Demand for thematic investment solutions has skyrocketed in recent years, spurring the launch of a record 589 new thematic funds globally in 2021, up from the previous record of 271 in 2020. Assets under management in these funds grew to just over $800bn by year-end 2021, a nearly threefold increase in just three years. These funds promise concentrated exposure to new and exciting themes, drawing investor interest from retail investors and financial professionals alike.

Like a new car off the lot with a fresh coat of paint, these funds are designed to turn heads. However, if investors take a closer look at their holdings and construction methodologies, they would frequently come away disappointed by what lies under the hood.

Building on the comprehensive research of the Morningstar Manager Research team in their most recent Global Thematic Funds Landscape report, the Morningstar Equity Research team has conducted a thorough analysis of many leading thematic funds. Most fail to deliver the concentrated thematic exposure that they promise.

All too often, these funds include companies with only tangential exposure to a given theme. Investors might be surprised to learn that many thematic funds are constructed using automated keyword searches through regulatory filings.

The more often a company uses a given keyword or phrase related to a targeted theme, the more likely it is to be included in an associated thematic fund. However, this light-touch approach can lead to the inclusion of companies with as little as 1% or less of its overall revenue tied to the targeted theme.

After all, companies are eager to highlight any exposure they might have to an emerging, high-growth trend, even if that exposure is immaterial.

Furthermore, with the thematic fund landscape having become increasingly saturated in recent years, it has become increasingly difficult to be first-to-market with the new thematic concept. This has inspired thematic fund issuers to focus on ever-more-nascent and ever-more niche themes. However, the more nascent or niche a given theme, the more tenuous its durability and economic foundation.

As a result, we have observed the launch of countless thematic products that do not live up to their billing. Indeed, research from the Morningstar Manager Research team indicates that more than 75% of thematic funds globally have shut over the past 15 years.

Investors deserve better and Morningstar is in a unique position to empower investor success via its suite of thematic indices supported by the insights of the Morningstar Equity Research team. By drawing upon in-depth analysis and forward-looking research of Morningstar’s 100+ equity research analysts, Morningstar Indexes delivers unparalleled thematic purity across a range of durable themes. In short, Morningstar’s methodology for thematic index construction holds companies to a higher standard than conventional approaches.

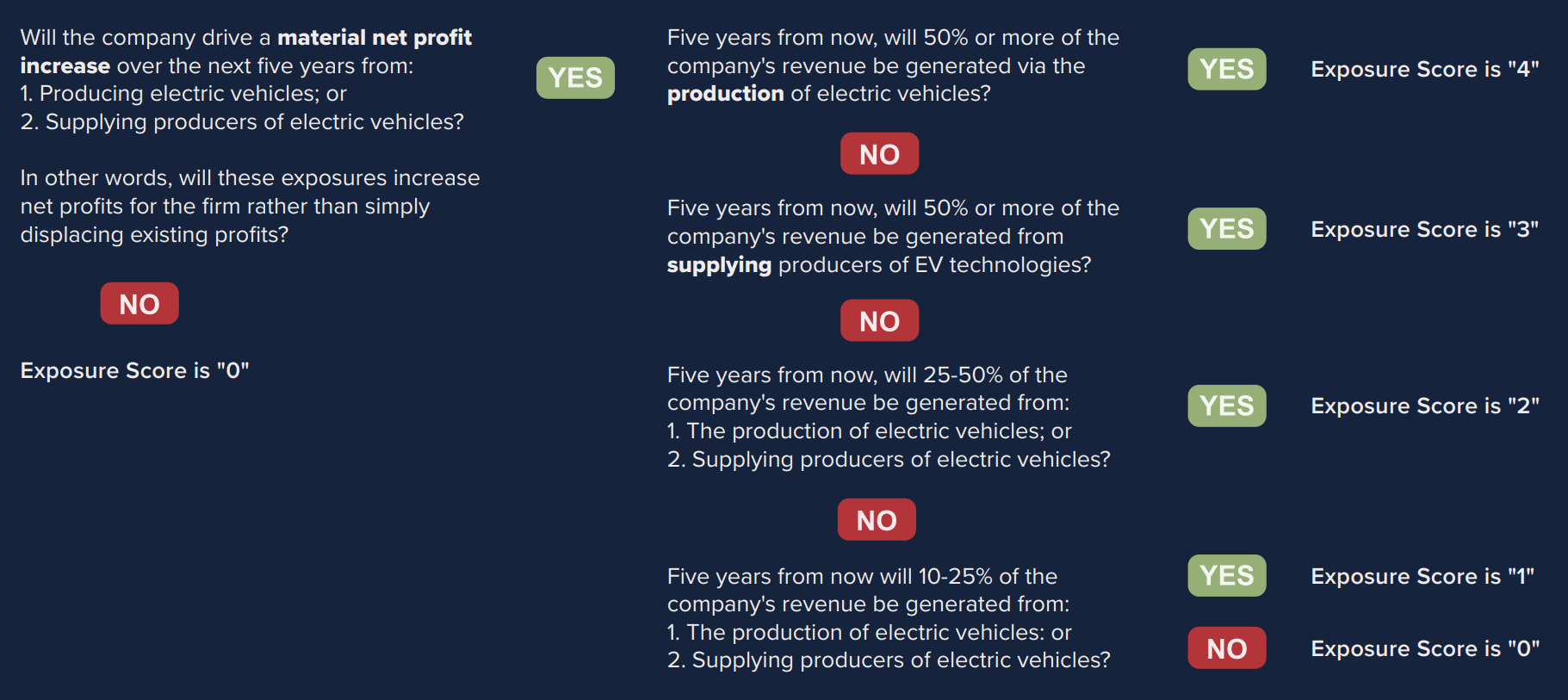

Morningstar equity analysts determine thematic exposure scores for potential holdings by assessing a company’s current revenue exposure to a given theme in addition to its revenue exposure five years forward, based on proprietary forecasts.

Additionally, for a given company, analysts determine if a thematic exposure is likely to drive a net profit increase over the next five years.

They also determine the company’s role in the supply chain for products/offerings tied to a given theme.

These insights help ensure that only companies with material exposure to a theme can be included in a Morningstar thematic index.

Leveraging the research of Morningstar equity analysts is a significant competitive advantage for Morningstar Indexes. After all, the primary responsibility of Morningstar equity analysts is to accurately forecast future cash flows in order to determine fair value estimates for each company they cover. Doing so requires a thorough understanding of emerging themes that might impact these cash flow forecasts.

Additionally, while competing thematic indices determine thematic exposure by use of keywords and historical metrics, Morningstar equity analysts forecast how themes are likely to evolve in the future, along with the business models of companies exposed to them.

While this unique approach to thematic index construction might seem to introduce subjectivity or appear “active” in nature, it is important to note that Morningstar Indexes incorporates the insights of Morningstar equity research analysts in a manner that is disciplined, transparent and replicable.

This involves the use of a thorough, standardised scoring process and an objective, rules-based approach. The result is a thematic index construction methodology that strives to optimise both thematic purity and investability.

Best-in-class client support is an additional benefit from leveraging the comprehensive research and insights of Morningstar equity analysts.

While issuers of thematic funds may struggle to answer client inquiries regarding the inclusion or omission of specific stocks, Morningstar shines in this regard.

In addition to producing proprietary research reports about emerging themes as well as white papers for related indices, Morningstar equity analysts regularly conduct marketing activities in support of indices that have gained traction in the marketplace.

In partnership with licensing partners, Morningstar equity analysts regularly participate in webinars and client interactions that pull back the curtain and surface the in-depth, high-quality research supporting Morningstar’s unique thematic indices.

With impressive demand growth for thematic funds likely to persist, the value proposition associated with Morningstar thematic indices is clear. Morningstar’s ecosystem of propriety research allows for not only the construction of unique thematic indices that offer superior thematic purity, but also for best-in-class client after a product is launched.

Chart 1: Morningstar Indexes' purity score methodology

Source: Morningstar Indexes

Discipline is critical in determining which themes merit new product development

While Morningstar Indexes holds companies to a higher standard of thematic exposure when it comes to index inclusion, we also hold themes to a higher standard than many competing index providers.

Drawing upon the insights of the Morningstar equity research team, Morningstar Indexes requires that a theme:

Have a clear definition and economic foundation such that company exposures can be accurately assessed.

Represent a secular trend that will persist for at least the next 10 years.

Provide meaningful economic benefits to a critical mass of eligible companies based on thematic exposure scores.

Be the subject of in-depth analysis from the Morningstar Equity Research team, such that Morningstar equity analysts may opine on future adoption in an informed manner.

While the first three criteria listed above may appear eminently reasonable, numerous existing thematic funds fail to satisfy them.

Employing this framework helps Morningstar Indexes avoid projects focused on ephemeral themes with no staying power. The trade-off of heightened selectivity is that situations may occasionally emerge in which Morningstar is unwilling to construct an index that a competing index provider might readily build.

In these cases, however, we would characterise the investor utility of these indices as questionable at best. For Morningstar Indexes, this framework and the subsequent focus on optimising thematic purity help ensure that the thematic indices we offer deliver superior thematic exposure to secular trends that should persist well into the future. We feel this disciplined approach better serves the end investor.

Company-level thematic exposure scoring methodology example

The methodology by which thematic exposure scores are determined for the Morningstar Global Electric & Autonomous Vehicles index is included below. This example highlights the three equity analyst assessments required for each company-level thematic exposure score:

What percentage of revenue will be derived from exposure to the theme five years forward?

Will the company enjoy a net profit increase from exposure to the theme over the next five years?

What role does the company plays in the supply chain for products/offerings related to the theme?

In addition, the Morningstar Indexes team requires that any holding have at least some current revenue exposure to the theme in question. This article was first published in Thematics Unlocked: Looking Under The Bonnet, an ETF Stream report. To read the full report, click here.

Morningstar Exhibit: Thematic Exposure Scoring Decision Tree: Morningstar Global Electric & Autonomous Vehicles Index Learn more about Morningstar Indexes: https://indexes.morningstar.com/