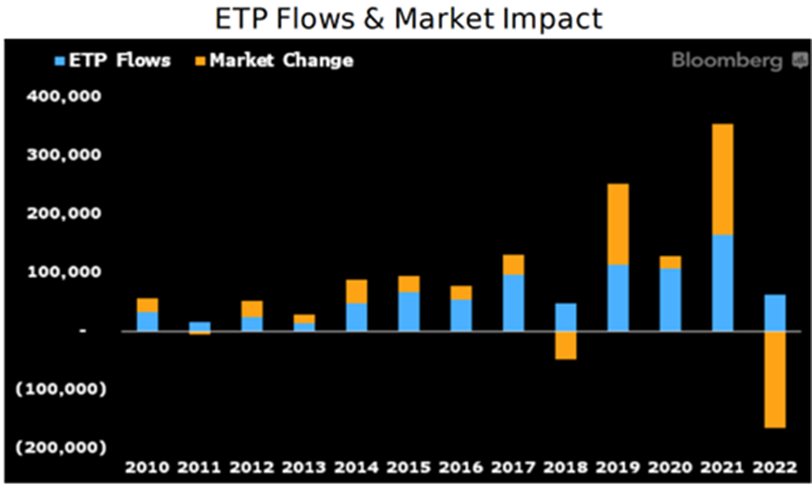

Exchange-traded products (ETPs) have once again proven to be the tool of choice for European investors during volatile markets as new money flowed into the wrapper even as €165bn was wiped off their value in the first 11 months of the year.

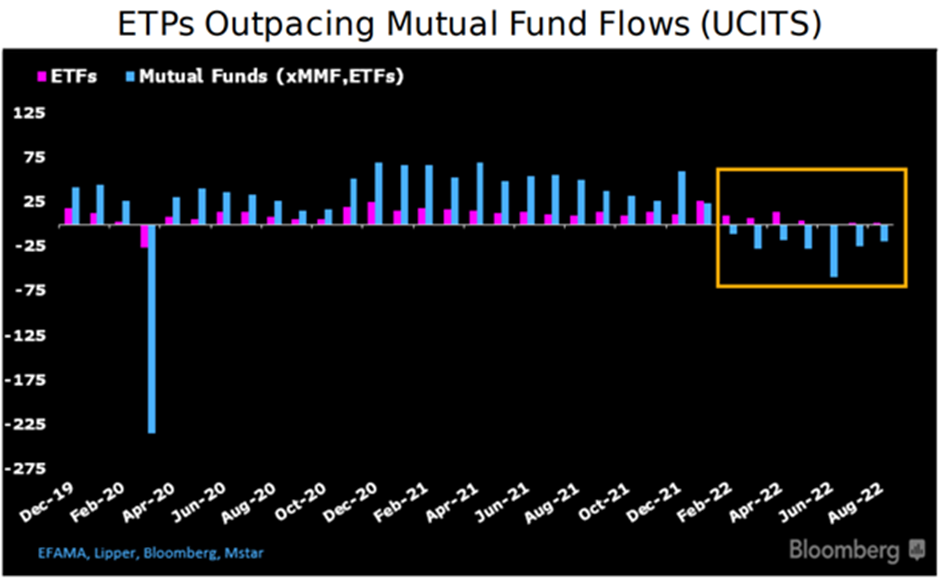

In what Bloomberg Intelligence ETF analysts Athanasios Psarofagis and Henry Jim described as “one of the toughest market environments ever”, the resilience, cost-effectiveness and added layer of liquidity in ETPs meant flows into wrapped products surpassed mutual funds for every month in 2022 by November, as they did during peak COVID-19 volatility in 2020.

As mutual fund flows went into deep negative territory, with UCITS funds as a whole amassing €198bn outflows in the first nine months of the year, European ETPs saw €77.9bn inflows this year, as at 16 December, according to data from Bloomberg Intelligence.

Annual flows into Europe-listed ETPs (€bn)

2018

2019

2020

2021

2022

48.2

112.6

106.2

163.6

77.9

Source: Bloomberg Intelligence

“This year will barely make the industry's top five for flows, yet it may be among the most important, given that ETPs continue to take in cash even though most are down for the year,” Psarofagis and Jim added.

Source: Bloomberg Intelligence

Echoing their thoughts, Stefan Kuhn, head of ETF distribution for Europe at Fidelity International, told ETF Stream the wrapper has “passed the litmus test in terms of resiliency and tradability” in volatile markets, sometimes with better liquidity than their underlying assets.

“This narrative started in early 2020, when ETFs – especially fixed-income – disproved sceptics that believed they are instruments only built for bull markets,” Kuhn said.

Another explanation for the broad shift from mutual funds to ETPs has been investors’ preference in 2022 for the low-cost passive model which dominates the ETF market.

Amid tough market conditions, this trend has accelerated as cost becomes a front-of-mind issue for investors.

Source: Bloomberg Intelligence

In the six months to November 16, ETPs with fees of 0.20% or less amassed €22bn of new money, whereas more expensive products saw a collective exodus of €28bn.

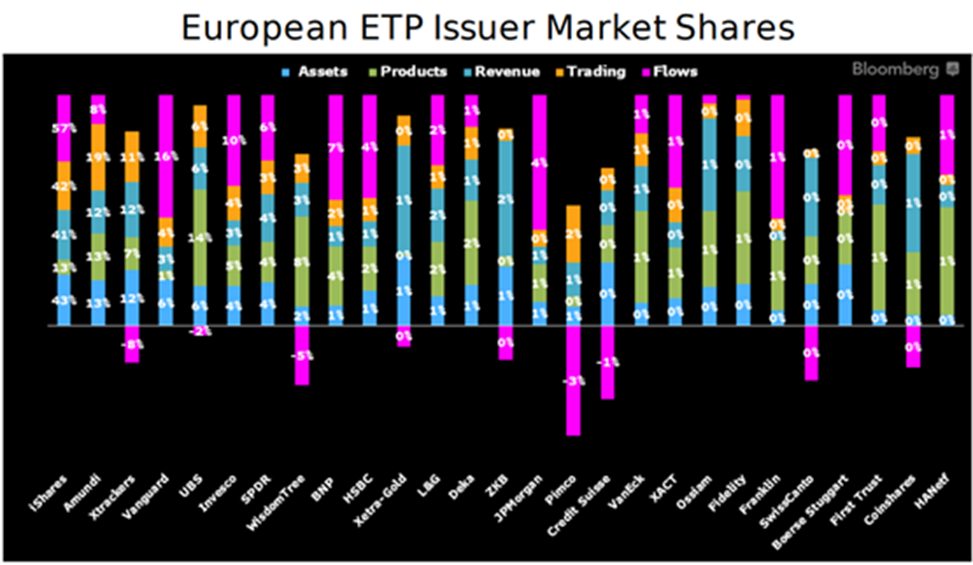

Naturally, this trend has benefitted asset managers operating at scale and command the lion’s share of assets housed in low-fee, diversified ETFs.

Overall, BlackRock gathered 57% of all European ETP flows this year by mid-November while smaller issuers – especially those specialised in thematics and crypto – floundered.

This year’s US market leader, Vanguard, only commands 6% of European ETP assets but has seen the second biggest take this year – with 16% of new money – as investors target the firm’s low-cost roster.

David Hsu, senior equity index and ETF product specialist at Vanguard, told ETF Stream: “We provide a very focused range of core ‘building block’ products – under 30 ETFs – designed for long-term investment.

“It is clear that the growth of ETFs is not just about investment trend chasing but fuelled by longer-term, secular trends in the marketplace, in particular the shift towards low-cost investing. With this in mind, we think the outlook is very positive for further ETF adoption in Europe.”

Source: Bloomberg Intelligence

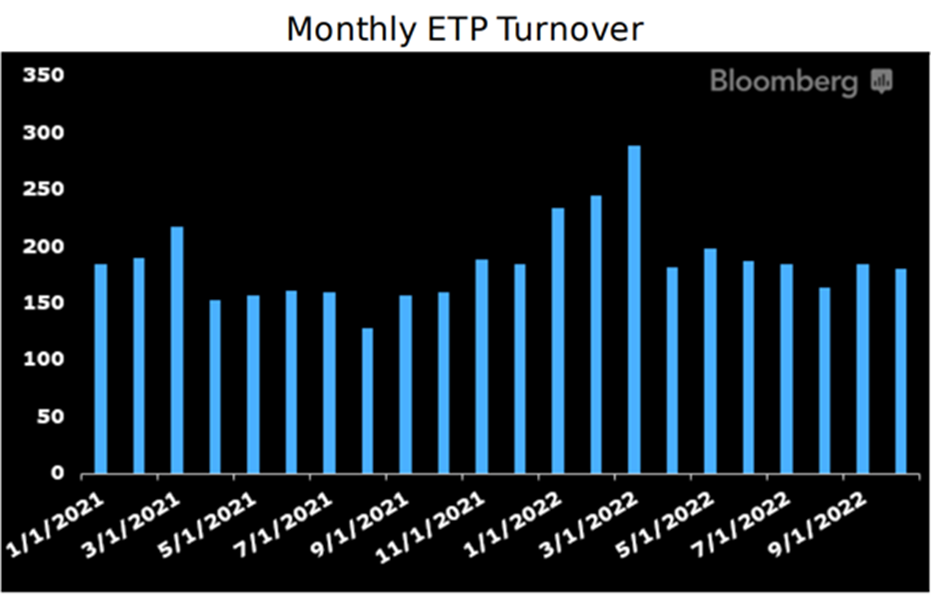

However, far from ETPs only being a tool for duck-and-cover investors, 2022 has actually been the wrapper’s most active year of trading ever in Europe, with trading volumes exceeding €2.1trn with six weeks of the year to spare.

This shows ETPs are increasingly being used tactically and as a liquidity sleeve, especially during volatile periods such as Q1, where volumes surpassed €200bn a month in Europe.

On ETPs’ use case as a tool for tactical asset allocation, an Invesco spokesperson said: “Even though ETF flows slowed between May and September, investors have returned to the market since then, with many looking for effective ways to position their portfolios in anticipation of peak inflation and interest rate hikes heading into the New Year.”

Source: Bloomberg Intelligence

In terms of which ETP segments have enjoyed particularly strong uptake this year, Invesco said fixed income accounted for 37% of net new assets through the end of November while ESG strategies captured 60% of all ETF flows to mid-December.

On the latter, Kuhn said ESG is in constant evolution and driven by regulation and end client demand.

“We have seen increased client demand, where they are looking to understand the construction of ETFs’ portfolios in terms of ESG integration and also the role ESG plays at the investment manager itself,” he noted.

Looking ahead, ETPs’ annual growth rate of around 20% a year since the Global Financial Crash (GFC) in 2008 and this year’s resilience would suggest their trajectory remains strong.

Simon Klein, global head of passive sales at DWS, told ETF Stream: “Even if ETFs have grown strongly, they count for only 12% of the assets in UCITS funds in Europe.

“In the US, the ETF market stands for more than 20% of the fund business. This difference shows the growth potential.”

In addition to continued institutional uptake, both Kuhn and Klein agreed a key vector for ETP expansion going forward will be retail participation through channels including ETF saving plans.

The world’s largest asset manager, BlackRock, shares this view. Having bought minority stakes in neo-broker Scalable Capital between 2017 and 2020, it recently forecast ETF assets on digital platforms in Europe would hit €500bn by 2026.

Related articles