Thousands of ETFs will see their MSCI ESG rating downgraded with hundreds more set to be stripped completely as the index provider tightens its methodology on what can be considered ESG.

A research note published by BlackRock said MSCI is set to tweak several aspects of its ESG rating methodology, including removing the adjusted factor from ESG fund rating calculations and lowering the coverage requirement for fixed income funds from 65% to 50%.

In addition, swap-based funds will be excluded entirely from the MSCI ESG fund rating coverage universe, meaning over 400 swap-based ETFs will be stripped of their rating.

The changes, which will be implemented from Q2, are set to have a major impact on the European ETF landscape and comes at a time when regulators are intensifying their scrutiny of asset managers in a bid to stamp out greenwashing.

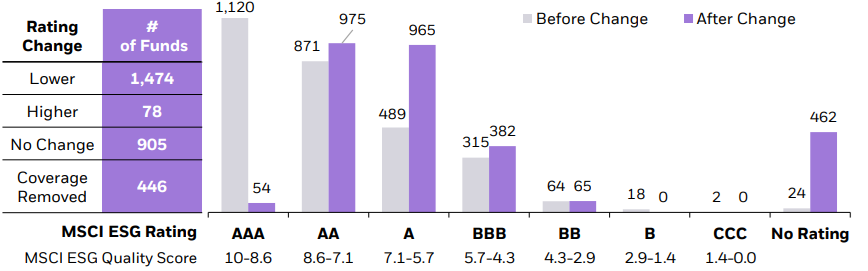

The top-tier triple-A-rated ETF universe will be almost totally wiped out following the changes, falling from 1,120 to just 54, according to the report.

Overall, BlackRock said almost two-thirds of the European ETF market will be rated lower or removed from coverage by MSCI.

Source: BlackRock

Swap-based, or synthetically-replicated ETFs, have been called into question in recent months as investors can often find themselves with unfriendly stocks via the collateral held by the ETF.

In January, Ossiam announced it was switching from synthetic to physical replication on the Ossiam STOXX Europe 600 ESG Equal Weight UCITS ETF (S6EW) following demand from investors.

Last year, the French regulator Autorité des Marchés Financiers (AMF) told investors to be “extremely vigilant” on the use of synthetic ETFs, noting the lack of transparency around the ESG characteristics.

MSCI said ratings providers may rate the fund's underlying index exposures, rate a proxy index and or rate the collateral.

"MSCI ESG research is actively exploring methods to provide a rating for swap-based ETFs based on the underlying index," it added.

Alex Matturri, former CEO of rival S&P Dow Jones Indices, agreed with MSCI’s decision to eliminate swap-based products from its ESG ratings but criticised the move to eliminate the adjustment scores.

“From an ESG risk perspective, looking through a swap-based product to the underlying index is appropriate as that is what the investor should be focused on, not the swap collateral,” he said.

“Eliminating an adjustment for improving ESG scores, on the other hand, can penalise companies that are modifying their business practices in a positive way, which is one of the goals for using capital markets to change corporate behaviour and forcing companies to prepare for the energy transition.”

MSCI said it would be simplifying the adjustment factor process which currently considers whether ESG laggards of the fund have improved or worsened their ESG rating from their previous score.

“Improvement in a company's behaviour should be rewarded. Measuring just a current snapshot doesn't tell the full story,” Matturri added.

In a statement, MSCI said: "The upcoming methodology change will remove the ‘adjustment factor’ from the calculation so that a fund’s ESG Rating will be based solely on the ESG scores of its underlying holdings.

"The corporate and government ESG ratings methodologies do not include an ‘adjustment factor,’ so this change will also lead to greater alignment between issuer and fund ESG ratings."