Global equities, as measured by the MSCI All Country World, posted a robust 9.6% gain in local currency terms in Q1.

The single strongest regional gain came from Japan, which benefitted from improving global growth, improved corporate governance and a (finally) normalising inflation and rates environment.

Europe also picked up but it was the US that made the strongest contribution to market progress given its two-thirds allocation within the MSCI All Country World index. The S&P 500 was up 10.6% over the review period, with the Nasdaq 100 technology Index up 8.7%.

Justifying continued gains in a rally now dating back to October 2022 is on the surface challenging, with US interest rates standing at an elevated 5.25% and valuations becoming increasingly stretched.

By the end of the review period, the forward earnings yield on the S&P 500 was 4.6%, offering investors just 0.4% more yield than the 10-year US Treasury’s risk-free 4.2%.

Similarly, the Shiller CAPE, or cyclically-adjusted price-to-earnings ratio, stood at 34, above the 30-year average of 28. How did stocks get to this point without a serious adjustment? We would note that a potentially significant change may have altered the usual dynamics in both the economy and markets in recent months, in the form of increased productivity.

In the US, output per hour worked has been steadily rising and, combined with strong consumption, appears to have created a ‘goldilocks’ environment of improving economic growth without changing the generally stabilising course of inflation.

Much of the improved productivity can be put down to post-pandemic supply chain normalisation but the case for a growing contribution from the gradual adoption of artificial intelligence (AI) across the economy is also strong.

A poll by the US Census Bureau in late February reported that nearly 5% of firms had made use of AI in the previous two weeks to produce goods and services.

Markets both drove and reflected these developments. Most obviously, ‘picks and shovels’ providers of AI technology and infrastructure have led US stocks to both strong earnings and the prospect of more in the near future.

Nvidia is a case in point, but it should also be noted that participation in the S&P 500’s gains is starting to extend beyond just technology.

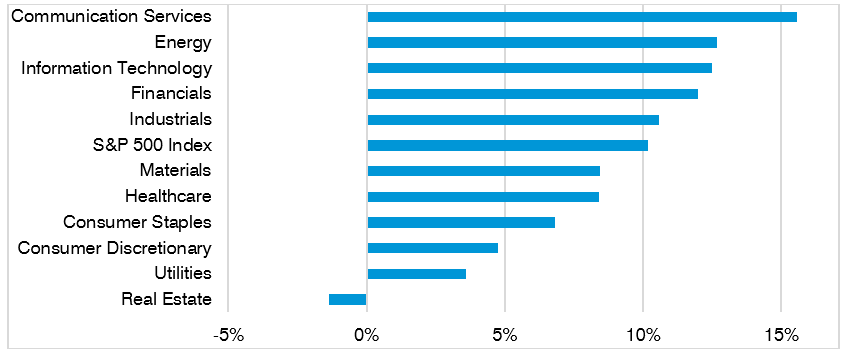

Sectors such as industrials, energy and materials have all posted gains in excess of 8% this year to the end of March, suggesting that cyclical parts of the stock market which more closely reflect the state of the real economy somehow did not feel the usual need to worry about inflation or interest rates anymore.

The rally, in other words, began to show signs of a more profound sustainability.

Chart 1: Not just technology enjoying the productivity party this year

Source: Bloomberg. S&P 500 sector price return from 29 December 2023 to 31 March 2024

Not another dot-com bubble (at least not yet)

The US, and US technology in particular, has of course been a significant contributor during the review period.

Philosophically it is worth noting that we have not ‘played AI’ per se, but instead captured the trend by virtue of our deliberate exposure to the unique powerhouse of US innovation generally, whatever the specifics are from one year to the next.

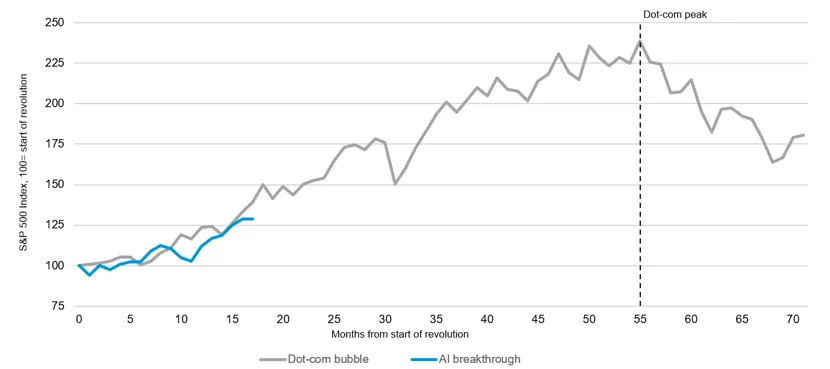

As it happens, we do not equate today’s run-up in technology stocks with the dot-com bubble of the late 1990s but somewhat extended valuations and the duration of the rally (since October 2022) make it particularly important from a risk management perspective that the capital preservation sleeve of our portfolios performs consistently and reliably.

Chart 2: S&P 500 from 31 January 1996 to 31 March 2024

Source: Bloomberg. ‘Start of revolution’ = Telecommunications Act end Jan 1996 for dot-com bubble and introduction of ChatGPT end November 2022 for AI breakthrough.

Outlook

As cliched as it may sound, markets probably are now at a pivotal moment. Price appreciation can only go on so long without some confirming evidence coming due.

While the inflation and rates debate has been raging since the end of the pandemic, the more proximate determinant of what happens next could well be the future course of productivity.

If the rebound in productivity observed in the last couple of years peters out as the tailwind of supply chain normalisation fades, and AI adoption stalls amid a realisation that it was not so transformative after all, markets will turn their full attention back to that 5.25% Fed funds rate and the Federal Reserve’s apparent reluctance to quickly unwind all of it in short order.

If however, the gains in productivity can be continued into the rest of the year thanks to the widespread take-up of AI into even more aspects of economic activity, then the rally could propel itself anew.

Economists have concerned themselves with the so-called ‘productivity puzzle’ on both sides of the Atlantic since the aftermath of the global financial crisis (GFC), primarily because its absence seemed to be holding back a true restoration of pre-GFC trend economic growth.

Should the productivity puzzle be solved this year, it will potentially create a set of near-perfect economic and market conditions, for the US at least.

High productivity would afford the US economy the means of growing without generating undue inflation and the adverse consequence of higher interest rates.

Stocks will benefit not just because listed technology corporations will continue to supply and improve the AI ‘product’ but also because other cyclically-sensitive sectors will also be able to grow without butting up against higher inflation and rates.

As this plays out, investors will still need to contend with an unedifying conveyor belt of geopolitical risks.

The Middle East remains volatile, US-China relations are poor and unlikely to improve post-November and then of course there is November itself. A Trump win would bring tax cuts on the one hand, but higher fiscal deficits, tariffs and general policy ambiguity on the other.

One consolation of all this is that America’s exceptionalism seems to allow recklessness and uncertainty to go unpunished. This is nowhere better exemplified than in its markets which we are confident will remain focused on cold, hard fundamentals.

The US therefore offers an ironic haven from what could be a bumpy few months ahead in the geopolitical sphere. And beyond the noise, the prospect of a genuinely new economic era could be quietly unfolding.

Julian Howard is lead investment director, multi-asset solutions, at GAM