Northern Trust Asset Management (NTAM) is to close two more ETFs leaving it with just one strategy in Europe.

The firm announced it would be closing the FlexShares Developed Markets Low Volatility Climate ESG UCITS ETF (QVFD) and the FlexShares Developed Markets High Dividend Climate ESH UCITS ETF (QDFD) which have a combined assets under management (AUM) of $20m.

It comes just under three months after NTAM announced the closure of two emerging market factor ETFs due to low AUM.

NTAM now has one remaining ETF in Europe, the $263m FlexShares Listed Private Equity UCITS ETF (FLPE).

The future of NTAM’s European business was also called into question following the departure of the firm’s EMEA head Marie Dzanis and several other senior employees earlier this year.

In a shareholder letter, NTAM said: “Following a recommendation of the funds' manager, NTAM, and acting in accordance with the applicable provisions of the prospectus, the directors of the company intend to close the funds on the basis that each of the funds are below their stated minimum fund size of $20m.”

Despite being the only remaining ETF, FLPE has held the majority of the group’s assets following its launch in December 2021.

ETF Stream has contacted NTAM for comment on the closures.

Following Dzanis departure, the group told ETF Stream it remained committed to meeting its investors' needs through FlexShares ETFs.

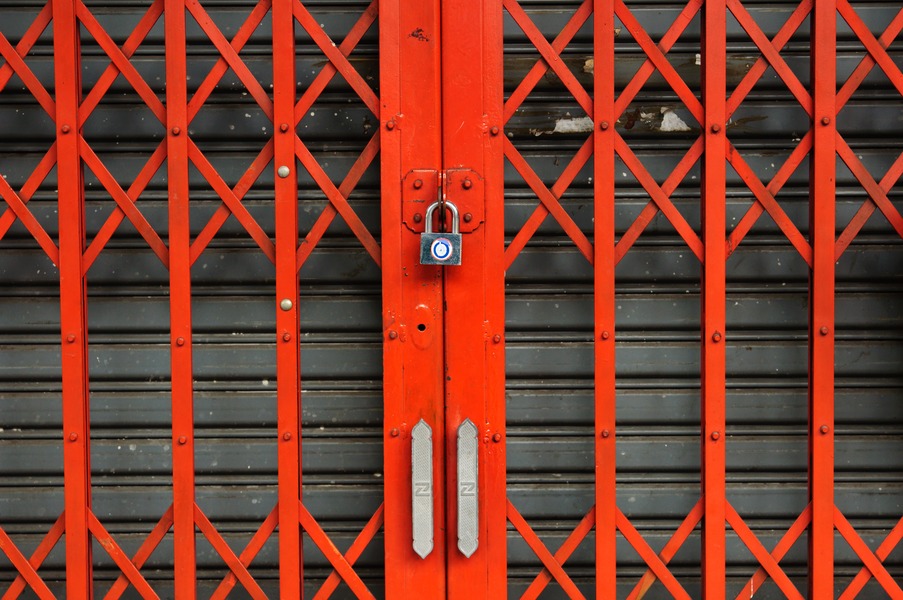

The closures highlight the difficulty of entering the European market.

Recent research conducted by ETF Stream found just over half of UCITS ETFs are currently in profit-making territory despite almost €119.7bn inflows in the first 11 months of 2023, according to data from Refinitiv.