Market volatility has long been considered a happy hunting ground for active managers but investors are increasingly turning to ETFs in times of uncertainty.

Volatility came to the fore again in September when the VIX indicator – which tracks investor sentiment – jumped 40% over the month as the S&P posted its worst month since COVID-19, falling by 4.7%, with many anticipating a spicy October to follow.

Traditionally considered an environment for an active manager to flourish, the Bank of America (BofA) found just 42% finished ahead of their benchmark for September, the same number that have so far outperformed this year.

Worryingly for active managers, it is on track to be their best year since 2018 and well above 2019 and 2020 – one of the most volatile years on record – in which 28% and 39% finished ahead of their benchmark, respectively.

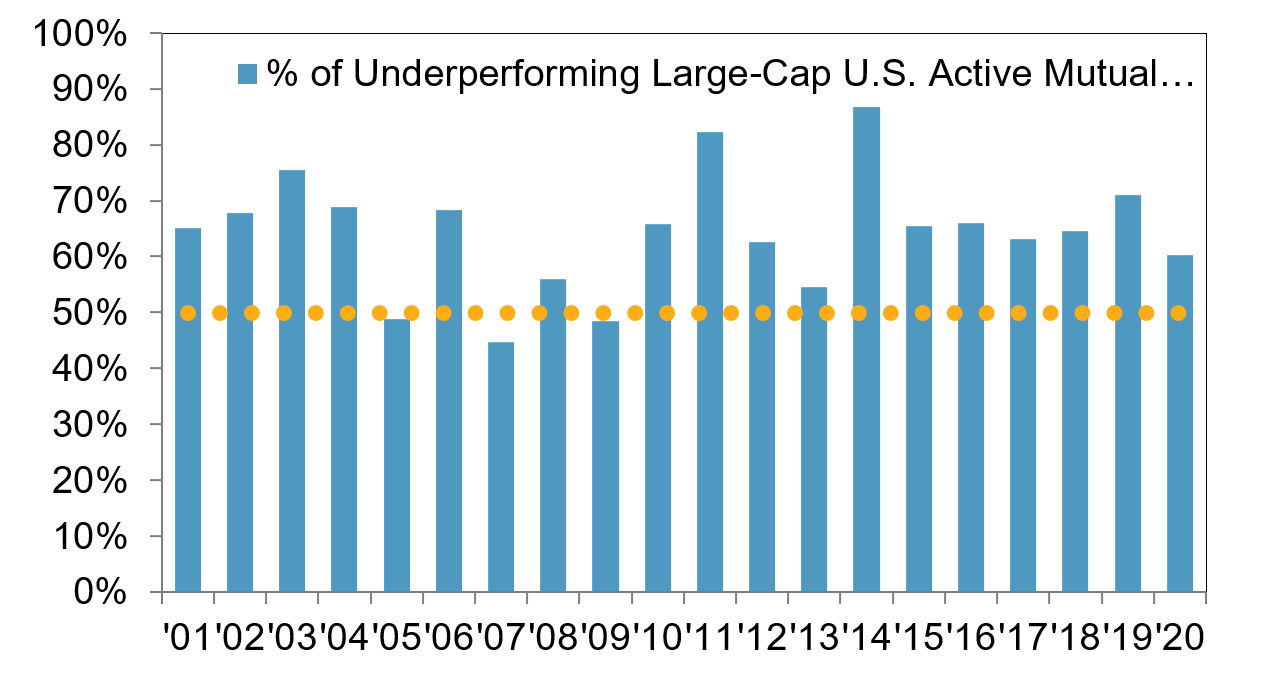

The trends are borne out over the longer term too. The S&P Dow Jones Indices (SPDJI) annual SPIVA scorecard, which measures the performance of actively managed equity funds versus their benchmark indices, found a staggering 94% of funds underperformed the S&P 500 since 2001.

Furthermore, in the volatile years such as the 2001 dot com bubble, the 2008 financial crisis and more recently the 2016 political uncertainty, the number of underperforming funds stayed relatively close to the average at 65%, 56% and 66%, respectively.

Source: SPDJI SPIVA US Scorecard

Tim Edwards, managing director for index investment strategy at SPDJI said: “The data does not really stack up versus the intuition and what you would probably conclude is that just because there is an opportunity for outperformance doesn’t mean it will necessarily manifest.

“If you are not more skilled than the average investor then you should not expect there to be outperformance just in time for it to really matter.”

Flows into ETF

As a result of active stock picker underperformance, investors have been voting with their wallets.

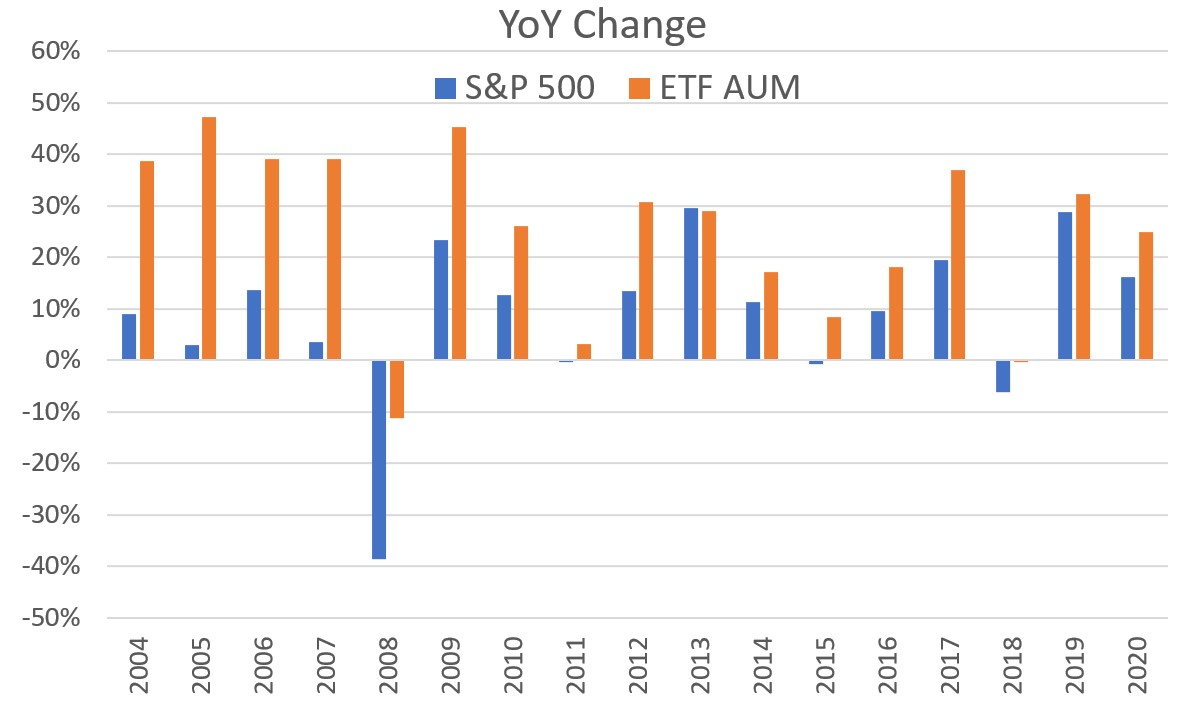

According to Statista, ETFs have generally experienced above-average growth in assets under management (AUM) in the years following extreme market volatility. In 2009 and 2017 ETF AUM grew by 45% and 37%, respectively, above the annual average of 24% since 2003.

Edwards said while the timeframe is not long enough to do a “rigorous statistical analysis” it does look as though volatile markets are triggering inflows into ETFs.

“If you are hoping your active manager does much better than the index in a volatile period, and you get a period like 2008 and 2020 and it doesn't do very well, that's going to trigger a decision point ‘this is when I needed you for and you didn't help’,” he said.

Dimitar Boyadzhiev, senior analyst of manager research passive strategies at Morningstar, said while there are several reasons for flows into passive products, active manager underperformance is one of them, alongside high fees.

“Over the long term, the failure of active funds to deliver performance over the benchmark has been one of the initial driving factors,” he said. “Sometimes active funds may outperform sometimes they may not. We have to judge the ability to compound these gains over the long term and this is where they fail because their fees are too high.”

Source: Statista

Edwards added it is not just performance driving investors out of actively managed funds and into ETFs, but also the liquidity benefits of an ETF in times of volatility.

“One of their central value propositions is their ability to get in and get out on an exchange-traded basis,” he said. “If you have challenges of liquidity in your active fund or your hedge fund then that can trigger decisions and could be a driver towards ETFs.”

Mark Northway, investment manager at Sparrows Capital, said while active managers often talk of outperforming in volatile periods, their ability to time their risk-off and risk-on calls perfectly will have a huge impact on their ability to outperform a benchmark.

“There are quite a few studies that talk about the damage done through intervention. In a volatile period, everybody is motivated in the same way – to protect their underlying clients – so they take risk off the table. That side of the decision tends to be very easy, what is a lot harder is the decision as to when to re-risk the portfolio,” he said.

“If you are active, you have to beat two hurdles. You have to beat your benchmark, otherwise, you are not adding value, and you have to be top decile, otherwise, you are not the optimum choice."