Ping An AM, the asset management arm of the Chinese insurance giant, is bringing Hong Kong its first robotics and multi-asset ETFs.

Ping An of China Asset Management (Hong Kong) (Ping An AM), the international investment arm of Mainland insurance giant Ping An Insurance Group, has been taking steps to diversify its ETF product suite with the launch of four innovative products in Hong Kong within a week from late November.

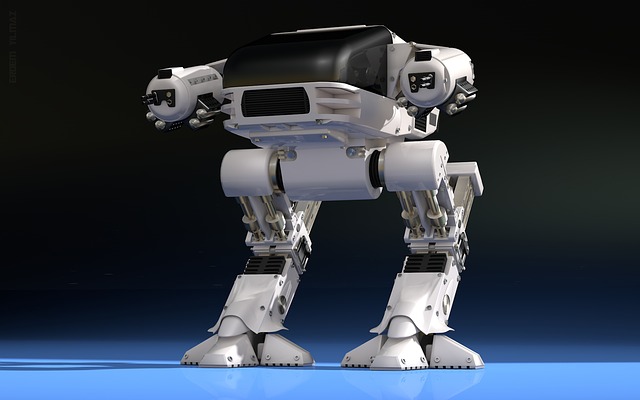

The new products include two first-of-a-kind artificial intelligence and multi-asset ETFs in Hong Kong, the Ping An Nasdaq AI and Robotics ETF and the Ping An 5 HANDL ETF, which started to trade on the Hong Kong Stock Exchange on December 7.

AI is still a relatively new concept in Hong Kong ETF market. Although there have been increasing number of AI indexes available globally, Ping An AM decided to use the Nasdaq CTA Artificial Intelligence Index as the underlying benchmark for the ETF as its index provider Nasdaq Global Indexes adopts a "value chain approach" to cover companies along the AI value chain.

The methodology will make the index to be more representative with a wider exposure and will not be concentrated in smaller sub-sector technology industry, according to Nasdaq Global Indexes.

With the unique features of their underlying indexes, Ping An AM believes the AI ETFs will allow investors to ride on the global AI trends while the multi-asset 5HANDL ETF will maximise their risk-adjusted returns by providing a combined exposure to multiple asset classes.

Ping An AM does not specify whether the ETFs are institutional focused or retail focused, but the company is striving to explore the untapped clients locally.

Mona Chung, head of ETF and cross-asset investment at Ping An AM says the launch of the product is to enrich its product offering. She expects Hong Kong ETF market still has plenty of room for growth as it only accounts for about 1% of the global ETF market.

She believes ETF issuers with competent management capabilities will be able to take a bigger share of the market.

The launch of the AI and multi-asset ETFs comes hot on the heels of Ping An AM rolling out two smart-beta ETFs on the Hong Kong exchange on November 30.

The Ping An MSCI Quality Factor ETF tracks large and mid-cap stocks of China equities including H-shares, red chips and P chips listed in Hong Kong, A-shares and B-shares listed on Shanghai and Shenzhen exchanges, and foreign listed Chinese companies.

The Ping An MSCI Multi-Factor ETF tracks large and mid-cap stocks of Chinese enterprises with desired characteristics - value, momentum, quality and low size.

Chi Kit Chai, head of capital markets and chief investment officer of Ping An AM, says the company launches the factor-based ETFs as factor investing can provide investors with "relatively transparent and cost-efficient" way to construct a result and risk optimised portfolio in a systematic fashion

Also, factor investing can be used as the strategies to achieve diversification benefits and better risk-adjusted returns than traditional market cap-weighted indexes, he adds.

They are the second smart-beta ETFs for Ping An AM after the Ping An of China CSI HK Dividend ETF launched in 2012.

Obviously, Ping An AM is putting more focus on alternative ETFs with Hong Kong investors having stronger appetite for smart-beta products for asset allocation or raising market exposure.

According to figures from Morningstar, there were 15 smart beta ETFs listed in Hong Kong with total value of HK$3.6 billion (US$461 million) as of November.

US bank BNY Mellon said in its ETF blog in November that new ETF strategies such as smart-beta and multi-factors ETFs, alongside new structure products such as active wrapper and exchange traded managed funds (ETMFs), and ETFs with new exposures such as fixed income, thematic and ESG ETFs, are expected to be the focal points in the Hong Kong ETF market going forward.

Ms. Chung points out "smart beta seeks to improve returns, reduce risk and increase diversification while delivering greater exposure to the market."

Product wise, Chinese new economies are one of the major underlying themes for the smart-beat ETF as international investors have stronger appetite to raise their exposure to the sectors especially after the A-shares inclusion into the MSCI Emerging Markets Index earlier.

Hong Kong-based Premia Partners is one of the pioneers tapping into the market at which the company rolled out the first China new economy multi-factor ETFs in the city in October 2017.

The products, Premia CSI Caixin China Bedrock Economy ETF and Premia CSI Caixin China New Economy ETF, are designed to mirror the performance of new economy sectors in China such as healthcare and technology.

From the global perspective, London-based ETF consultancy firm ETFGI said assets of global smart beta ETF and ETP rose to US$659 billion as of July from US$606 billion in January.