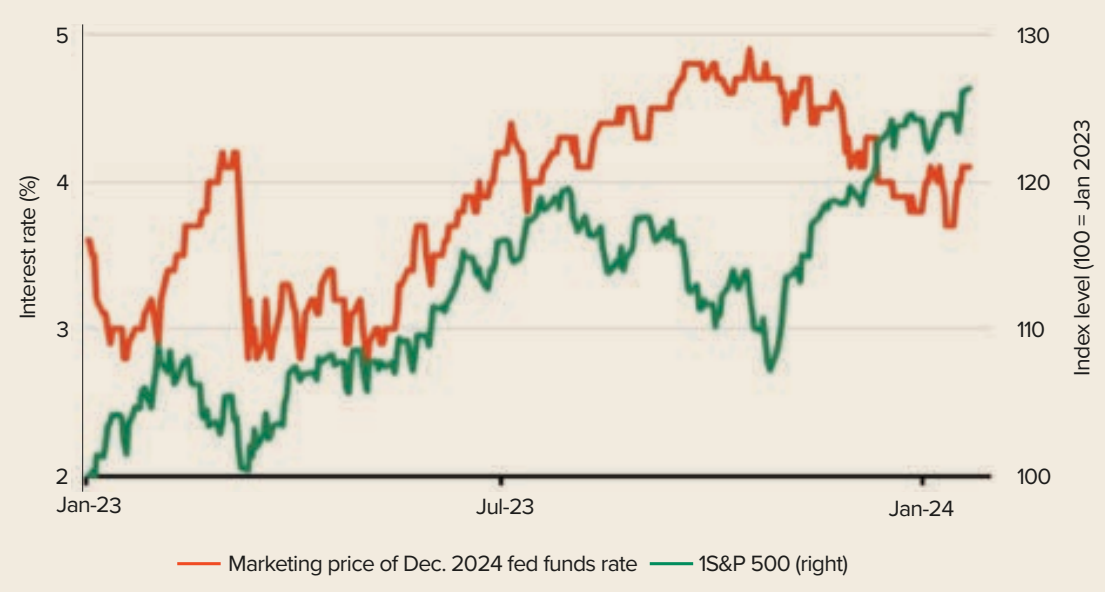

Chart 3: S&P 500 price versus December 2024 Fed funds rate expectations

Source: BlackRock, LSEG

Interestingly, by mid-January, the S&P 500 was 11% ahead of its price when the Fed began hiking rates in March 2022. The headline US benchmark had also failed to respond to year-end Fed funds rate expectations creeping upwards, as it had done with two steep downticks in 2023.

From a technical perspective, JP Morgan also highlighted the proportions of outstanding shares of the SPDR S&P 500 ETF (SPY) and Invesco QQQ ETF (QQQ) being sold short at the start of 2024 were at their lowest since the arrival of COVID-19.

Looking to diversify away from market cap equity, Ahmer Tirmizi, head of fixed income strategy at 7IM, said the global healthcare sector represents an attractive defensive allocation.

“Earnings stability is more certain – and less connected to the economic cycle – valuations are attractive and it is coming off one of its worst runs of performance in decades,” he said.

Separately, while noting equal-weighting equities “hurt” last year amid artificial intelligence (AI) mania, Tirmizi suggested an equally weighted basket of US equities “has been a historically profitable investment strategy over time and especially at times like this”.

Unknowable unknowns

For market pundits, it is usually safer to be overly bearish and safe, rather than bullish and end up with egg on their face.

Interestingly, most are in lockstep in agreeing US inflation will not drift below 3% in the short-term. In fact, BlackRock’s Li said a long-term regime “closer to 3%” is one of her team’s “strongest views on a strategic horizon”.

Charlie Lloyd, head of investments at Skerritts, argued structurally higher inflation would be a likely outcome if the Fed were to enact the market implied rate cuts – bringing with it a new set of risks.

“Quelling a second wave of inflation would necessitate even tighter policy than is currently in place, putting recession back on the table,” he said.

Walking that tight rope is the job of policymakers – and responding to it the job of fund selectors – in the months ahead. With 16 investment banks predicting up to 275bps of cuts starting in March, to 50bps of cuts from July, there are plenty of unknowns and moderation is key.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.