Global equities, as measured by the MSCI AC World Index, posted a stellar +22.2% gain in local currency terms in 2023. For many investors, this result was something of a surprise given the laundry list of reasons to be fearful during the course of the year.

Things started badly with a US mini-banking crisis that brought back painful memories of 2008 and threatened to spread more wildly. In the meantime, the war in Ukraine dragged on, with the defenders’ summer offensive making little headway and Russia seemingly resuming the initiative from the autumn.

Doubts about the depth of the US commitment were never far from the surface as funding became a partisan issue bitterly contested in Congress.

The Hamas attack on Israel in October and the ensuing war in Gaza threatened a wider Middle East conflagration. Despite Iran’s prior knowledge at best, and direct involvement at worst, oil prices remained remarkably stable and continued to be so amid Houthi militants’ strikes on Red Sea shipping.

In China, the economy underperformed amid worsening stress in the real estate market and the country suffered the indignity of a Moody’s outlook downgrade, with its stock markets correspondingly lagging global indices.

The economy’s re-opening had been touted as one of the biggest economic stories of 2023 but ended up being one of the most underwhelming instead.

Global politics were hardly conducive to stability either, with the populist right apparently in the ascendancy around the developed world.

Victory for Geert Wilders in the Netherlands served merely as a backdrop to the main attraction, namely the spectacle of a criminally indicted former President not only leading the Republican nomination race but outperforming the incumbent Joe Biden in the presidential polls.

How then, to account for the stock market’s enthusiasm amid all this? The explanation lies in the combination of an increasingly benign economic backdrop, coupled with a surge in excitement about a new era of innovation.

The US economy defied expectations of recession as consumers continue to enjoy cash piles accumulated during the government’s pandemic largesse, along with plentiful job availability in an economy where unemployment stood at less than 4% by the end of the year.

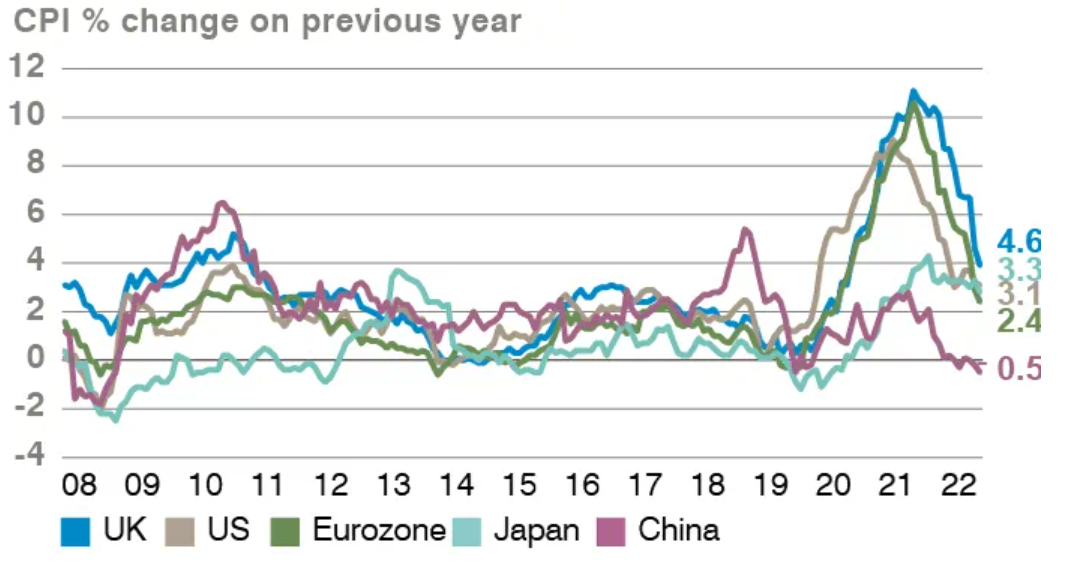

At the same time, the pressure of inflation – and therefore interest rates – started to ease meaningfully both in the US and around the world. US headline Consumer Price Index (CPI) inflation fell from nearly 6.5% to 3.1% over the course of the year, and the Federal Reserve (Fed) effectively declared the end of the monetary policy tightening cycle in December, leaving the target rate at 5.5%.

Longer-dated interest rates in the US Treasury market had risen over much of the year, peaking at just under 5% in mid-October before easing to 3.9% by the year-end as cooling price pressures and early signs of softness in the economy – housing, credit card delinquencies, consumer confidence – became more apparent.

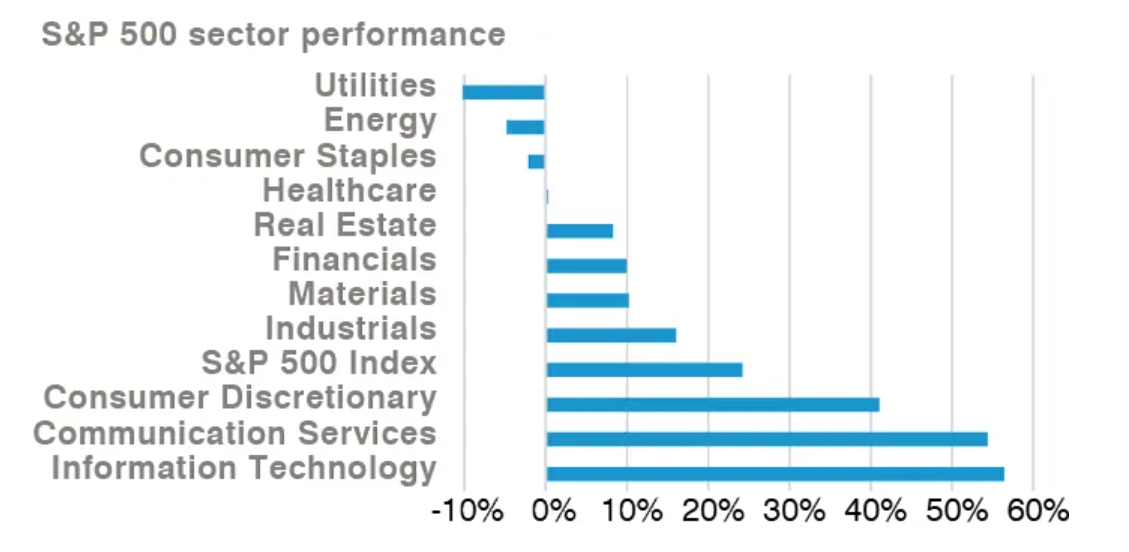

Within the stock market itself, fervour for all things technology-related but especially artificial intelligence (AI) remained undimmed, with the so-called Magnificent Seven stocks – Amazon, Apple, Alphabet, Meta Platforms, Microsoft, Nvidia and Tesla – accounting for nearly the entire 26.3% gain in the S&P 500 in US dollar terms over the year.

This was not supposed to be how things played out - tech stocks with their long-range revenue flows are traditionally meant to underperform as the cost of capital (rates, yields) rises and conversely outperform as the cost of capital falls.

Investors will likely look back on 2023 as a year in which US markets at least – which account for around two-thirds of the MSCI AC World index – chose to focus on the prospect of lower rates and a new technology era to the exclusion of everything else.

Chart 1: Inflation really, really started to ease off in 2023

Source: Bloomberg.

Positioning

Asset class preferences are overwhelmingly based on fundamental precepts that we observe across the long history of economics and markets, with near-term adjustments tending to the conservative.

Stocks over time, according to the so-called Siegel Constant and the National Bureau of Economic Research’s (NBER’s) seminal 2017 study ‘The Rate of Return on Everything’, have delivered a 7% real return and this has been consistent enough to make global equities a core area for us, sized according to suitability and risk tolerance.

As such, the thin equity risk premium (ERP) – excess earnings yield over risk-free bond yield – and stretched valuations observed in US equities in 2023 has not deterred us from continued strategic interest in stocks, although it should be noted that neither are we holding higher conviction views versus stated ‘neutral’ guidelines.

Within said equity preference we favoured a barbell approach which emphasises US technological innovation on the one hand alongside the huge structural growth opportunity of emerging markets and China on the other.

As stated, we are fairly agnostic to near-term market movements regardless of how well or poorly these underlying components fare, since the aim is to capture the returns that inevitably accrue from such trends only over longer periods.

As it happens, 2023 favoured both our overall equity views as well as our interest in US innovation, though less our emerging markets and China preferences.

Of course, for all but a few investors, a portfolio singly devoted to equities is likely to prove unsuitable given the inherent volatility and inability to perfectly time redemptions.

As such, in multi-asset strategies, we blended the equity weighting with a capital preservation element whose aim is to smooth out volatility and generate returns along the way.

Our focus here remained overwhelmingly on reliable fixed income and credit vehicles including mortgage-backed securities, subordinated financial debt, insurance-linked bonds, government bonds, short-dated investment grade and near-term treasury bills.

We pragmatically increased our preference for said short-dated instruments over the course of the year as interest rates rose.

By the final quarter, six-month US Treasury bills were offering a cool 5.6% yield, representing a compelling risk-reward ratio which we saw as an opportunity across portfolios – deploying sterling and euro equivalents as applicable.

Where our dedicated tactical asset investment view was relevant, we focused on the same short-dated treasury instruments.

The fundamentals – the ERP and valuations – did not warrant any additional tactical leaning towards equities, though towards the end of the review period a small exposure to US mid-cap stocks was adopted to take advantage of the euphoria around the Fed’s change in position described above.

Taken together, our favoured investment areas allowed for meaningful portfolio participation in the market’s rise over the year in a steady, risk-controlled manner.

Chart 2: Technology completely dominated US equities in 2023

Source: Bloomberg.

Outlook

Predicting the course of inflation and rates is notoriously challenging at the best of times, but 2023 offers sufficient data points from which to reasonably extrapolate a continued easing of headline CPI around the developed economies.

In the US, supply chains have normalised from the pandemic disruption, the one-off jump in labour costs in 2022 looks to be in the rear-view mirror and consumption is showing signs of cooling in response to higher interest rates.

Clearly, remaining progress is unlikely to be linear but it would not be unreasonable to suggest that by the end of 2024, inflation will figure less highly in economists and analysts’ top list of concerns.

The Fed certainly seems to be of this view, although plenty of uncertainty remains around the timing and extent of eventual rate cuts.

One UK central banker aptly used the analogy of Table Mountain rather than The Matterhorn to describe how he saw the monetary policy outlook.

Still, even an extended pause in the US, UK and eurozone, safe in the knowledge of no further rises, is encouraging.

Bond yields also seem set to continue to settle down over the next year as inflation and growth expectations fall, pointing to a set of conditions much more akin to 2019’s ‘old normal’ than the 2022-23 post-pandemic fallout.

As with all outlooks, this scenario is of course not guaranteed. In the US, former President Donald Trump has openly talked about introducing a blanket 10% import tariff should he win re-election, while consumer expectations of high future inflation sometimes have a habit of becoming self-fulfilling.

Turning to stocks, the concern is that with high valuations and precious little excess earnings yield over Treasuries, the market has rushed to price in today the prospect of a gradually more benign inflation and rates backdrop, leaving little room for error.

Similarly, should the AI narrative stumble, say further corporate governance issues such as were seen around OpenAI recently, or an earnings miss or two, we sense that a market priced for absolute perfection will at least pause if not outright start to adjust.

We are acutely conscious that neat narratives around growth, inflation and rates have fluctuated several times within the last year, and we freely admit that our near-term assessment has also continually evolved.

Without sounding trite, none of this really matters too much. This is because longer term, we are of the far-higher conviction that secular stagnation remains the defining trend of the era, driven primarily by demographics and inequality which show little sign of improving.

Such a low-growth world will see correspondingly low bond yields re-assert themselves which should be supportive for those stocks offering the prospect of generating their own growth narratives over time.

For this reason, while we are happy to observe and comment on current market trends, and make pragmatic enhancements along the way, our overwhelming focus must remain on delivering returns from the long-term themes described above while minimising portfolio risks and costs.

Julian Howard is lead investment director, multi-asset solutions, at GAM