Melbourne’s coronavirus lockdown is starting to strain the ETF industry, with Vanguard seeing slower growth across its ETFs.

Vanguard, Australia’s largest ETF provider, is usually the reliable winner every month for bagging investor money. And thanks to its large number of staff and outstanding reputation Vanguard usually usually wins by a comfortable margin.

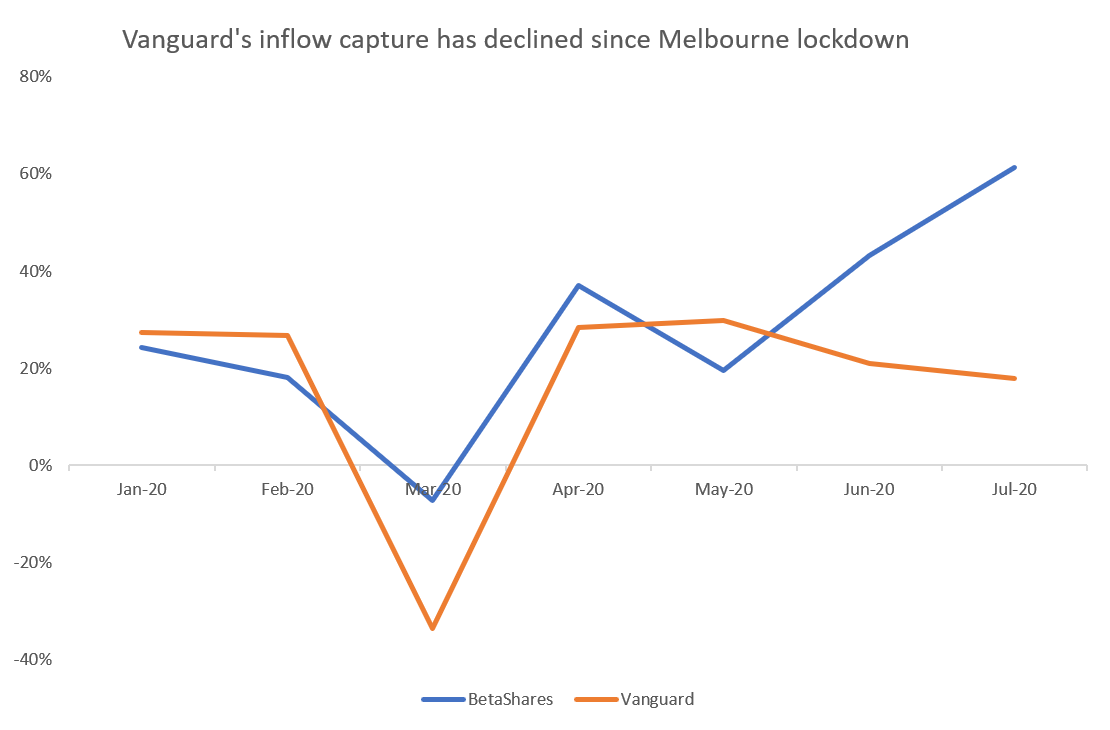

Since Victoria began its coronavirus lockdown, however, Vanguard's growth rate has started to sag. In June and July, local manager BetaShares took in more new investor money than Vanguard, despite possessing a fraction of Vanguard's resources. This is the first time Vanguard has lost in consecutive months by such a substantial margin. BetaShares is now up on Vanguard in 2020 inflows.

The wilting growth very probably owes to the coronavirus, which has forced Vanguard staff to work from home. Vanguard is the only ETF provider based in Melbourne – which has been the hardest hit Australian city, going into complete lockdown in late-July.

The other five local issuers – State Street, BlackRock, BetaShares, Van Eck, ETFS – are based in Sydney.

This has meant that Vanguard's operations have been more heavily effected than competitors.

While inflows have stalled they remain substantial. And Vanguard's market share remains unaffected.